To work from home, from the office or both. The jury is still out. Large cities like London depend so much on the commuter market. How soon historic commuter patterns return – if at all – is very significant for the local economy. Earlier this week we looked at the rise in daily trips into the Square Mile from towns in Essex. Some tantalising indications emerged. Today we look at peak travel times on TFL’s Greater London network and measure how the profile has changed.

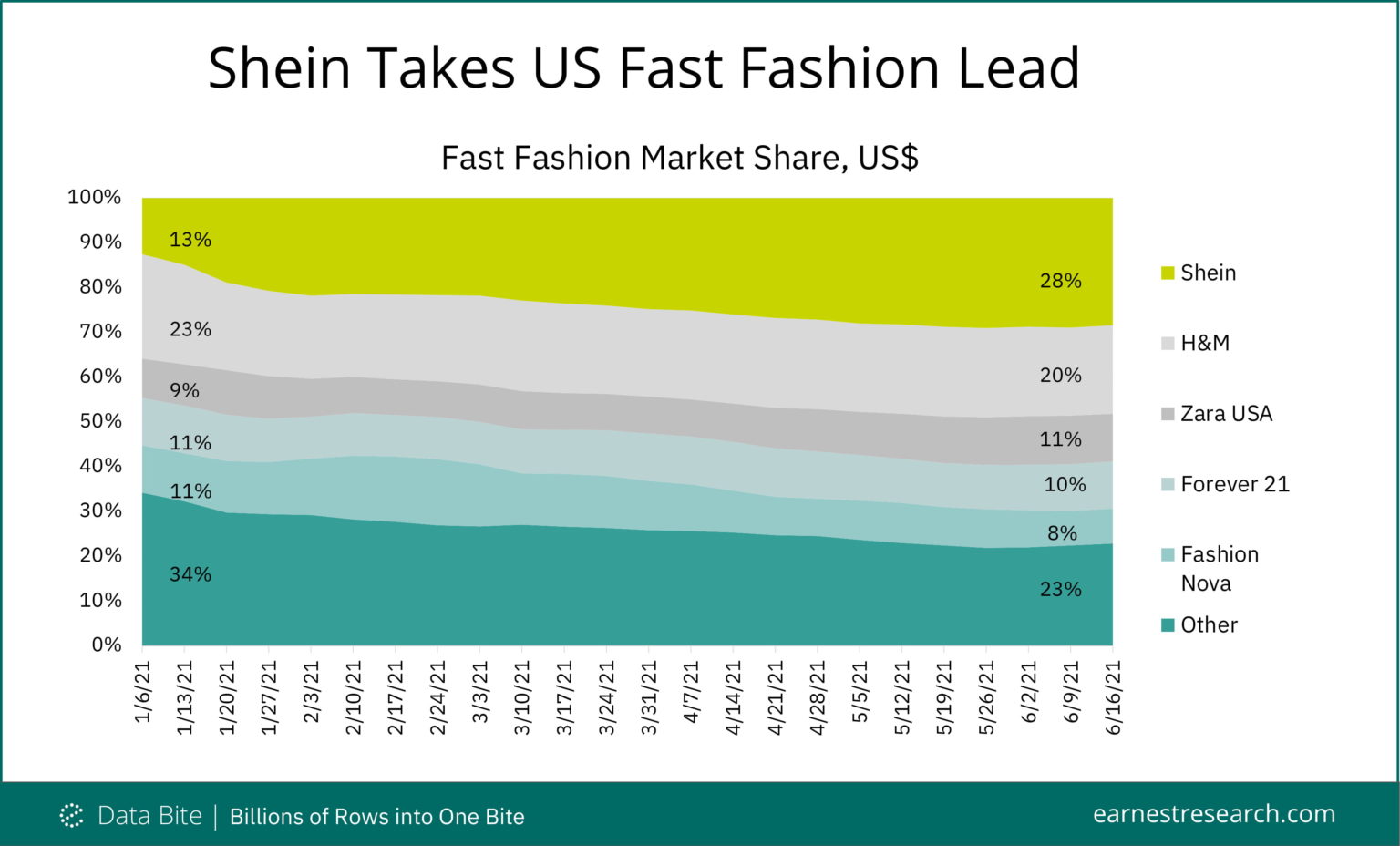

The Chinese brand loved by Gen Z and rumored to be exploring an IPO — Shein– is now the largest Fast Fashion retailer in the US by sales, only two months after displacing Amazon as the top e-commerce app downloaded in the US. Market share data from Earnest shows that Shein began 2021 with 13% of total Fast Fashion sales, trailing traditional leader H&M. Since January, Shein continued to gain share and now leads with 28% of the Fast Fashion market, with Zara the only other brand growing share during that period.

The headline rate of U.S. property price growth quickened in May, powered by accelerating increases in apartment prices and gains across all major property types, the latest _RCA CPPI: US_ summary report shows. The US National All-Property Index grew 0.8% from April and 8.9% from a year ago. Apartment sector prices were the fastest growing in May at 10.1% year-over-year, overtaking industrial at 9.5%. Office price growth came in at 2.9% and the retail sector turned in a 2.3% annual gain.

Throughout the pandemic there were certain sectors that enjoyed a particularly strong showing, like [Home Improvement](https://www.placer.ai/the-square/quarterly-indexes/home-improvement/) and [Grocery](https://www.placer.ai/the-square/quarterly-indexes/grocery/). But with the retail recovery continuing at a strong pace, we dove into three segments that could see a better than expected Back to School season. While beauty brands may have taken a hit during the pandemic, the recovery period has been especially kind to the segment. Ulta saw monthly visits up in four of the first five months of 2021 when compared to the equivalent periods in 2019

Last week felt like a big one in California. Vaccination rates are up, cases have slowed to a trickle, and the state has now fully reopened. Across the US, our initial spike of foot traffic enthusiasm has subdued a bit. All the things we didn’t expect to pop — like grocery, big box, and dollar stores — have subsided to their usual levels. But the Vacillating category — the hotels, casual restaurants, entertainment venues, and bars — hasn’t given up its gains. And in some cases, traffic is still trending upward.

We recently shared how our data is providing early and predictive signs that growth in Food Delivery spend remains elevated. While spend remains relatively high versus pre-pandemic levels, we can look at a number of underlying customer metrics to help unpack the reasons for the improvement. This week we look at how customer cohort analysis enables a deeper and more accurate understanding of customer behaviour trends over time, relating to retention, spend frequency, order size and customer spend value.

The pandemic-driven transformation to working remotely was one of the biggest shakeups of the past year, the effects of which we are still witnessing today. With just over half the US population now vaccinated and many local economies reopened, the nature of remote work is top-of-mind: are employees returning back to the office, or will remote work be a sustained new reality in the post-pandemic workforce?

Comscore (NASDAQ: SCOR), a trusted partner for planning, transacting, and evaluating media across platforms, today announced very positive news for theatrical exhibition in France, with our exclusive data demonstrating how the recovery of the movie theater business is taking shape in the international arena. Key Comscore box office information show that France enjoyed 8.5 million admissions in one month following the reopening of the cinemas on May 19th.

As outdoor activities continue to grow in popularity, stores selling hiking and camping gear are preparing for a busy summer season. In today’s Insight Flash, we dig into performance among the top players in the Outdoor space, focusing on changes in market share, how much of the business is driven by the most loyal customers, and what average transaction size implies about product mix. Spend growth in Sporting Goods has been booming in 2021. Spend in January was up almost 50% y/y, followed by almost 30% spend growth in February.

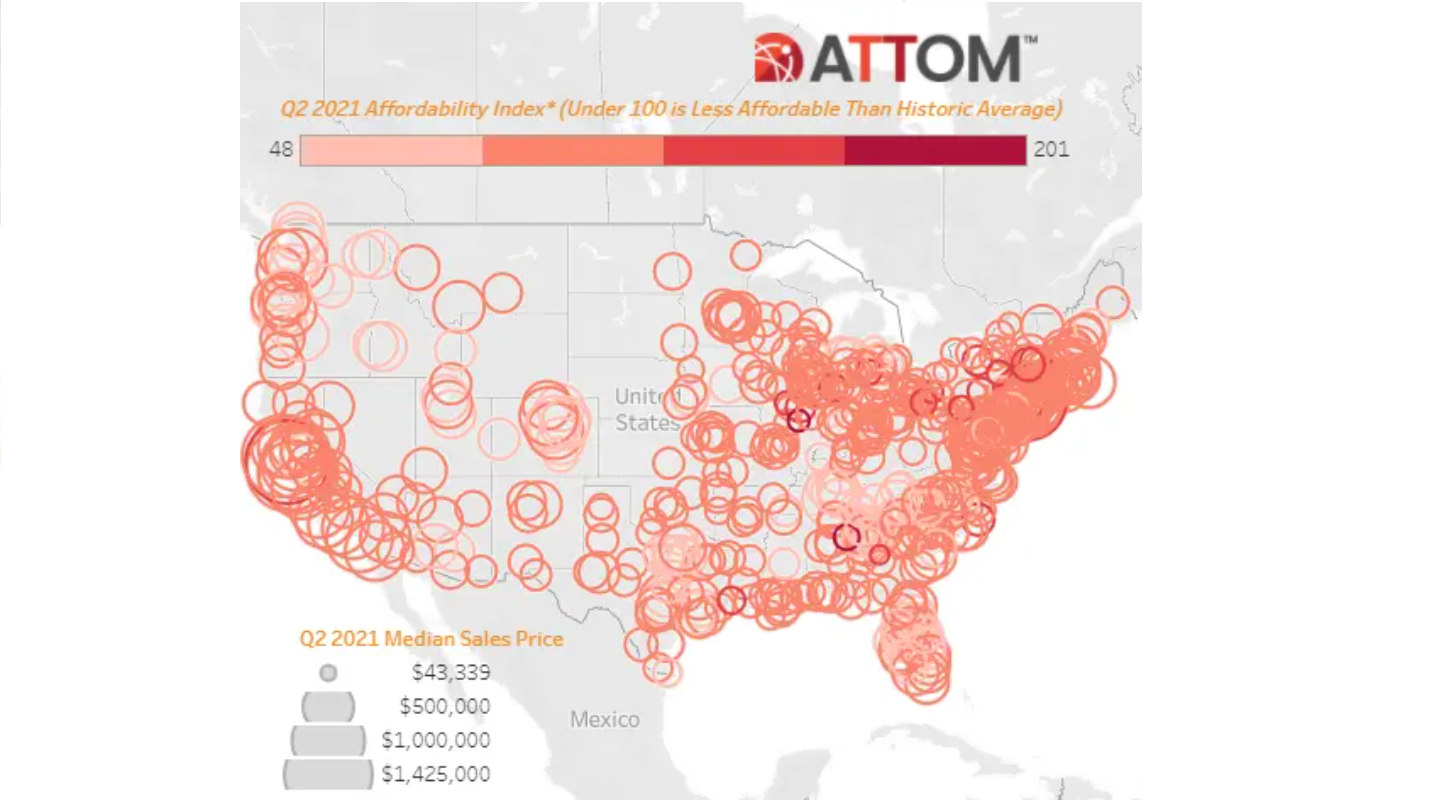

ATTOM, curator of the nation’s premier property database, today released its second-quarter 2021 U.S. Home Affordability Report, showing that median home prices of single-family homes and condos in the second quarter of this year are less affordable than historical averages in 61 percent of counties across the nation with enough data to analyze. That was up from 48 percent of counties in the second quarter of 2020, to the highest point in two years, as home prices have increased faster than wages in much of the country.

To assess how severely the rental market has been disrupted by the COVID-19 pandemic, and how quickly it is returning to pre-pandemic prices, we use historical rent data to estimate “projected” rent prices from April 2020 onward. These projections assume that rent growth in 2020 and 2021 mirrors pre-pandemic growth and follows typical seasonal trends in each city studied. For more details on these projections, see the Methodology section below.

Once upon a time in the not-so-distant past, Nike and Adidas were enjoying what seemed to be an unbreakable bond with their Chinese fans. Both brands have very popular flagship products with loyal followers, such as the Adidas Yeezy, Nike Air Max, Nike Air Jordan. But this seemingly unbreakable bond started to crumble almost in a split second when the two companies released a sensitive statement in March of this year, leading to an overnight boycott of the brands. A crushing, bombshell “break-up” neither Adidas nor Nike knew was coming

Fears of inflation are heating up. But wages are telling a different story. This week we explore salaries to see what industries and jobs are most affected. In a previously published newsletter titled, Labor Markets are Not as Healthy as They Look, we documented an 8.8% decrease in salaries from March to August 2020. In the figure below, we continue to observe a similar trend by looking at the average salary for the past 3 years.

U.S. commercial real estate transaction volume jumped in May compared to a year prior when the pandemic put the brakes on activity, the latest _US Capital Trends_ report shows. Apartment sector activity was more than double that seen a year ago and deal volume surpassed that of the office and industrial sectors combined. For the first five months of 2021, the apartment sector is the only major property type to eclipse deal levels in the same months of 2020 and the average of the years leading up to the pandemic.

In this Placer Bytes, we dive into Torrid and its peers and take a look at the pet supply sector’s recovery. Plus-sized retailer Torrid Holdings Inc. recently filed for an Initial Public Offering, two years after withdrawing its previous IPO filing. This is huge news for Torrid, and can signal good tidings for the plus-sized clothing sector as a whole. Since Torrid was acquired by Sycamore Partners in 2013, and the same private equity firm (through affiliate Premium Apparel LLC) recently acquired additional plus-size retailers Lane Bryant and Catherines

Housing prices continue to surge—frustrating potential homebuyers. “It’s becoming clear that record-high price growth and an enduring shortage of available homes are beginning to hinder would-be homebuyers,” said Matthew Speakman, an economist at Zillow. “Sales volume continues to struggle to regain the momentum it built late last year.” Residential homeowners and politicians are pointing fingers at investment firms, but data points to other culprits. At the same time, commercial real estate won’t fully rebound for another couple of years.

After months of cramped up home workouts, people across the U.S are now looking to get their fitness routines back on track. Our research data suggests that gyms across the country have been seeing increased customer traffic as a result of the recent easing of Covid restrictions and the long-awaited return to normalcy. As of May 2021, foot traffic in nationwide gym chains was back to 51% on average compared to Jan 2020 and 47% back to May 2019 levels, suggesting that gyms overall are halfway through to reach pre-pandemic levels.

For some seasonal industries, the COVID-19 pandemic has spurred increased demand outside of the typical busy season. This is particularly true for the direct-to-consumer (DTC) flower industry—including flower subscription box companies—which experienced strong sales growth throughout 2020 and early 2021. Consumer transaction data reveals that sales for DTC flower companies were collectively 28 percent higher in 2020 than in 2019, and 2021 year-to-date sales as of May are 10 percent higher than the same time frame in 2020.

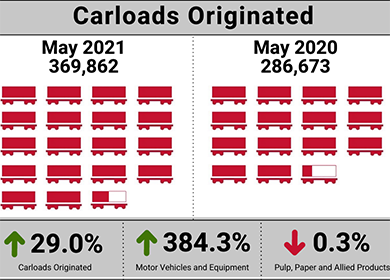

The number of carloads moved on short line and regional railroads in May 2021 was up compared to May 2020. Carloads originated increased 29.0 percent, from 286,673 in May 2020 to 369,862 in May 2021. Virtually all carload groups were up. Motor Vehicles and Equipment led gains again with a 384.3 percent increase. Petroleum Products was up 102.8 percent and Waste and Scrap Materials and Nonmetallic Minerals increased 67.6 and 65.7 percent respectively. Pulp, Paper and Allied Products was the only decline, down 0.3 percent in May.

The wider retail recovery is well underway, but a more nuanced perspective is necessary to properly appreciate the relative rebounds of specific brands. Some sectors saw significantly greater challenges, while others benefitted from the unique retail circumstances driven by the pandemic. We dove into the data to uncover some of the more impressive retail rebounds. The ‘death’ of the department store was an oft-reported trend before and during the pandemic. And while the sector has certainly experienced its fair share of challenges.