As many Americans are returning to the office, pet owners are faced with the question of what to do with their pets while at work. That’s potentially good news for pet care companies, which struggled early in the pandemic as more people were staying home. In fact, the dog-walking platform Wag announced in February 2022 that it is planning its public debut via a SPAC deal. Its main rival, Rover (NASDAQ: ROVR), went public in August 2021, also through a SPAC merger. But pandemic recovery has differed for these two canine care companies.

The Omicron wave drove record numbers of COVID cases throughout the country. And the impact the variant had on retail was also unique, creating some of the most notable COVID related side effects since the early stage of the pandemic. We dug into the effects of the Omicron wave, and what the early recovery data shows. The wider brick-and-mortar retail sector had seen a steady recovery through the summer with the combination of declining cases, renewed demand and vaccination driven confidence driving visits.

Despite the COVID and supply chain challenges of 2021, several major retailers chose to go public last year. We looked at some of the companies – including Warby Parker, Arhaus, Allbirds, and Dutch Bros. – in our Top 10 Retail Brands to Watch white paper. Here, we dive into two more recently public brands – Joann and First Watch – to see how they finished off 2021 and where they stand in 2022.

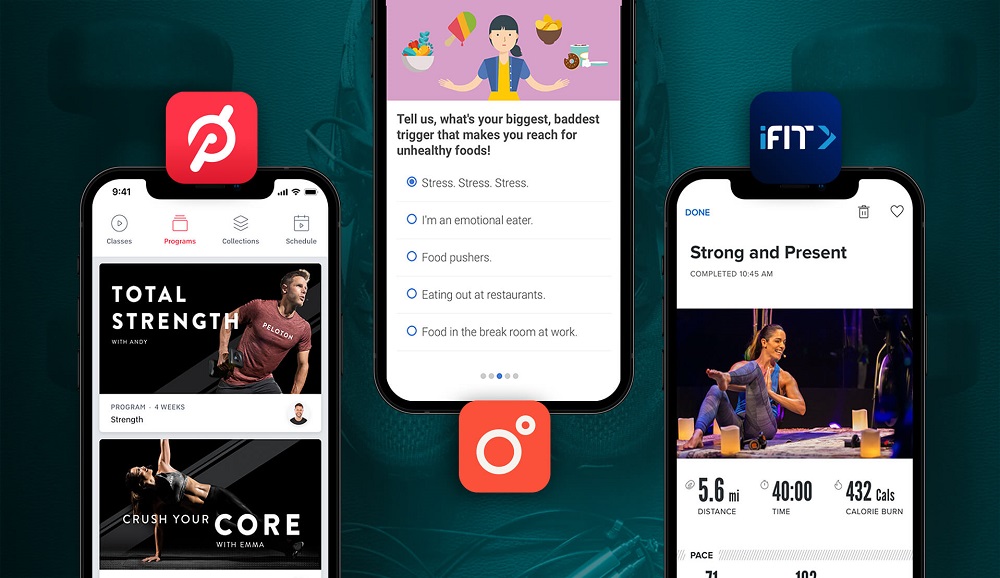

If it seems like your Facebook feed is suddenly full of diet and workout ads, you’re not imagining things. Pathmatics data from January 2022 tells us that fitness and weight loss brands like Noom, Peloton, and iFit have been investing heavily in Facebook ads. In fact, all three brands have spent more on this channel than any other in January 2022, and far more than they did in January 2021. So which devices are these three companies advertising on, and just how much have they beefed up their ad spend?

One of the most interesting questions when it comes to consumer behavior is how city dwellers spend differently from those living in the suburbs or rural areas. Our newly launched UK cohort dashboards allow a deep dive into spend for the London region to complement our existing CSA-level analysis in the US. In today’s Insight Flash, we do a side-by-side comparison of spending in London, Los Angeles, and New York to see whether cities worldwide are more similar to each other than they are to surrounding areas.

Dollar and discount stores gained momentum over the pandemic, and recent data indicates that these superstores are largely holding onto their strength. So while Walmart is still the undisputed leader of discount retail, the rise of alternative value retailers is beginning to impact the power dynamics in the sector. To better understand these shifts, we dove into foot traffic and consumer demographic data for the legacy discount retail giant as well as for Family Dollar, Dollar General, Five Below, Big Lots, and Dollar Tree.

Faced with a rise in inflation resulting from a myriad of factors such as COVID-induced supply chain bottlenecks to increases in wages and pent-up demand, U.S. consumers in 2021 had to act definitively and fine-tune their spending behavior. Envestnet® | Yodlee® financial behavior trends, derived from aggregated and de-identified transaction datasets, can be utilized to provide answers to questions around major shifts in consumer spending trends such as those emanating from inflationary pressure.

Happy Valentine’s Day from Consumer Edge! In light of the recent holiday, today’s Insight Flash provides a sneak peak of our new CE Transact UK Cohort data to analyze similarities and differences in how Americans and Brits find love online. We dig into which daters spend more on app bonus features, how many return to spend on the app when their dates are unsuccessful, and what cross-shop looks like in the US and across the pond in the UK.

According to its most recent earnings call, profitability remains a long-term goal for Blue Apron (NYSE: APRN). The meal kit pioneer has faced increased competition from other meal kit companies in recent years. Additionally, the industry has seen challenges related to seasonal demand and high operational and marketing costs. But how does Blue Apron measure up against other meal kit competitors? We looked at a few of the major meal kit companies—including Blue Apron, HelloFresh, Home Chef, Marley Spoon, and Sunbasket—to see how market share, customer retention, and quarterly transactions per customer compare within the industry as of the end of 2021.

With all the attractive perks such as convenience in getting license plates, government subsidy, better driving experience, and shrunken price difference, electric vehicles sales in China skyrocketed 154% last year as more consumers opt for greener cars. Tesla and BYD remain as market leaders followed by Xpeng, Li Auto and Nio. Tesla beat market expectation and finished 4Q21 strong with 116,236 delivery units in China, attaining +92% y/y growth. Xpeng and Li Auto also showed positive momentum with 41,751 and 35,221 delivery units respectively in 4Q21, while Nio had a mediocre 4Q21 performance with 25,034 units delivered.

In this Placer Bytes, we dive into Best Buy and Costco as they kick-off 2022. Best Buy has always been a very Black Friday-centered brand, so the heavy impact on the day’s strength in 2021 was always going to have repercussions. However, once again, Best Buy has proven to be one of the retailers most capable of strategically adapting to new challenges and concerns. In 2020, Best Buy was incredibly effective at maximizing the retail reopening with tactics like appointment shopping improving efficiency. And in 2021

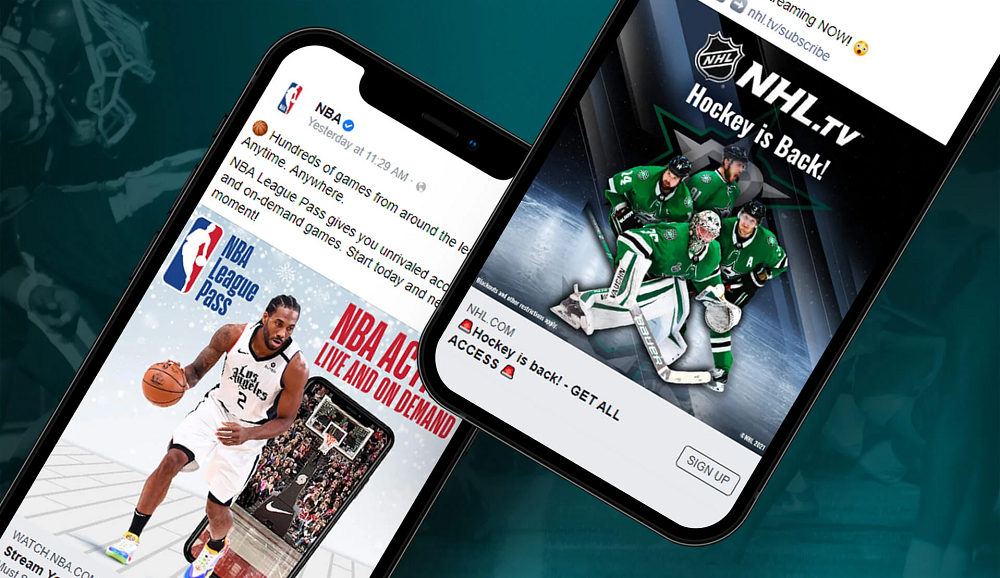

Like so many other industries, major league sports have shifted their advertising strategies to adapt to the ongoing pandemic. During the pandemic, major athletics went through a transformation, with most games canceled, postponed, or held to cardboard cutouts of adoring fans. While this disruption impacted athletes and fans alike, it also posed an even bigger challenge for the leagues' marketing teams. We'll dive into how professional sports leagues pivoted their digital advertising strategies during the pandemic.

In January 2021, the world’s largest collection of non-fiction content became available to the masses. Discovery+ was here. Since then, Discovery+ has attracted a respectable audience, surpassing 20 million paid subscribers by the third quarter of 2021, which exceeded internal targets. To help propel it to this point, Discovery+ launched a partnership with Verizon that gave select customers 12 months of Discovery+ for free. Like most new streaming platforms, Discovery+ is built on an ad-supported model. On launch day, advertising partners included Kraft Heinz, Lowe’s and Toyota.

While a lot of focus around the great resignation has been on people quitting their jobs, the reality is that the vast majority of people are quitting to start a new job – a phenomenon called The Great Reshuffling. But this trend raises an interesting question, how frequently do employees not only change jobs, but change careers, i.e. start a new job in a different field?

In this Placer Bytes, we dive into Planet Fitness to see if the fitness chain can recover from a rough start to 2022 and check in with Dick’s Sporting Goods as it continues to gain strength. While the wider retail sector saw visits down over 4% in January ‘22 amidst record COVID cases, Dick’s Sporting Goods saw visits rise 1.9% compared to the same month in 2020. This followed a 2021 where all but a weather-affected February and COVID-decimated November saw visit growth.

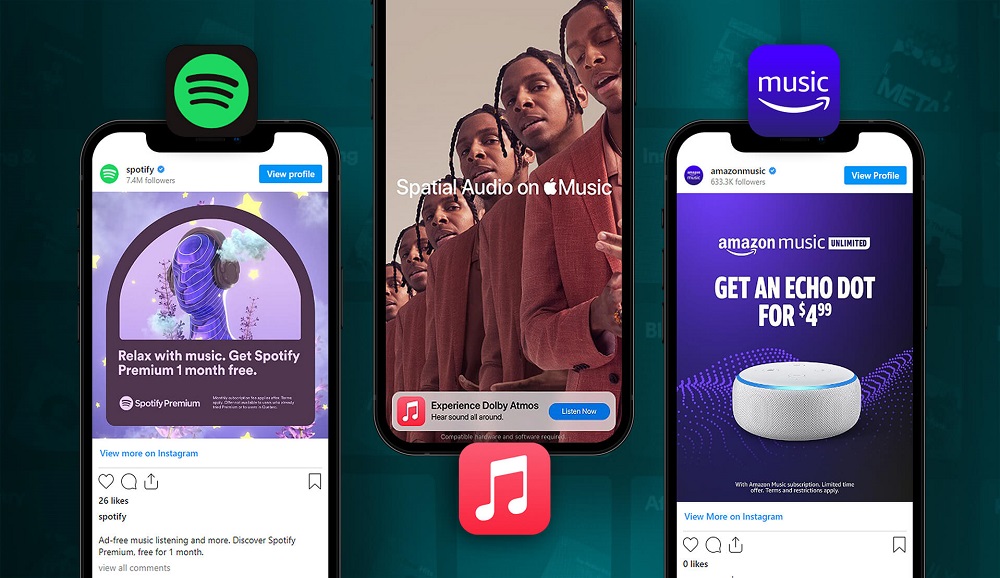

For music lovers, Spotify is practically synonymous with music streaming. And for good reason: The streaming giant says it had 172 million paid subscribers and 381 million monthly active users as of October 2021 — more than any other music streaming service. Its closest competitors, Apple Music and Amazon, are more tight-lipped about their exact subscriber count, but media analyst Midia Research put them at around 79 million and 68 million, respectively. While Spotify reigns supreme, both Amazon and Apple Music have been making moves to attract new listeners.

Digital payments in India are growing at a scorching pace. According to the Economist Intelligence Unit, when it comes to digital payments, India has outpaced the rest of the world, registering the highest number of real-time payment transactions. CLSA Research forecasts the digital payment market in India to grow three-fold to touch US$1 trillion by financial year 2026 compared to $300 billion in 2021. India’s large number of real-time transactions can largely be explained by the prevalence of low-value payments in the Indian economy. Similar trends can be witnessed in developing countries.

With HP and Dell’s earnings releases right around the corner, there are rumblings that Dell is expected to beat estimates. Given this optimistic outlook, we thought it would be worth taking a quick 2-minute look at these companies’ recent hiring patterns using Linkup’s Insights platform, just to see whether we can add evidence to confirm or deny the existing narrative, and if we can provide a better understanding of the future demand both companies can expect.

Though Fish and Chips may be a British staple, fast food popularity in the UK is quite diverse overall. In today’s Insight Flash, we take advantage of our newly launched CE Transact UK Cohort data to analyze where Brits go for a quick bite. We dig into which chains are the most popular in which countries, which pizza chains have seen the highest return behavior, and what cross-shop looks like across burger brands.

In Silicon Valley, Netflix is a rare unicorn that pivoted not once but three times, ultimately allowing it to develop programs tailored to multiple audience interests simultaneously. The company started as a mail order DVD service. When that model ran its course, it switched to streaming movie content online. Then, in 2011, it switched again, moving away from licensing third party content in favor of its own homegrown material. In effect, it became a studio.