Recovery is on the minds of most everyone in the industry at this point in the pandemic. In a previous article published at the beginning of the year, STR analyzed South America and how the region’s hotel performance has been closely tied to its pandemic timeline. With the pandemic situation in mind as we enter the last quarter of the year, is it now time to talk about real recovery in South America? Let’s start with some global perspective.

Summer 2020 undoubtedly looked much different around Europe due to the global impact of the COVID-19 pandemic. Fast forward to this year, and there was hope that the region’s effort toward a more “normal” summer would be successful. On 1 July 2021, the EU Digital COVID Certificate Regulation entered into application, allowing fully vaccinated tourists to avoid tests or quarantines and broaden the list of European regions in which they could travel.

U.S. demand and occupancy continued to surprise and delight as both measures rose again during 19-25 September 2021, which was the second consecutive week of such gains. Most industry observers expected a moderate to sharp performance decrease in the weeks after Labor Day given the seasonal return to in-person schooling as well as the increase in COVID hospitalizations and a low volume of business travel. Occupancy for the week advanced to 63.2%, up 0.3 points week on week and 89% of the comparable level from 2019. During the summer, from the week of Memorial Day to the week of Labor Day, occupancy averaged 66.1% and 91% of 2019’s levels.

While the apparel sector as a whole is still struggling to consistently match or exceed its 2019 visit levels, major sporting goods stores are seeing their visits jump. We dove into the data to get a better understanding of this category’s impressive offline success. For the past five months, visits to four major sporting goods brands – Hibbett Sports, Dick’s Sporting Goods, Academy Sports + Outdoors, and Big 5 Sporting Goods – have consistently outpaced 2019 monthly visits.

Before the pandemic, it was typical for many of us to make several weekly runs to our neighborhood grocery stores so we could throw together a last-minute dinner. And if we were too tired to cook, dining in at our local restaurant would also work in a pinch. Since COVID-19 was declared a global pandemic, those carefree grocery habits and preferences have evolved for consumers around the country. Initially, customers embraced these new behaviors out of necessity. However, as the pandemic persisted, these new habits ended up sticking around as life adjusted around this new normal.

We are delighted to have sponsored today’s The Seaside and Coastal Regeneration Conference 2021, chaired by Professor Sheela Agarwal and featuring contributions from Sally-Ann Hart MP, Chair, All-Party Parliamentary Group on Coastal Communities. Our own Ben Ward-Cochrane, industry lead for Local Government presented original research contrasting seasonal coastal economies through footfall and catchment area analyses using mobility data from Community Vision

At the end of September 2021 – 18 months after the passage of the CARES Act which provided millions of homeowners the protection of COVID-19 payment forbearance – many mortgage loans are expected to reach the end of forbearance. That is, of an estimated 1.7 million mortgage loans that are in forbearance at the start of August, more than 1.2 million loans will reach the maximum 18-month term limit at the end of September, representing 73% of the total forbearance plans.

This year’s back-to-school season was different in a lot of ways for many children, but not much changed in retailers’ pursuit of their parents’ spend. In this week’s Insight Flash, we use our unique ability to cut our data by households with children to see where back-to-school growth was strongest. We examine average ticket growth by subindustry, changes in channel trends, and which brands are most exposed to households with children.

Labor Day marks the unofficial end to the summer travel season in the US, and 60% of Americans reported travel plans according to Cars.com, up 17% year over year. 9.2 million consumers hit the skies during the Labor Day holiday weekend, while cars.com reported more than 20% canceled flights and chose to drive amidst concerns over the delta variant. While global regions still face varying levels of pandemic safety regulations and Delta variant precautions, data shows travel and navigation apps surpassed 1.1 billion downloads from May to Aug 2021,

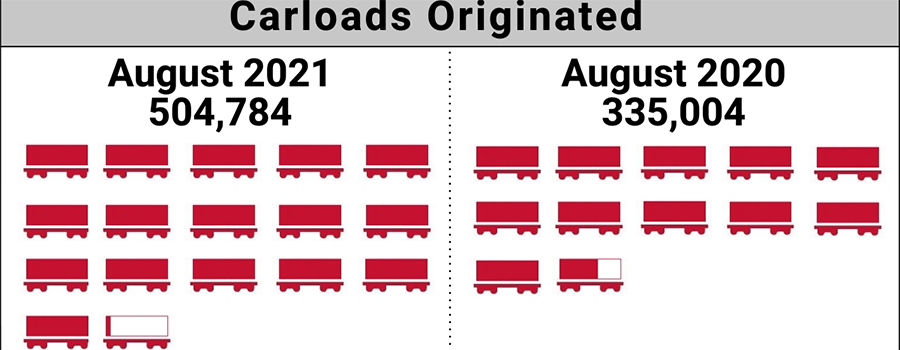

The number of carloads moved on short line and regional railroad in August 2021 was up compared to August 2020. Carloads originated increased 50.7 percent, from 335,004 in August 2020 to 504,784 in August 2021. Nonmetallic Minerals led gains with a 120.4 percent increase. Petroleum Products was up 106.5 percent, and Trailer and Container and Chemicals increased 100.8 and 82.0 percent, respectively. Grain led declines, down 11.2 percent. Motor Vehicles and Equipment was also down in August.

For ten of the past thirteen weeks, scheduled airline capacity from Russian airports has exceeded capacity in the same weeks in 2019. While there has been plenty of focus on the recovery of the domestic Chinese market and domestic US market, much less has been said about Russia but the country has witnessed a remarkable increase in flying this past summer. While international capacity from Russia has been steadily growing all year it still remains at 39% below 2019 levels, but domestic capacity has been positive since March, and seen a major surge between April and June.

Prior to the pandemic, most consumers didn’t pay much attention to the names of big pharmaceutical companies. But now that public health has been on the forefront of our minds for more than a year and a half, we’ve moved from indifferent to engaged. Pharmaceutical companies are highly regulated but that didn’t stop them from spending [**$6.58 billion**](https://www.fiercepharma.com/special-report/top-10-ad-spenders-big-pharma-for-2020) on advertising last year across B2B and B2C sectors. Here’s a check-in of the latest trends and spending taking place in the pharmaceutical category.

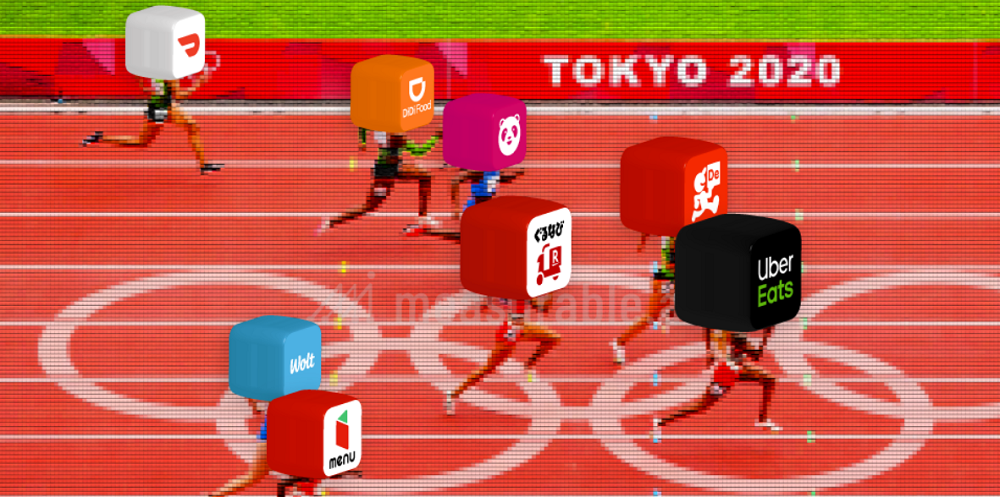

The rapid development of the on-demand food delivery industry has transformed dining all over the world. Even cultures where dining at home is more the norm, they have succumbed to the convenience of ordering online from food delivery apps now. This can be seen even in countries like Japan, which remains one of the largest food delivery markets in the world but yet it still remains grossly underpenetrated relative to the size of the population and the size of the economy.

During the peak summer months, Spain was one of the destinations in the world to see its domestic tourism sector get close to pre-pandemic levels with the most resilient destinations for both local and international tourists being the Balearic Islands and the Canary Islands. Tickets confirmed in September for any future travel versus the same period in 2019 show the Canary Islands as the most desired destination for locals and internationals yet again.

This week, we collaborated with Hedge Fund Alert to track hedge fund hiring trends as people return to offices. Our analysis shows that after a dip following the pandemic, hedge fund hiring rates in 2021 are greater than they have been in 8 years and are continuing to rise sharply. Looking at the headcount growth of certain roles in 2021 versus 2020, we see that there is a strong growth of senior roles with engineering and technical focus. Traditional banking roles, which are still strong in absolute numbers, are seeing a relative decline. This may be due to the industry’s growing focus on algorithmic trading.

The infamous dot plot from the Federal Reserve meeting last week suggests an expectation of a 2022 liftoff for U.S. interest rates. But who knows, forecasting interest rates is not like forecasting commercial property market trends: a lot can happen quickly. Still, seeing that chart, market professionals are asking if cap rates will go up if that expectation comes to pass in 2022. My question is, why should cap rates start responding to interest rates now all of a sudden?

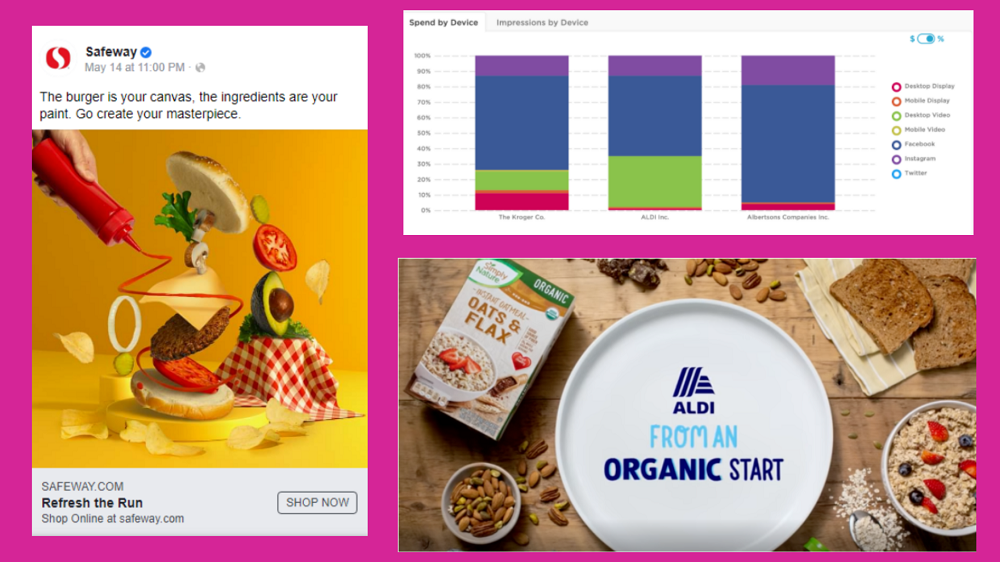

Many businesses, small and large, have taken a hit due to the coronavirus outbreak. But one category, in particular, enjoyed predicted and substantial gains: online grocery delivery. The pandemic converted millions of Americans into first-time online grocery shoppers, fueling a 54% growth in web sales across the category in 2020. So how did grocery delivery connect with consumers during the height of the pandemic? Drizly, Instacart and Shipt emerged as the top three advertisers in the grocery delivery category during this period.

STR’s monthly 51-chart map focusing on revenue per available room (RevPAR) on a total-room-inventory basis shows a variety of recent national/regional market trends as well as the general pace of the industry’s continued recovery from the pandemic. With Labor Day marking the unofficial end of the summer leisure-oriented travel season, recent weeks have produced a dip from summer peaks in many markets with ground lost from 2019 RevPAR levels. This expected seasonal slowing in U.S. hotel business is evidenced in most states’ performance.

In this Placer Bytes, we dive into the recovery of Disney’s two namesake theme parks and explore what Labor Day weekend may be telling us about department stores’ upcoming holiday season. Following an extended period of depressed visits, Disney World and Disneyland both saw visits climb impressively close to 2019 levels during the summer. July visits were down 8.2% to Disney World and 25.3% to Disneyland.

Global airline capacity has increased week-on-week but remains stubbornly below the 80 million mark with an additional 180,000 seats taking the global total to 79 million (with a little bit of rounding up). A 0.2% increase in seats is at least a positive development compared to recent weeks, but capacity remains 30% below the 2019 level with little hope of an improvement in the coming weeks. The reopening of the United States, at a date sometime in November, may have resulted in a surge of airline bookings but it certainly hasn’t resulted in airlines adding capacity