Though worldwide beverage alcohol volume increased slightly in 2019, reversing declines from the year prior, it will be five years before the global industry rebounds from the ongoing Covid-19 crisis, according to comprehensive new research from IWSR Drinks Market Analysis.

Container capacity on all major trade lanes has been severely reduced, with the deepest cut planned for Asia – Red Sea at 14%. The world’s most active trade lane has taken a 10% haircut, while Asia – US West Coast has been dialed back 8%.

Student loans of $1.59 Trillion in the United States are now the second largest category of consumer loans behind only Mortgage loans. With students now taking classes remotely there is little opportunity to work part time either at school or at nearby businesses to pay off those loans.

Game spending totaled a record-breaking $10.5B in April 2020, showing the continued strength of the medium during the COVID-19 crisis. Lockdowns that began during March had an even greater impact on gaming habits in April as they continued for the entire month in many regions.

The majority of STR participating hotels are closed across Europe. As of 30 April, Barcelona showed the largest percentage of closures (96%), followed closely by Madrid (95%) and Athens (92%). Moscow and Saint Petersburg closures, however, were the lowest in Europe, at 15% and 19%, respectively.

The BBB cliff has been widely discussed and the growing number of recent “Fallen Angels” shows that a number of corporates are falling over the cliff edge.

With the US economy on pause, many companies are struggling to remain profitable. As we have seen in prior crises, advertising budgets tend to be the first expenses to be cut. This leads to the inevitable layoffs at media companies, advertising agencies, and internally at companies.

Auto manufacturers have been preparing plant restarts for weeks, balancing county ordinances, financial concerns, demand shock, and protecting the safety of their workers.

Orbital Insight has been closely monitoring U.S. and international auto production, plant by plant, to help investors quantify the economic impact of COVID-19 on the autos sector and recovery by geography and brand.

The month of May underlined the volatility expected in global demand as markets wrestled with the fallout from the COVID-19 virus pandemic and the resultant regional lockdown measures. The Seasonally Adjusted Annualised Rate (SAAR) has fallen to just 49 million units in April 2020, from 91 million units in December 2019.

As many Americans continue sheltering in their homes due to the coronavirus pandemic, meal delivery sales have reached new heights. Our data reveals that, through the end of April, meal delivery services saw sales nearly double year-over-year, collectively. As Uber is reportedly working on a deal to acquire Grubhub, these thriving businesses are in the spotlight during the COVID-19 era, while Uber’s rideshare business has taken a major hit.

Based on Transactions in April, DoorDash takes #1 Spot with 45%, Ahead of Uber Eats (28%) and GrubHub (17%)

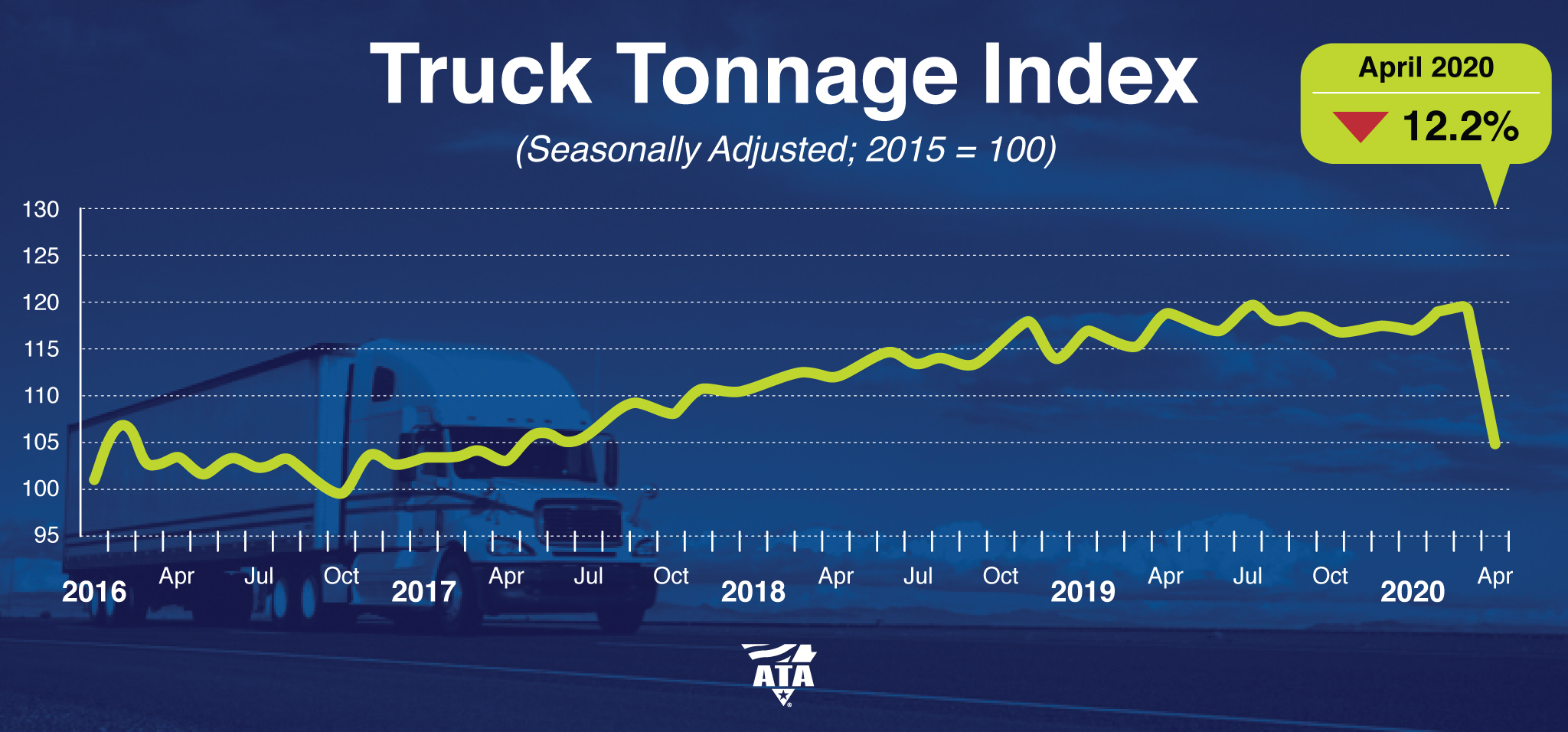

American Trucking Associations’ advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index contracted 12.2% in April after increasing 0.4% in March. In April, the index equaled 104.9 (2015=100) compared with 119.5 in March.

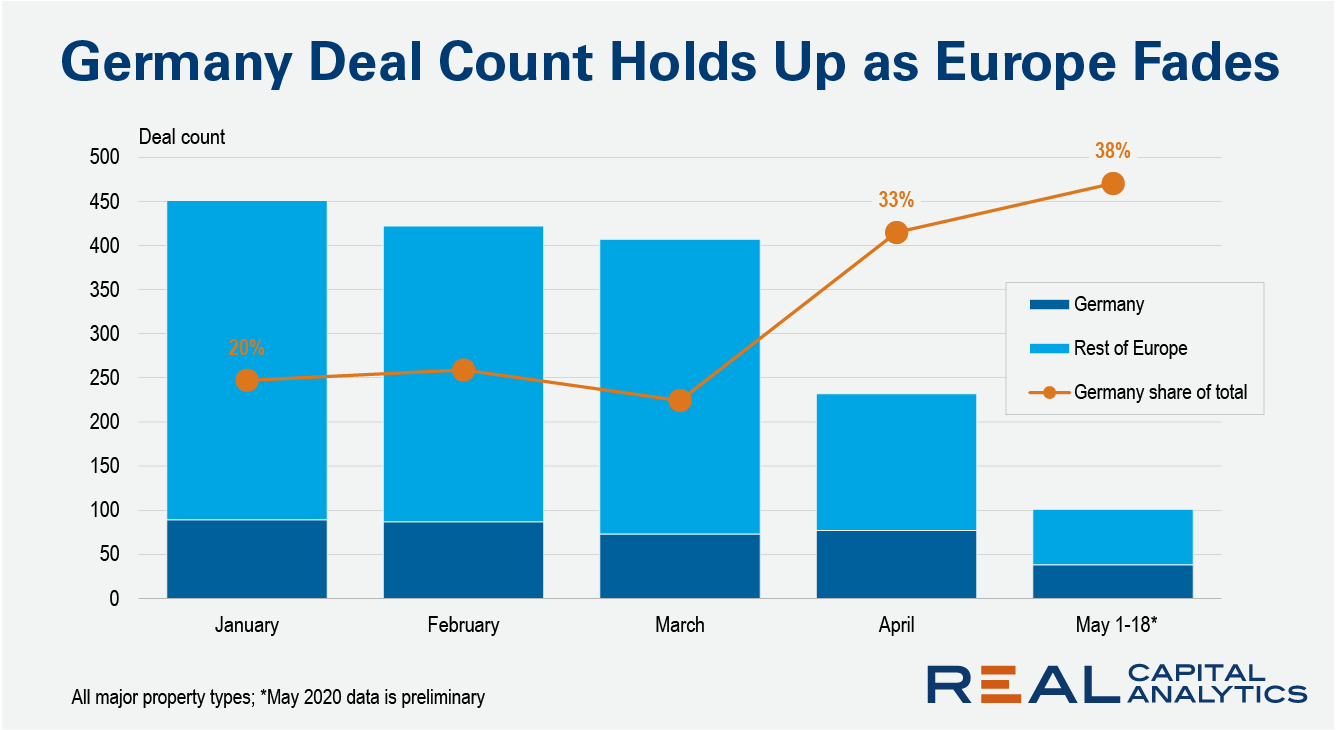

The count of commercial property deals in Europe has dropped sharply due to the impact of the Covid-19 crisis. So far, Real Capital Analytics has recorded some 230 deals for April, which is around one-third of the April 2019 figure.

Before we mention how the coronavirus pandemic impacts online ad spend, keep in mind the changing consumer behavior. We are seeing an unprecedented increase in people staying indoors.

This means people are spending a significant share of their lives online. And we will most likely see this behavior remain for a considerable amount of time when the pandemic ends.

The point of the Paycheck Protection Program (PPP) was to prevent businesses from having to lay off employees, adding to the country's already startlingly high unemployment. Writing the legislation was executed quickly and offered hope that the economy could survive the pandemic. Unfortunately, the execution continues to be lackluster.

STRONG growth in Newspaper ad spend is the common early COVID-19 ad spend trend across the Australian and New Zealand media markets, although total media market trends vary markedly in March.

Australian media Agency bookings are back 10.6% in March as a lower level than usual of late Digital bookings failed to push the market into a single digit decline, as had been expected.

We're looking at apps like Zillow, Redfin, Realtor.com, Apartments.com and more. Interest in shopping for homes and apartments took a hit when social distancing started. As states announce plans to open back up and as people have had time to purchase face masks and hand sanitizer, we're getting back into business.

There are many data points that help to tell the story of the coronavirus pandemic. This week, we were particularly interested in what LinkUp data tells us about how states job counts are changing amid the pandemic, and whether there is a relationship between job counts at the state level and the number of confirmed COVID cases per county.

Over the past several weeks, meat processing plants around the world have been receiving increased attention in the media. The high numbers of COVID-19 cases in these locations, where physical distancing can be difficult, has affected meat supply chains across the country.

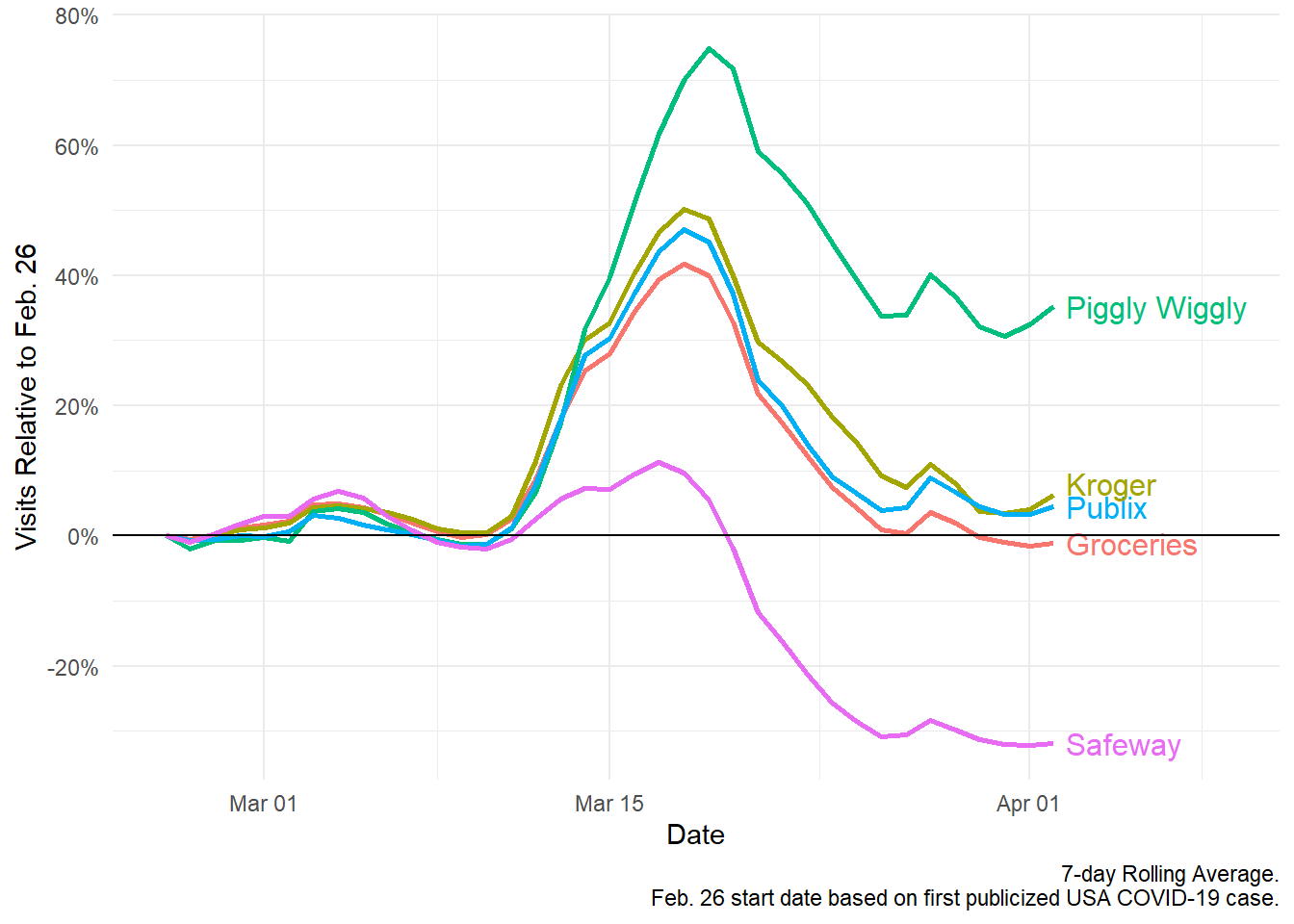

In the charts that follow, we’ll look at SafeGraph’s weekly foot traffic patterns dataset to take a closer look at what’s becoming more and more of a tenuous relationship between consumers and grocery stores—as well as a few other select food service businesses—as we get closer to the peak of the COVID-19 crisis here in the U.S.