In 2018, investment bank UBS published an 82-page report titled “Is the kitchen dead?” It made a strong case for the rise of online food ordering. It estimated the market to be worth $35 Billion, but said it could grow 20% a year to $365 billion by 2030. It even made the dramatic statement: “There could be a scenario whereby 2030 most meals currently cooked at home are instead ordered online and delivered from either restaurants or central kitchens.”

Aftermarket sneaker resellers have witnessed a surge in consumer demand over the last 12 months, likely accelerated by the closure of brick-and-mortar sneaker stores during the pandemic. While traditional sneaker retailers—FootLocker, FinishLine, and ShoePalace—saw little or no growth in 2019 and then experienced a collective year-over-year sales decrease of 72 percent in April 2020, aftermarket sneaker resellers, which largely sell online, saw a collective year-over-year sales increase of 68 percent that same month.

In an increasingly fragmented video landscape, the NFL continues to be a juggernaut that generates billions of dollars in ad revenue for their cable and broadcast partners each year. Our NFL data intelligence reports the broadcast and cable networks captured $3.3 billion in ad revenue for the 2020-21 season, excluding Super Bowl LV, a year-over-year increase of +3%.

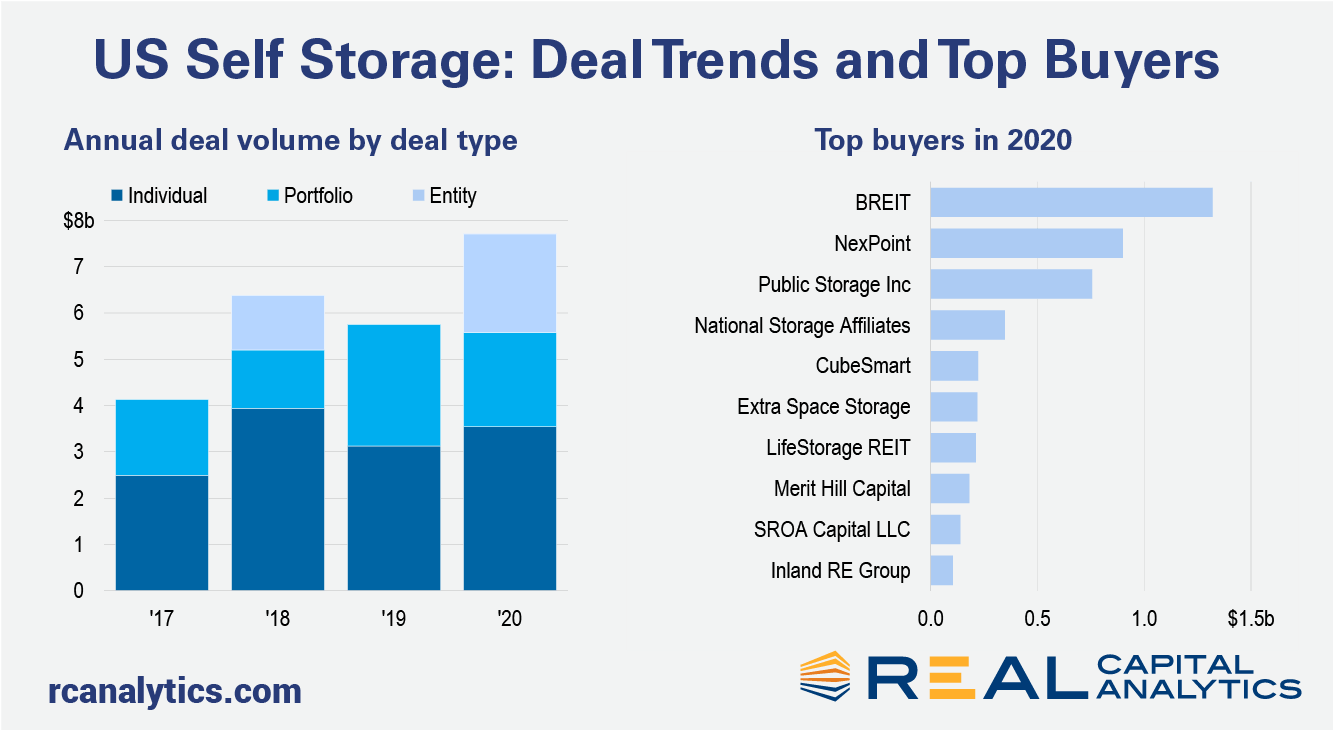

Transactions involving U.S. self storage assets reached a record level in 2020 despite the disruption and uncertainties caused by the global pandemic. While two outsized entity-level deals boosted transaction volume, individual deals and a wide range of buyers are evidence of ongoing broad interest in the sector. At $7.7 billion for the year, self storage deal activity was one-third higher than that of 2019, a stark outperformance compared to the U.S. market overall which slumped by more than a quarter.

In January 2020, mortgage delinquencies were at a generational low. After the pandemic hit, many families, especially those working in service occupations that entail in-person contact, faced a large income shock through job loss, illness, or death of a family member. Places that were hardest hit by job loss saw the biggest spikes in past-due loans over the last year. Nationwide, the CoreLogic Loan Performance Indicators reported past-due rates up by 2 percentage points last year. In Hawaii and Nevada past-due rates jumped 4 percentage points.

The amount of equity in mortgaged real estate increased by $1.5 trillion in 2020, an annual increase of 16.2%, according to the latest CoreLogic Equity Report. The average annual gain in equity was $26,300 per homeowner -- the largest average equity gain since the third quarter of 2013. The nationwide negative equity share for the fourth quarter of 2020 was 2.8% of all homes with a mortgage, the lowest share of homes with negative equity since CoreLogic started tracking this number in the third quarter of 2009.

The commercial aviation industry is attempting to make a comeback from its pandemic-induced fallout. Despite favorable tailwinds, the road to recovery will almost certainly drag into 2021 and beyond. After a staggering drop of more than 60% in 2020, global air travel demand will not likely return to pre-COVID levels until 2022. U.S. air travel volumes are still half the normal levels and aren't expected to pick up until late 2021.

The retail industry during the pandemic has undergone a huge shift in its offerings, fulfillment and prominent shopping channels. E-commerce-focused brands, like Amazon, have done extremely well, given that many consumers are choosing to forgo entering physical stores. Some big-box retailers have adapted to the need for fast, free shipping, using their physical presence as an advantage for more same-day delivery options. Pinterest saw significant growth with 193 million global downloads in 2020, up 50% year over year — driven by an acceleration of consumers leveraging the platform for product discovery, design inspiration and shopping.

In this Placer Bytes, we look at two of retail’s strongest in Five Below and Michaels and break down the potential for a Belk recovery. Five Below is among the most interesting brands to watch as it is seeing exceptional offline strength heading into a period where its value offering could be even more attractive. Following a dip in year-over-year visits driven by the pandemic, the brand quickly saw visits return to year-over-year growth by July 2020.

Amid the recent warm weather, roadmap announcements and continuing restrictions, park usage has increased significantly during February. Building on our recent coverage of this trend, new data from Huq Industries reveals that the driving force behind park visits are those in their 30s, out-stripping those in their 40s by 15pts and those in their 20s by 20pts.

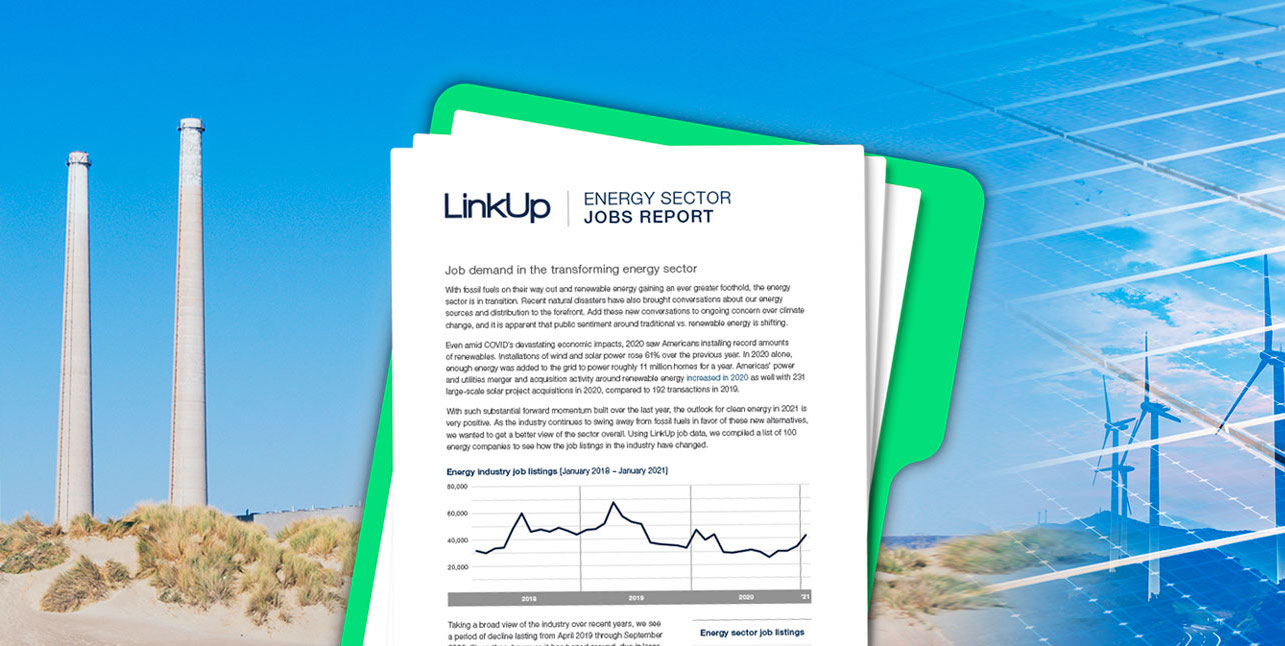

With fossil fuels on their way out and renewable energy gaining an ever greater foothold, the energy sector is in transition. Recent events like the winter storms in Texas, and their impact on the state’s power grid, have brought conversations about renewable energy to the forefront. Add these new conversations to ongoing concern over climate change, and it is apparent that public sentiment around traditional vs. renewable energy is shifting.

In a blog post last week markets with notable population change from 2017 through 2019 according to the US Census Bureau were mentioned. As a follow-up to that, in this post smaller markets that have stood out regarding population change over that same period of time will be the focus. This time, rather than total population change, population percent change will be used. Because each ALN market contains only complete metropolitan statistical areas (MSAs), MSAs will be combined where appropriate to represent whole ALN markets. No market had a higher total population percent change increase from 2017 through 2019 than Fayetteville, NC.

With shoppers unable to see friends and family during the COVID-19 pandemic, gifting surged. But with almost 20% of the country vaccinated and grandparents able to hug their grandchildren again, will these trends slow? In today’s insight flash, we look at the trajectory of gifting trends, as well as which shoppers were most likely to be gift givers and which brands saw the biggest boost. Throughout the pandemic, Specialty Food/Drinks saw the largest jump in spend among gifting options, with spend nearly doubling in April 2020 vs. the prior year April.

The number of unique, active buyers in a market is a key signal for liquidity and one of six measures that Real Capital Analytics uses to calculate the RCA Capital Liquidity Scores. In the chart below we show 18 leading commercial real estate markets and the buyer count measure for Q4 2020 compared to the average and range of the past 10 years.

The demand for athleisure apparel has been soaring as Americans continue to work from home and swap their gym routines for at-home workouts. As a result, activewear companies have experienced strong sales growth over the past year, while several retailers and clothing subscription box companies have incorporated more athleisure into their offerings. Additionally, our analysis of athleisure brands reveals that UK-based Gymshark is gaining market share from its more established competitors, and continues to gain traction in the U.S.

India has seen strong internet speed increases during a year when internet access has been crucial. 4G expansions are leading to mobile speed improvements, while fiber rollouts are driving jumps in fixed broadband speeds. Today we’re looking closely at how India’s improvements compare to other countries in the South Asian Association for Regional Cooperation (SAARC). We have also paired the internet speed performance of India’s top internet providers with data on consumer sentiment to shed light on how consumers view their operators.

Our CE Web data correlates very well to auto sales metrics for companies like Carvana (CVNA) and Vroom (VRM). But what happens when strong sales aren’t enough? Vroom stock took a hit last week when profits were down, with our inventory data providing a key explanation why. Though both CVNA and VRM have had strong sales boosted by a pandemic-driven shift away from mass transit, CNVA is much better at turning that inventory. Since almost the beginning of the pandemic, VRM has shown an escalating average number of days inventory stays on its site, topping out at an average of almost 80 days at the end of 2020.

In this Placer Bytes, we dive into Ulta’s performance, Sephora’s expansion plans, and the continued rise of Citi Trends. It’s becoming increasingly clear that Ulta resides in a stratosphere reserved for retail’s top players. After delivering a very strong 2020, especially considering the context, the brand had one of the fastest starts to 2021.

We’ve highlighted some recent examples of how Earnest data products tracked business health per management’s commentary for Target (TGT), Planet Fitness (PLNT), Lyft (LYFT), and Tractor Supply (TSCO).

In December 2020, 5.8% of home mortgages were in some stage of delinquency (30 days or more past due, including those in foreclosure), a small decrease from November 2020, but a 2.1-percentage point increase from December 2019, according to the latest CoreLogic Loan Performance Insights Report. The share of mortgages that were 30 to 59 days past due – considered early-stage delinquencies – was 1.4% in December 2020, down sharply from a post-pandemic high of 4.2% in April 2020 and below the year ago rate of 1.8%. The share of mortgages 60 to 89 days past due was 0.5% in December 2020, down from 0.6% in December 2019 and down from 2.8% in May 2020.