Paramount+ launched on March 4th in a similar fashion to how HBO Max launched in May 2020, in that it took an existing app (CBS // HBO NOW) and simply transitioned it into a new product. This certainly lends itself to a lower number of downloads than a true new app launch would have as there are a number of existing users who will continue to use the service but do not require a new install.

In this Placer Bytes, we dive into the performance of Dick’s Sporting Goods and break down the newest addition to the Tractor Supply kingdom. Dick’s Sporting Goods is an especially impressive brand and the company’s offline recovery was – even amid COVID circumstances – certainly predictable. But the period from November 2020 through January 2021 may actually be one of the strongest testaments to the brand’s unique reach. Dick’s saw visits decline 30.5% year over year in November as holiday visits were hammered by a resurgence of COVID cases.

Optimism continues to build in the recovery with weekly capacity increasing once again week-on-week with some 57.9 million seats or nearly 58 million planned over the next seven days as the Summer Season is now only two weeks away. It may only be a 1.4% increase on last week’s capacity and we remain at 54% of pre COVID capacity levels but a steady climb in the right direction appears underway. In March some 19,502 unique airport pairs will be operated by the 407,500 scheduled flights delivering an average frequency of 25 flights per route; it’s amazing what trivia numbers can produce!

Visits to England’s parks and gardens have surged past pre-Covid levels in recent weeks as warmer weather and light at the end of the lockdown tunnel coaxes people out for walks. Park-going stood at two-thirds of year-on-year levels at the end of 2020 – 30pts higher than the first national lockdown – before starting to climb again at the start of February.

When TJX reported sales performance recently, investors were surprised to learn that while US sales were strengthening, international sales were weaker due to new rounds of store closures. Our data picked up on the trends in both geographies, allowing both investors and corporations to appropriately understand business trends worldwide.

The mobile game Top War caught my eye as I watched it begin to rise up the grossing charts. On the surface, what stood out most to me was that it's not owned by one of the major players I’m used to seeing in the top charts. In fact the publisher is simply named 'Topwar Studio' after the game's namesake. After doing some light googling, I didn’t come across much on the game besides a few gameplay review videos on YouTube. Let’s poke and prod a little bit and get into what the game is, it’s performance thus far, and how it's faired against its competition.

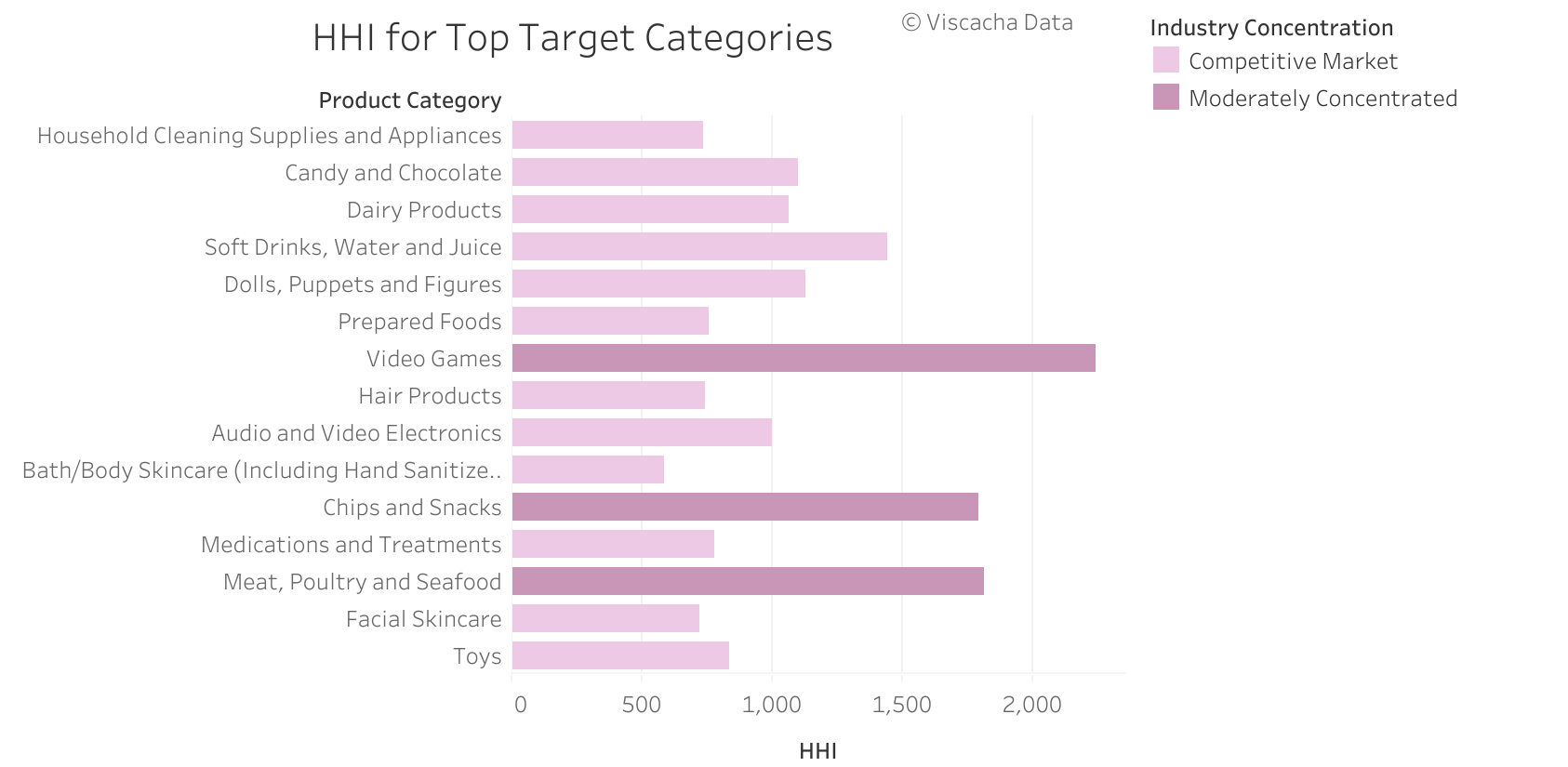

Antitrust has returned to the limelight with the rise of tech giants after enforcement fell during the Reagan administration. While public focus and congressional hearings have centered around market power among FAANGs, the potential for stronger antitrust regulation contained in proposals like that of Senator Amy Klobuchar would also have implications for large retailers and CPG brands. Viscacha Data’s store-level price and sales data helps to produce nuanced insights into antitrust risk that could result from changes in pricing strategy, mergers and acquisitions, and exclusive distribution agreements.

On Feb. 23, Estée Lauder announced its plans to pay $1 billion for a majority stake in Deciem – a Canadian-based company that owns multiple beauty brands. The Ordinary, Deciem’s flagship D2C brand netted $460M in sales the past year and has developed a cult-like following. In this article, we’ll explore The Ordinary’s winning eCommerce strategy and provide tips to advance it to the next level.

In-person visits to UK supermarkets during the second national lockdown has been consistently lower than in May with high-frequency data suggesting that the shift towards online grocery shopping is becoming entrenched. In-store supermarket footfall fell by around 25% during the first national lockdown almost a year ago before regaining near normal levels in the Autumn. However, during this latest national lockdown in-person visits have declined to 50% – a reduction of a further 25pts.

The United States recently hit a grim milestone, with more than 500,000 lives lost to the COVID-19 pandemic. As that number continues to climb, the federal government is stepping up its vaccination push, increasing the number of vaccines it distributes to states. Last week, the government said states were on track to receive 14.5 million doses. This marks a substantial increase from 13.5 million vaccines received the previous week, and 8.6 million in President Biden’s first week in office.

The Dodge Momentum Index rose 7.1% in February to 149.0 (2000=100) from the revised January reading of 139.1. The Momentum Index, issued by Dodge Data & Analytics, is a monthly measure of the first (or initial) report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year. The institutional component of the Momentum Index jumped 26.3% during the month, while the commercial component was essentially flat.

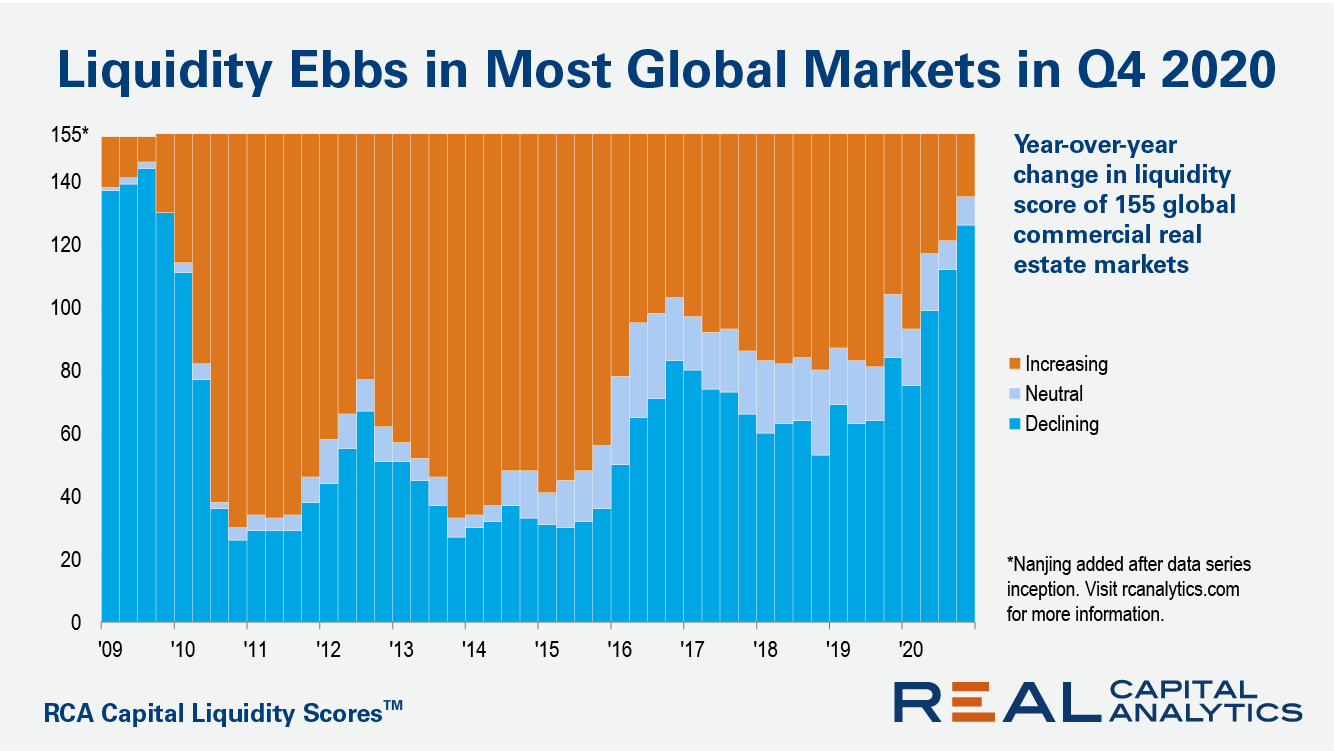

Commercial property market liquidity at the end of 2020 was below the levels from a year prior in 126 out of 155 markets worldwide, the latest update of the RCA Capital Liquidity Scores shows. The count of markets with scores falling on an annual basis was the highest since the end of 2009, during the Global Financial Crisis. However, there are signs of optimism.

Robinhood has been making headlines in recent weeks after a group of Reddit-inspired retail investors used the commission-free investing platform in an attempt to take down some of Wall Street’s top hedge funds, by investing in Gamestop (GME) and raising its share price. The news resulted in a further $2.4B investment for the company, taking total funding to date to $5.6B. No company could have planned this, but it definitely bodes well for the securities and exchange commission (SEC) regulated FinTech company ahead of its potential initial public offering (IPO) expected later this year. So, will Robinhood still go ahead with its planned IPO? It appears so.

In this Placer Bytes, we dive into Dollar General’s continued strength and the recoveries of Gap and Old Navy. Dollar General has seen exceptional growth in the last year with every month since January 2020 showing year-over-year increases. And while the jumps themselves are good enough, it’s the continuity of these increases that makes them all the more impressive. Even as COVID cases surged in November, visits continued to remain up 8.9% year over year, and this continued with December and January up 5.3% and 7.5% respectively.

While we’ve had a solid track record over the years with our non-farm payroll forecasts, it’s not often that we’ve actually written in advance the Bloomberg Chyron for jobs Friday, so it’s hard to pass up on the opportunity to start with the images below from last month – starting with our NFP forecast email alert and the Bloomberg screenshot the following day. And unfortunately, our job market data is giving strong indications that February’s jobs report will be equally as disappointing.

The COVID-19 pandemic has changed shopper behaviors dramatically over the last year, especially in accelerating the adoption of online shopping. As vaccines roll out to more and more consumers, will this behavior revert back? In this week’s Insight Flash, we take advantage of our demographic variables to dig into changes in spending habits, particularly among the 65+ age group that is getting the vaccine first in most states.

Superstores and wholesale retailers saw strong growth in downloads and engagement in 2020. We attribute this to consumers being especially focused on affordability and bulk buying this year. You can learn more about this consumer trend, and all the retail performers who benefited, in our joint analysis with Semrush.

With 2020 in the rear-view mirror, we can gauge the true impact of COVID-19 on the Business & Productivity app space, and it was truly remarkable. Our State of Mobile Report reveals that consumers across the world installed Business and Productivity apps 7.1 billion times in 2020 – up 35% from 2019. Predictably, the biggest surge began in mid-March 2020 when shelter-in-place became the norm across many regions. At this time, millions of employees were restricted from visiting their offices and had to find new ways of collaborating from home. While there was a surge in the spring, Business & Productivity app downloads remained high, as they were a consistent area of focus for the rest of the year and beyond.

In a challenging year for apparel companies, many clothing subscription companies doubled down on their e-commerce strategies. In March 2020, Nordstrom closed its brick-and-mortar Trunk Club locations in favor of ramping up its digital channels. Similarly, Rent the Runway announced that it would permanently close its five stores while revamping its membership tiers to eliminate the unlimited rental option.

The Association of American Railroads (AAR) today reported U.S. rail traffic for the week ending February 27, 2021, as well as volumes for February 2021. U.S. railroads originated 824,636 carloads in February 2021, down 11.1 percent, or 102,972 carloads, from February 2020. U.S. railroads also originated 1,015,995 containers and trailers in February 2021, up 1.8 percent, or 18,184 units, from the same month last year.