Amazon held its annual Prime Day event on the 12/13th July this year. In an environment where online spending has continued to decline from the highs reached in 2020 and 2021 and the current cost-of- living crisis is biting hard, we were curious to know whether this squeeze on incomes might have dulled the consumer love affair with Amazon in 2022. However, our data shows that the number of Amazon transactions during the week that this year’s Prime Days took place, rose nearly 12% compared to 2021.

A heat wave at the end of July led to scorching temperatures across the US. As consumers cranked up their air conditioners and iced their beverages, did any businesses benefit from the warmer weather? In today’s Insight Flash, we take advantage of our partnership with WeatherOptics to examine the impact in two markets on the East and West Coast, and to deep dive into how the heat wave progressed for movie theatres, a seemingly cool haven for those looking to keep their AC bills down.

Subway has made headlines for both its store closures and creative menu updates, so we decided to dive into recent foot traffic data to understand how these changes are impacting Subway visits nationwide. Rightsizing has been classically seen as a softer terminology to discuss store closures. But there is a significant trend of rightsizing that is more focused on optimization. Foot traffic data shows that Subway’s overall visits are down year-over-three-year (Yo3Y) while Yo3Y visits per venue are nearing or exceeding 2019 levels.

With our latest location data, we analyzed foot traffic for three leading theater chains – AMC Theaters, Regal Cinemas, and Cinemark – to see how the movie theater recovery is progressing and to understand how inflation and changes in media consumption are impacting the behaviors of moviegoers. Year-over-three-year (Yo3Y) data for the first half of 2022 shows that visits to the three leading movie theater chains are steadily rising to pre-pandemic levels.

What do the COVID-19 pandemic, a looming recession, rising interest rates and global conflicts have in common? They all impact nearly every aspect of life, including how brands spend their ad dollars. While the lasting impact of these events remains to be seen, we are starting to see how advertisers are responding to the shifting sands. Hint: Most of them are spending less. Still, there are opportunities to convince them to open their wallets. Recently, MediaRadar looked at a sampling of advertising on over 215 digital content companies like BBC News, ABC, and USA Today.

In October 2021, Facebook announced its rebranding to Meta to reflect its focus on building the “metaverse” – an immersive virtual environment that could redefine social interactions online. Many believe the metaverse is the next big thing in tech. In collaboration with Bloomberg, we took a look at the recent hiring trend in the world of metaverse to see which companies have been riding the recent hype.

We dove into foot traffic trends for Popeyes, KFC, and Taco Bell to see how menu changes impact visits. Although the data presented here does not include all drive-thru and pick-up orders – and so does not represent the totality of the brands’ foot traffic – these metrics still show how a single popular item can significantly boost traffic across a QSR brand.

After a contentious battle between JetBlue and Frontier, Spirit Airlines has finally announced a deal with JetBlue. In today’s Insight Flash, we look at what the deal will mean for their combined consumer spend share, how close the companies really are when it comes to ticket prices, and which competitors are the most at risk in key hubs based on cross-shop.

Meal Delivery app engagement is stagnating for the second year in a row, giving Meal Kit apps room to grow monthly active users (MAU) 98% from last year. MAU among the top 7 U.S. Meal Kit apps jumped 42% in Q1 2022 from Q4 2021, and another 56% in Q2. Meanwhile, MAUs among top Meal Delivery apps grew 1% and 2% across the same timeline. As Americans realize economic pressures, mobile data shows that high cost conveniences may be being cut. The Ultrafast Delivery app market (Getir, Gopuff, etc.) is a perfect poster child example. In Q2, it declined growth for the first time in two years at a -30% loss.

Gap Inc (NYSE: GPS) recently saw its CEO step down amidst weakening sales and supply chain issues. However, our consumer transaction data shows that while some brands within Gap Inc’s portfolio—Old Navy and its namesake brand Gap—saw their U.S. sales decline year-over-year in Q2 2022, other brands like Athleta, Banana Republic, and Banana Republic Factory experienced positive growth. Our analysis shows that in addition to year-over-year sales growth, these three brands experienced increases in average quarterly sales per customer compared to before the pandemic.

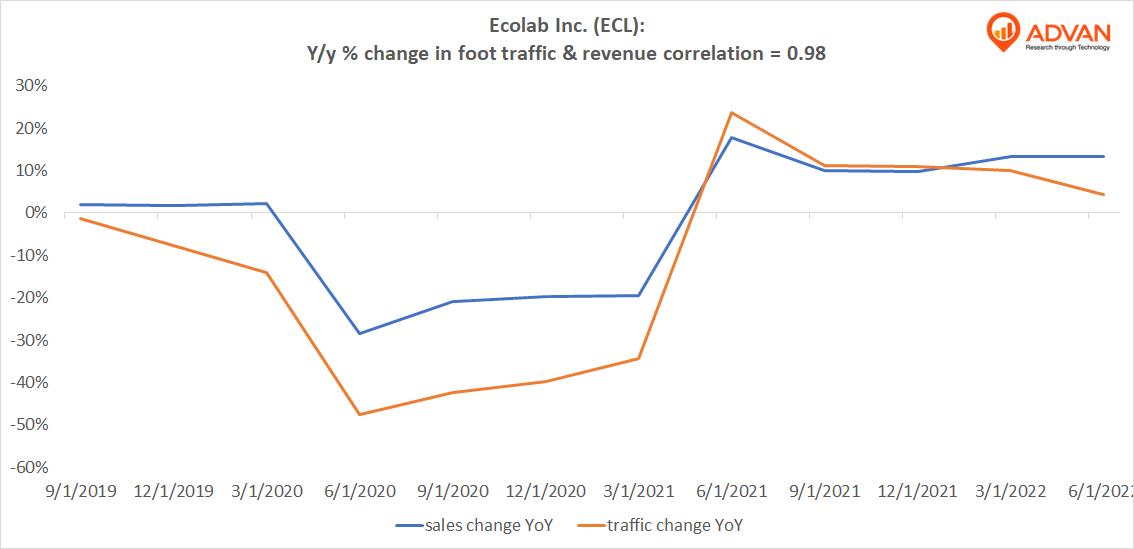

Notable Hit 1: (ECL:NYSE) On Tuesday July 26, 2022 Ecolab Inc. (ECL) posted better than expected revenues of $3.58bn surpassing the consensus estimate of $3.50bn or by +2% and in the same direction as Advan's forecasted sales. The revenue was up 13.2% YoY and in line with Advan's employee foot traffic data increase of 4.3% YoY at its factories for Q2 2022. Advan's footfall data has a correlation of 0.98 on a YoY basis with ECL's top-line revenue over the last 12 quarters.

Our latest white paper dives into the spectacular return of the offline fitness industry. We looked at overall fitness visit patterns, regional variance trends, and changes in gym-goer behavior to analyze how consumers’ relationships with health clubs have evolved as a result of the pandemic. We also explored the impact inflation has on the sector to understand how fitness consumer behavior is adapting to changing economic circumstances. Below is a taste of our findings – for the full report, read the white paper here.

According to consulting firm Quinlan and Associates, the virtual banking industry in Hong Kong is forecasted to create a HK$76 billion ($9.7 billion) per annum revenue opportunity by 2025, servicing a total customer pool of 1.9 million (i.e. 24.9% of the current Hong Kong population). In 2019, the Hong Kong Monetary Authority licensed eight virtual banks. These eight firms are: ZA Bank, Mox Bank, WeLab, Airstar, Livi, PAOB, Ant Bank and Fusion.

Mall mainstay Claire’s jewelry has seen a recent turnaround, moving to off-mall locations and partnering with large brick-and-mortar chains to display its products. In today’s Insight Flash, we look at how the company’s DTC business is performing in the US and UK versus the broader subindustry, whether it’s capturing nostalgia Gen Zers or a new audience in the US, and whether its new Walmart partnership is likely to boost sales.

Consumer needs for their health & fitness regimens continue to evolve and mobile apps play a major part in serving them. Downloads and revenue across Health & Fitness apps continue to grow into the summer, even surpassing the “New Year Resolution” spike in January 2022. As consumers dropped “New Year, New Me” and adopted ‘Everybody is a Summer Body,’ there is a clear opportunity for health & fitness brands to become embedded in people’s wellness routines and find ways to retain existing customers.

Employee morale has taken a significant hit since the onset of the pandemic. In fact, in a previous newsletter, we found that the greatest predictor of employee satisfaction was Workplace Culture, followed by Career Opportunities and Work-Life Balance. But instead of looking at companies, this week we look at what cities have the most satisfied workforces.

In the early days of the pandemic, amidst the lockdowns, population exodus, and mounting daily COVID cases, many predicted that New York City was finished. But as it turns out, it takes more than a global pandemic to destroy the city that never sleeps. Using foot traffic data, we dove into recent retail, tourism, and migration patterns for Manhattan and Brooklyn to understand how the past two years have impacted these iconic urban hubs.

In today’s difficult and unprecedented times, taking care of our mental health is more important than ever. With online mental health therapy services like BetterHelp, TalkSpace and Cerebral, consumers have a variety of options to meet with a therapist and support their mental health anytime, anywhere. We took a look at how these services have adjusted their ad spend throughout 2022 so far, and may continue to shift their spending with current events.

In its first appearance on our download leader charts, Sweatcoin is the most downloaded Health & Fitness app in H1 2022. Flo Period and Ovulation Tracker held the top spot for the full year 2021, but is losing its grip globally and, in particular in the U.S., as the Roe v. Wade decision surfaced mainstream media conversations about Flo's not-so-distant past sharing sensitive user data.

It’s known that millennials love their furry companions after it was confirmed that 58% of millennials said they’d prefer to have pets over human children. Even more, the same survey revealed of 1,000 pet owners that 57% of pet parents love their animals more than their siblings. The trend doesn’t stop at millennials, either. In 2020 70% of US households owned pets, an all-time high. With many seeking some form of companionship, people turned their attention to their fur babies, spending more on them than ever before.