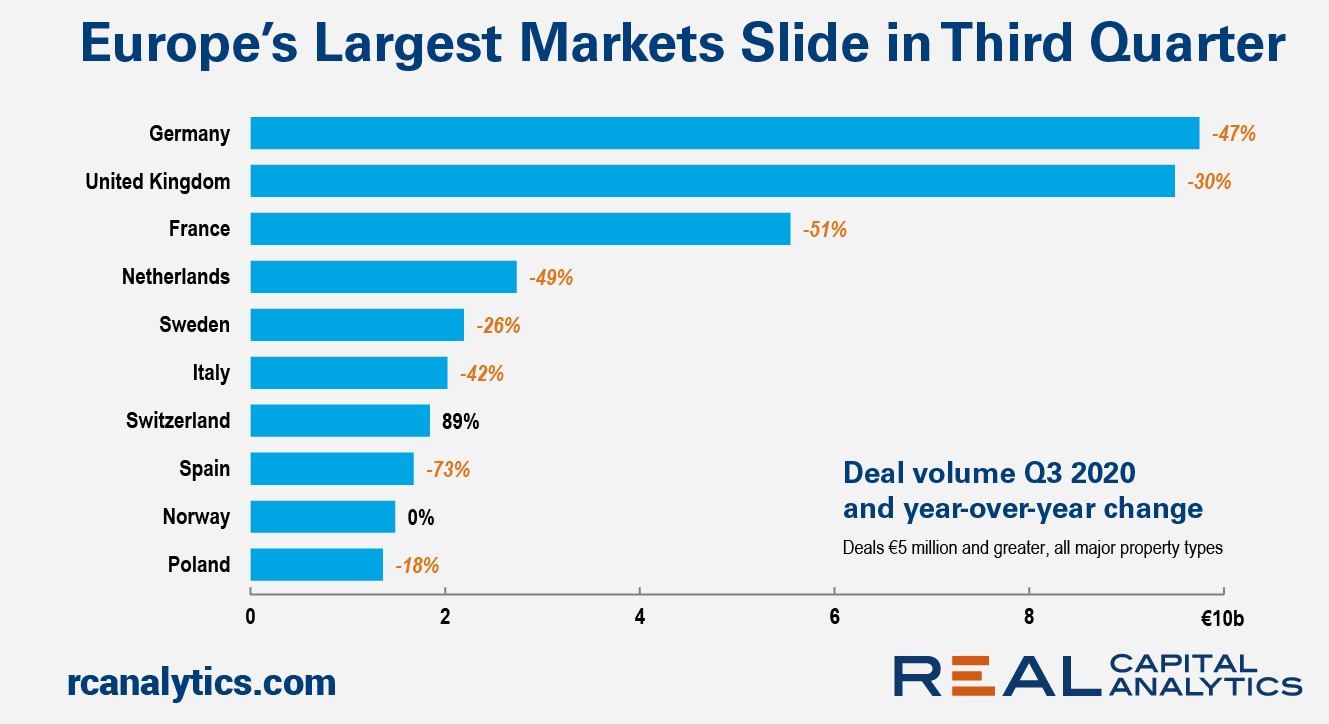

Commercial property deal activity in Europe slumped during the third quarter, rocked by the Covid-19 pandemic’s continued impact on dealmaking, economic growth and market prospects. The latest edition of Europe Capital Trends shows deal volume dropped 43% in the third quarter from a year ago, and was down from the levels seen in the second quarter of this year.

The forgone spring home-buying season appears to have fully shifted into summer months, leading to sales volumes that are picking up speed at a time when they would normally show signs of slowing. Not only was demand in August fueled by buyers planning on purchasing a home in the spring, but also by those motivated by record-low mortgage rates, desire for a larger home or desire for a vacation home as a result of the pandemic.

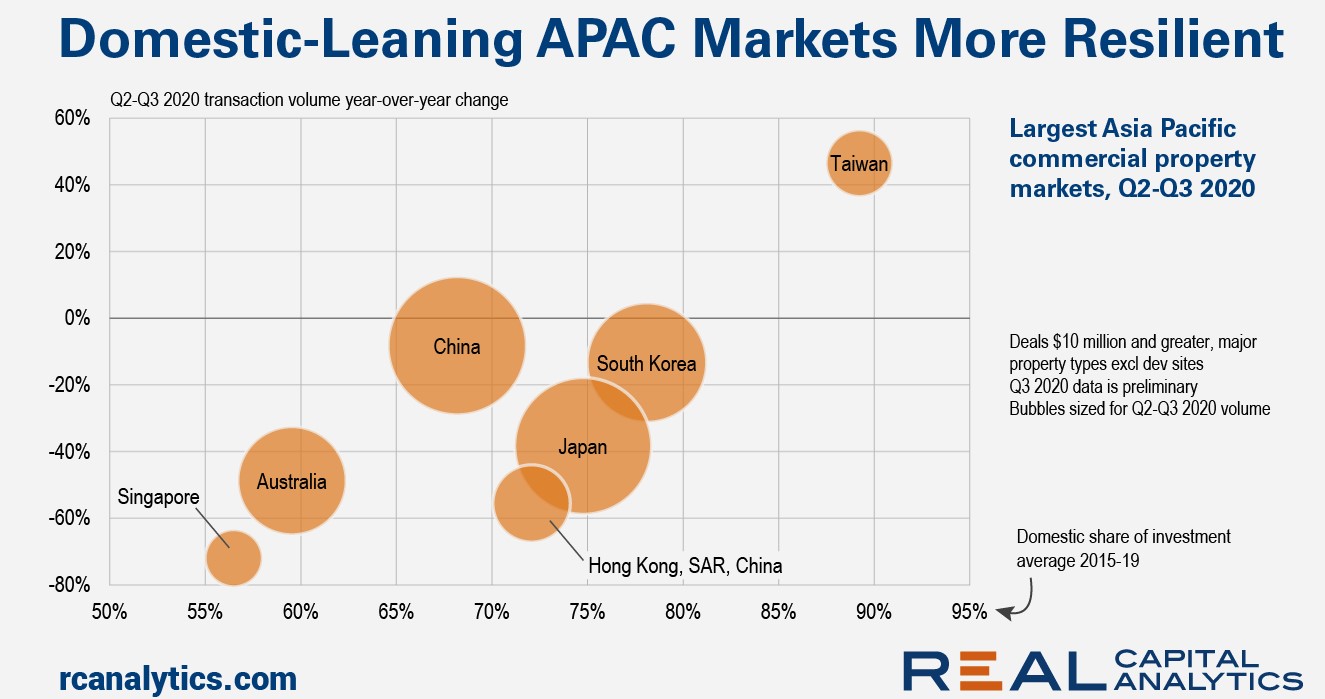

Global and regional cross-border investors pulled back from new Asia Pacific deals in Q3 2020 at almost double the rate that domestic buyers retreated, preliminary Real Capital Analytics data shows. Investment by domestic buyers was higher in the third quarter than the second quarter of 2020, though the level was down significantly versus a year ago.

The winners and losers in the virus crisis are becoming clearer. China reports a strong economic rebound while Western economies continue to struggle. Hotels and airlines fight for their survival while online fulfilment and delivery logistics firms cannot hire staff quickly enough. And real estate is seeing a “race for space” in residential markets, but serious viability issues in some commercial lines – Bloomberg report that Land Securities will sell a quarter of their total portfolio, mainly lightening up on retail and leisure.

INRIX released its report on activity around COVID-related street closures last week. As part of that study, which used anonymous GPS mobile app data to better understand utilization and user demographics of restricted streets, INRIX looked at specific types of streets programs in New York. The City’s Open Streets implementation is one of the largest and most interesting cases we studied due to the size of the Open Street: Restaurant program.

Credit Benchmark have released the October Credit Consensus Indicators (CCIs). The CCI is an index of forward-looking credit opinions for US, UK and EU Industrials based on the consensus views of over 30,000 credit analysts at 40 of the world’s leading financial institutions.

Londoners are shying from big brand retailers in favour of shopping at independent outlets, with independent and single-site retailers consistently outpacing chains throughout the autumn.

Consumer Edge credit card data has been very effective in predicting Macro-level economic growth trends. For the unadjusted Retail sales number that the Census Bureau reports every month, government data accelerated +730 bps and CE data caught this acceleration with data delivered well in advance of the report. Pent-up demand may be a key driver of this acceleration, as the September growth rate was higher than even any 2019 monthly growth rates.

ATTOM Data Solutions, curator of the nation’s premier property database and first property data provider of Data-as-a-Service (DaaS), today released its third-quarter 2020 U.S. Home Sales Report, which shows that profits for home sellers nationwide continue to hit high points despite the economic distress caused by the worldwide Coronavirus pandemic.

In recent weeks, the term “K-shaped recovery” has been popping up with increased frequency; used by political figures, economists and media personalities alike. Investopedia, in short, defines a K-shaped recovery as when “different parts of the economy recover at different rates, times, or magnitudes.”

U.S. single-family rent growth strengthened in August, increasing 2.1% year over year, a bit higher than the 1.7% rate reported for July 2020, but a slowdown from the 2.9% rate recorded for August 2019, according to the CoreLogic Single-Family Rent Index (SFRI). The index measures rent changes among single-family rental homes, including condominiums, using a repeat-rent analysis to measure the same rental properties over time.

The Association of American Railroads (AAR) today reported U.S. rail traffic for the week ending October 17, 2020. For this week, total U.S. weekly rail traffic was 518,763 carloads and intermodal units, up 2.2 percent compared with the same week last year.

The market experienced steady year-over-year growth across almost all housing indicators in September. Single-family housing authorizations were up for the second consecutive month, signaling strong demand and homebuilder confidence in the market. New construction grew alongside construction employment in the U.S. last month. However, construction employment remains well below levels seen in the months preceding the pandemic, indicating room for growth in this segment.

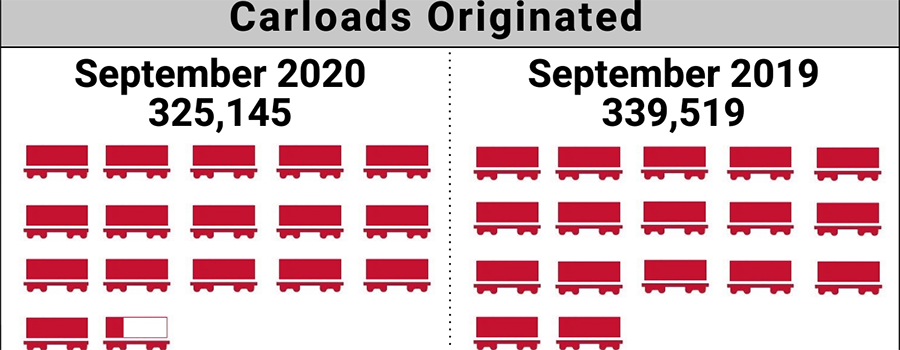

The number of carloads moved on short line and regional railroad in September 2020 was down compared to September 2019. Carloads originated decreased 4.2 percent, from 339,519 in September 2019 to 325,145 in September 2020.

There is no doubt that malls took a serious hit during the spread of COVID. However, as we’ve seen in previous reports analyzing the different recoveries of indoor and outdoor centers, the pace of recovery can be highly tied to format. So, we decided to dive into an intrigued subset of the outdoor center, outlet malls, to see how they’re recovering and stacking up against other competition.

The World Health Organization declared COVID-19 a global pandemic on March 11. By mid-March, shelter-in-place orders were issued across many nations. While each of us may think about how it has affected our own local neighborhood, it has also affected communities across the world.

Pedestrian footfall in Manchester has sunk to 50% of year-on-year levels as tighter restrictions and ambiguity over lockdown policy impacts mobility and trade. Through the summer, Huq’s mobility indicator for the city shows a steady recovery to levels of around 75% of 2019 by September, however this has dropped sharply over the last week.

Winter wheat dryness has intensified, as ongoing dryness across the US High Plains has limited moisture for wheat germination and establishment. This has pushed Kansas and CBOT wheat prices higher, with the US hard red wheat carry-out expected to be at a multiyear low. As the bread basket of Ukraine, the southern region remained short in soil moisture. Winter wheat conditions in central and eastern Russia also deteriorated. There is less than a month before the southern Russia crop heads for dormancy.

According to ATTOM Data Solutions’ newly released September and Q3 2020 U.S. Foreclosure Market Report, foreclosure filings are down 12 percent from Q2 2020 and down 81 percent from Q3 2019, to the lowest level since ATTOM began tracking quarterly filings in Q1 2008. The reports shows there were a total of 27,016 U.S. properties with foreclosure filings in the third quarter of 2020.

Footfall to the Pub and Pub and Restaurant sector is dwindling in the wake of tighter restrictions, with attendance dropping below 20% of usual levels for the first time since June. Following a steady recovery boosted by Eat Out to Help Out in August, Pubs and Restaurants attendance had been hovering around 70% of usual levels throughout September.