With 2020 finally out the way, let’s take a look forward to 2021. We decided to put SimilarWeb’s powerful data to the test and pinpoint the top 10 digital stocks for the coming months. These are the stocks with strong digital trends that you should keep an eye on in 2021.

One of the sectors most heavily impacted by the pandemic was the fitness space. The inability to have large crowds indoors inherently limited the sector’s ability to reach its full offline potential. But Q4 was especially important because it marked the final point for analysis before an absolutely crucial Q1 – annually, the biggest quarter for fitness chains. So, how is the sector trending?

Fifty-two weeks ago, we wrote a short blog highlighting some of the regional capacity changes in Asia as a result of a small, localised outbreak of a new virus. At the time we thought that there could be some impact on global aviation, perhaps like a SARS or Ebola time impact. We were so wrong! A year later and we are reporting on what has become the single most destructive event in aviation history; it has to end soon, surely?

Footfall across the UK’s biggest supermarkets has fallen by 51 percent in the last year despite their essential retailer status and booming food sales. The big chains reported record sales during the Coronavirus pandemic and festive season claiming consumers treated themselves to luxury items to get them through the lockdowns and to compensate for the closed hospitality industries.

Foot traffic analysis for hotels around the US showed vastly different trends over the holiday season. Compared to the first week of November, hotels in Florida saw a foot traffic uptick of 20% in the week of December 22 - 28, and up 40% in the week between Christmas and New Year, as Americans flocked to warmer climates.

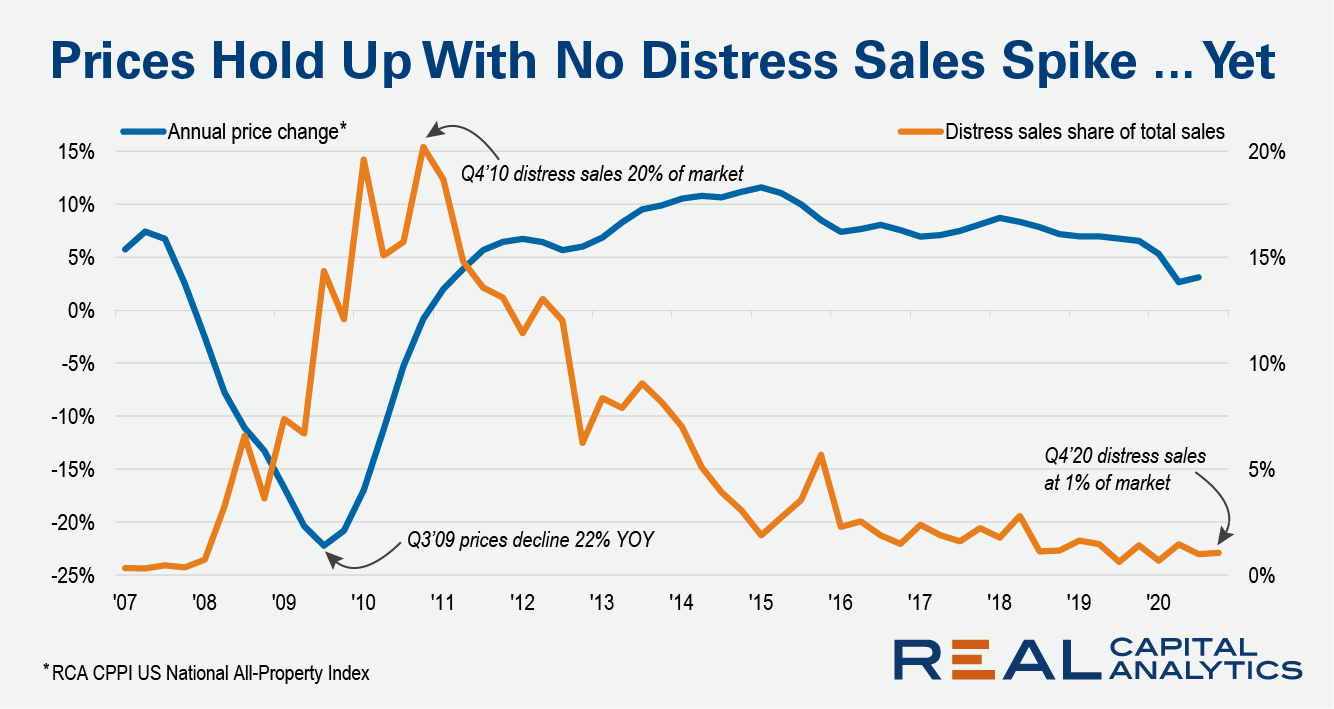

A common theme in the media for December was that we lived through a horrible year in 2020 and that 2021 would be better for us all. Perhaps this sentiment will hold by year-end but the start has been chaotic. Conditions might become more distressing for commercial real estate investors throughout the year, a turn of events that some players are hoping to see.

As COVID-19 has forced movie theatres to close and spurred increased subscriptions to streaming services nationwide, Disney has doubled down on streaming by releasing new movies straight to Disney+. Our analysis explores customer acquisition and retention in the days before and after the release of Mulan (when this surcharge went into effect) as well as consumer behavior around other noteworthy Disney+ launches.

Where other retail segments struggled to come close to their 2019 visit rate, home improvement leaders surged to impressive year-over-year growth. Yet, some brands were able to leverage the powerful surge in customer demand better than others. In our latest Home Improvement 2020 Deep Dive whitepaper, we dove into the major shifts that shaped the industry during the pandemic and investigated which brands succeeded to adapt and profit. Below is a taste of what we found.

Apple’s 5G-capable iPhone 12 is the latest step in the continuous cycle of new technical specifications, new network components, new (or refarmed) radio spectrums and compatible user equipment that aim to deliver enhanced 5G user experience.

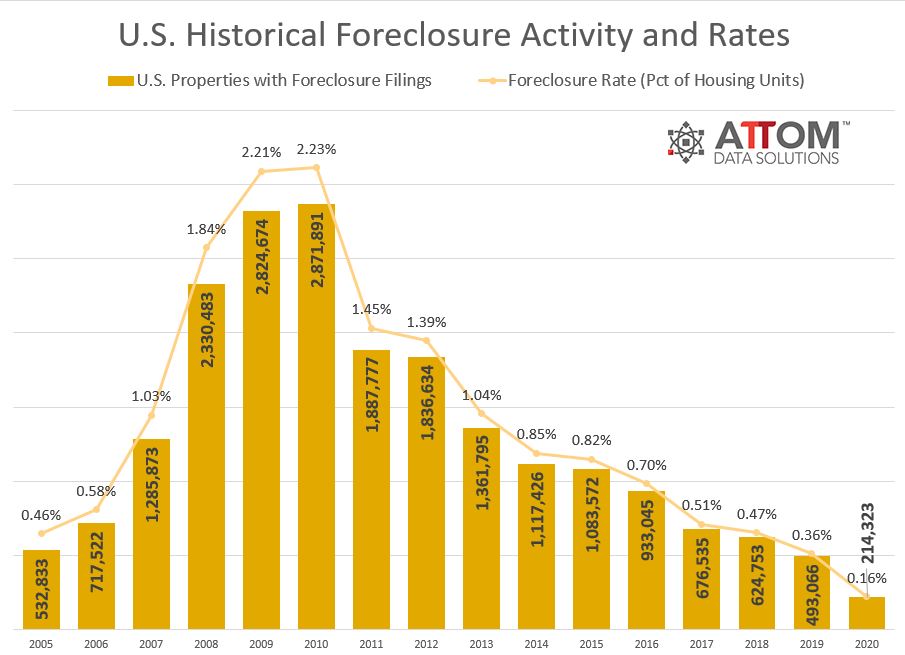

Foreclosure filings— default notices, scheduled auctions and bank repossessions — were reported on 214,323 U.S. properties in 2020, down 57 percent from 2019 and down 93 percent from a peak of nearly 2.9 million in 2010, to the lowest level since tracking began in 2005.

The COVID-19 pandemic made housing affordability a persistent concern throughout 2020. And as we enter the new year, rent payments remain a financial obstacle for many families. According to our latest survey, 30 percent of renters did not make their January payment on-time at the start of the year. This is down just slightly from the mid-summer peak when unemployment was at its worst, but up significantly from historic baseline levels.

The biggest institutional investors into Europe’s commercial property market set a new record for apartment investment in 2020. Nearly 30% of total acquisition activity was focused on the residential for rent and student housing sector last year, according to Real Capital Analytics data.

Costco began 2020 with significant year-over-year growth in January and February, and a slight increase in March before seeing the effects of COVID take over in April. Yet, by July, visits were back to year-over-year growth even as visit durations increased giving the brand the combined benefits of more visits and more impactful visits, likely indicating larger basket sizes.

With COVID cases resurfacing just in time for the holidays, we took a look at several hotels and airports to see how the pandemic affected the country’s holiday travel plans. While showing signs of a recovery, overall airport traffic was still down significantly during the holiday season – one of the normal peaks for travel.

Foot traffic on London’s Oxford St paints a positive picture of what may come as pedestrian traffic touched pre-Covid levels between lockdowns ahead of Christmas. Having regained 80%+ of previous levels for much of the summer, the Indicator fell sharply during Lockdown #2 before peaking at 98pts ahead of Christmas on Dec 9th.

The Association of American Railroads (AAR) today reported U.S. rail traffic for the week ending January 9, 2021. For this week, total U.S. weekly rail traffic was 525,253 carloads and intermodal units, up 4.7 percent from the comparable week of 2020, which was Week 2 – ended January 11, 2020.

J.C. Penney recently announced the closures of 154 stores across 38 states. We decided to look at the affected stores to find out how their human traffic patterns have been impacted by COVID-19 policies in their respective states.

There is a line of thinking around the Covid-19 pandemic that developers can solve some of the problems caused by rising office vacancies in Midtown Manhattan. Developers are capable of amazing feats, but a stabilization of the office market will ultimately depend on a curtailment of the pandemic.

There was major concern last year that the internet might fail under the pressure of increased use as COVID-19 drove unparalleled waves of remote work and schooling. We watched internet performance carefully using data from Speedtest Intelligence® as conditions changed in different areas of the world. Now we’re back to assess what happened during the year as a whole.

In October 2020, 6.1% of home mortgages were in some stage of delinquency (30 days or more past due, including those in foreclosure), a small decrease from September 2020, but a 2.4-percentage point increase from October 2019, according to the latest CoreLogic Loan Performance Insights Report.