Welcome to the March 2022 Apartment List National Rent Report. After a slight seasonal cooldown over the past few months, rent growth is back on an upward trajectory, with our national index up by 0.6 percent over the course of February. Even though month-over-month rent growth has moved back into positive territory, it remains substantially cooler than last summer, when rents grew by more than 2 percent per month for four straight months. Year-over-year rent growth currently stands at a staggering 17.6 percent, but most of that growth took place last spring and summer.

Dollar and discount stores gained momentum over the pandemic, and recent data indicates that these superstores are largely holding onto their strength. So while Walmart is still the undisputed leader of discount retail, the rise of alternative value retailers is beginning to impact the power dynamics in the sector. To better understand these shifts, we dove into foot traffic and consumer demographic data for the legacy discount retail giant as well as for Family Dollar, Dollar General, Five Below, Big Lots, and Dollar Tree.

The last week’s events in Europe have been deeply concerning for an industry still struggling to recover from the Covid-19 pandemic and we will continue to monitor the situation closely. Global capacity this week is slightly up on last week as we predicted at 82.1 million, another 1% growth on the previous seven-day period as we march into March. That weekly figure does however include some 103,000 seats from the Ukraine that airlines have yet to remove from the distribution systems or continue to show as planned but, are closed for sale to all but the very brave hearted.

The escalation of events in the Ukraine are a tragic development at all levels for people around the world and the responses have been quick from Governments. Inevitably aviation takes another hit and one country’s actions are normally followed by a swift response from the other, as we have seen today. Yesterday the United Kingdom banned Aeroflot from operating but did not stop Aeroflot’s ability to overfly UK skies. This morning, Russia not only banned UK domiciled carriers from operating, but banned them from overflight access.

After a brief plateau of national illness activity, Kinsa’s data now shows that over the past seven days, respiratory illness activity (cough, sore throat, fever) has started to increase in the Northeast, Midwest, and West, and South, largely driven by the pediatric population. The increased activity among kids is likely a result of several circulating respiratory illnesses like the common cold and RSV.

Faced with a rise in inflation resulting from a myriad of factors such as COVID-induced supply chain bottlenecks to increases in wages and pent-up demand, U.S. consumers in 2021 had to act definitively and fine-tune their spending behavior. Envestnet® | Yodlee® financial behavior trends, derived from aggregated and de-identified transaction datasets, can be utilized to provide answers to questions around major shifts in consumer spending trends such as those emanating from inflationary pressure.

Driven by the Presidents’ Day holiday weekend, U.S. leisure travel made a big comeback and pushed occupancy 4.6 percentage points to 59.1% during the week of 13-19 February 2022. That was the highest level of the past 13 weeks and the second consecutive week in which occupancy expanded by more than four percentage points from the previous 7-day period. The demand expansion was somewhat widespread as 40% of the 166 STR-defined U.S. markets reported weekly occupancy of 60% or more.

Happy Valentine’s Day from Consumer Edge! In light of the recent holiday, today’s Insight Flash provides a sneak peak of our new CE Transact UK Cohort data to analyze similarities and differences in how Americans and Brits find love online. We dig into which daters spend more on app bonus features, how many return to spend on the app when their dates are unsuccessful, and what cross-shop looks like in the US and across the pond in the UK.

According to its most recent earnings call, profitability remains a long-term goal for Blue Apron (NYSE: APRN). The meal kit pioneer has faced increased competition from other meal kit companies in recent years. Additionally, the industry has seen challenges related to seasonal demand and high operational and marketing costs. But how does Blue Apron measure up against other meal kit competitors? We looked at a few of the major meal kit companies—including Blue Apron, HelloFresh, Home Chef, Marley Spoon, and Sunbasket—to see how market share, customer retention, and quarterly transactions per customer compare within the industry as of the end of 2021.

With all the attractive perks such as convenience in getting license plates, government subsidy, better driving experience, and shrunken price difference, electric vehicles sales in China skyrocketed 154% last year as more consumers opt for greener cars. Tesla and BYD remain as market leaders followed by Xpeng, Li Auto and Nio. Tesla beat market expectation and finished 4Q21 strong with 116,236 delivery units in China, attaining +92% y/y growth. Xpeng and Li Auto also showed positive momentum with 41,751 and 35,221 delivery units respectively in 4Q21, while Nio had a mediocre 4Q21 performance with 25,034 units delivered.

In this Placer Bytes, we dive into Best Buy and Costco as they kick-off 2022. Best Buy has always been a very Black Friday-centered brand, so the heavy impact on the day’s strength in 2021 was always going to have repercussions. However, once again, Best Buy has proven to be one of the retailers most capable of strategically adapting to new challenges and concerns. In 2020, Best Buy was incredibly effective at maximizing the retail reopening with tactics like appointment shopping improving efficiency. And in 2021

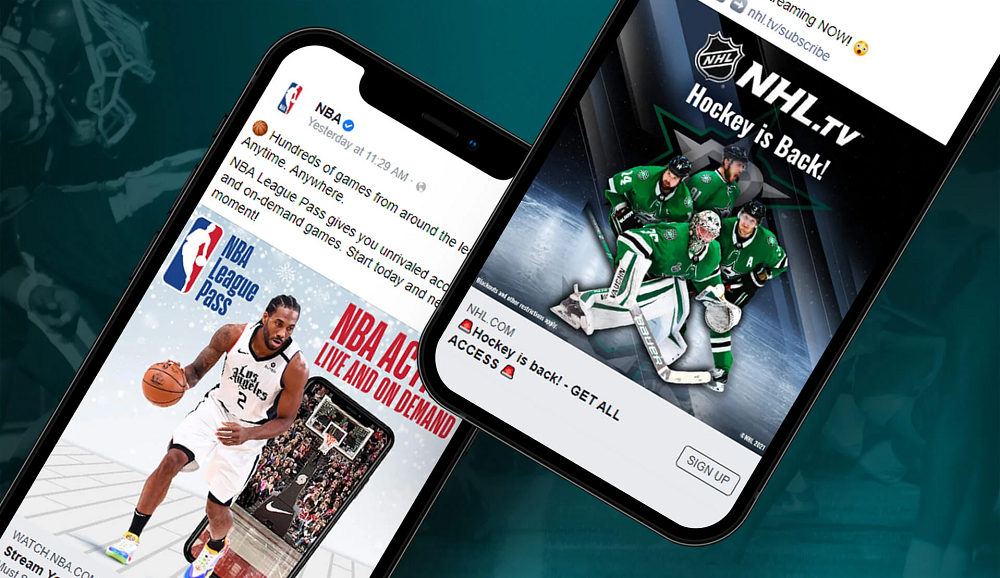

Like so many other industries, major league sports have shifted their advertising strategies to adapt to the ongoing pandemic. During the pandemic, major athletics went through a transformation, with most games canceled, postponed, or held to cardboard cutouts of adoring fans. While this disruption impacted athletes and fans alike, it also posed an even bigger challenge for the leagues' marketing teams. We'll dive into how professional sports leagues pivoted their digital advertising strategies during the pandemic.

In January 2021, the world’s largest collection of non-fiction content became available to the masses. Discovery+ was here. Since then, Discovery+ has attracted a respectable audience, surpassing 20 million paid subscribers by the third quarter of 2021, which exceeded internal targets. To help propel it to this point, Discovery+ launched a partnership with Verizon that gave select customers 12 months of Discovery+ for free. Like most new streaming platforms, Discovery+ is built on an ad-supported model. On launch day, advertising partners included Kraft Heinz, Lowe’s and Toyota.

The hardest-hit New York City is bouncing back once again as Omicron cases continue to rapidly fall at the same speed they increased in mid-December and New Yorkers look forward to enjoy the city as it was before the pandemic. ADVAN’s foot traffic data shows an uptick in foot traffic mobility overall however the trends differs from area to area. For example, foot traffic in fashionable SoHo started to increase significantly the first weekend of this month after the Omicron wave started to subside in the second half of January.

STR’s latest 28-day visuals show markets collectively getting closer to their seasonal performance expectations. The leaders and laggards are highlighted in the “bubble” charts below with averages covering the four weeks ending 12 February. Among the Top 25 Markets, four of five leaders have recently outpaced their comparable revenue per available room (RevPAR) from 2019. Miami had the top four-week RevPAR (US$203) and a RevPAR index score of 104 (4% above the 2019 comp) after hitting 161 last month.

While a lot of focus around the great resignation has been on people quitting their jobs, the reality is that the vast majority of people are quitting to start a new job – a phenomenon called The Great Reshuffling. But this trend raises an interesting question, how frequently do employees not only change jobs, but change careers, i.e. start a new job in a different field?

In this Placer Bytes, we dive into Planet Fitness to see if the fitness chain can recover from a rough start to 2022 and check in with Dick’s Sporting Goods as it continues to gain strength. While the wider retail sector saw visits down over 4% in January ‘22 amidst record COVID cases, Dick’s Sporting Goods saw visits rise 1.9% compared to the same month in 2020. This followed a 2021 where all but a weather-affected February and COVID-decimated November saw visit growth.

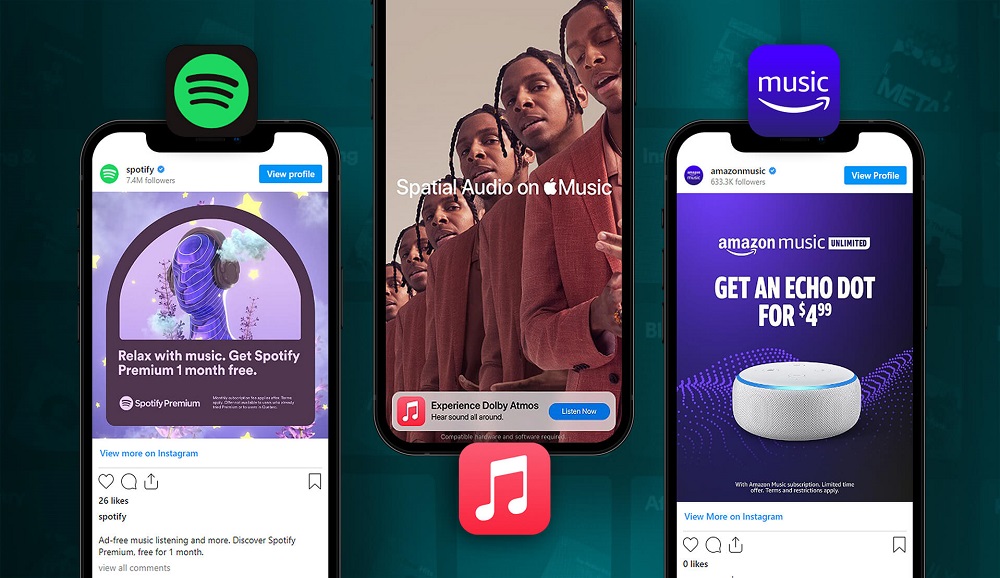

For music lovers, Spotify is practically synonymous with music streaming. And for good reason: The streaming giant says it had 172 million paid subscribers and 381 million monthly active users as of October 2021 — more than any other music streaming service. Its closest competitors, Apple Music and Amazon, are more tight-lipped about their exact subscriber count, but media analyst Midia Research put them at around 79 million and 68 million, respectively. While Spotify reigns supreme, both Amazon and Apple Music have been making moves to attract new listeners.

The last two years have challenged the airline industry in so many different ways - incredible network planning, financial engineering and then re-engineering, and of course considerable disruption to thousands of careers and businesses. The professionalism of the industry has never been in doubt but last Friday’s events in Europe where aircraft were landing into some of the strongest winds recorded were incredible; to those that were handling the aircraft well done, to those sitting further back, phew! In so many ways those images that travelled around the globe reflect the skill and robustness of an industry that has been stressed and tested.

Digital payments in India are growing at a scorching pace. According to the Economist Intelligence Unit, when it comes to digital payments, India has outpaced the rest of the world, registering the highest number of real-time payment transactions. CLSA Research forecasts the digital payment market in India to grow three-fold to touch US$1 trillion by financial year 2026 compared to $300 billion in 2021. India’s large number of real-time transactions can largely be explained by the prevalence of low-value payments in the Indian economy. Similar trends can be witnessed in developing countries.