As we head into 2021, we decided to carry out a deep dive into some of the biggest players in the UK supermarket business, namely: Tesco (TSCO), Morrisons (MRW), Ocado (OCDO), Asda (owned by Walmart, WMT), and Sainsbury’s (SBRY).

Petco re-entered the public markets on 14 January, raising $864M, and its stock price was up 55% in the moments after its third IPO. The company is now trading on the ticker WOOF, and the share price has stabilized following its initial surge. Whether you participated in Petco IPO or not, we used alternative data to gain insight into the online health and performance of the company.

With 2020 finally out the way, let’s take a look forward to 2021. We decided to put SimilarWeb’s powerful data to the test and pinpoint the top 10 digital stocks for the coming months. These are the stocks with strong digital trends that you should keep an eye on in 2021.

There is still a little time left on the clock, but a week before Christmas 2020 and right at the start of the 2021 NBA season, Nike continues to dominate Adidas in the COVID-19 recovery game. Since we last checked in mid-June, Nike has widened the gap, with total foot traffic at their outlet locations back to within 30% of 2019 levels. That’s up from -55% when we last checked the brand score.

2020 had one last dance move to bust out, and it will change the way you look at robotics, and think about the future. Boston Dynamics robots are dancing like no one is watching (though we know Elon Musk is keeping close tabs). The company’s fleet of robots are specializing and mastering new skills, and they are starting to sell. Their intimidating Spot the dog robot is currently up for grabs for $74,500 (with 400 already sold).

When U.S. cities and states faced shelter-in-place orders to limit the spread of the coronavirus, Americans’ reduced mobility resulted in plummeting sales at rideshare companies. While rideshare sales have been gradually recovering over the past several months, November marked a decline for the first time since April. In November, Uber sales were down 67 percent year-over-year and Lyft sales were down 69 percent year-over-year.

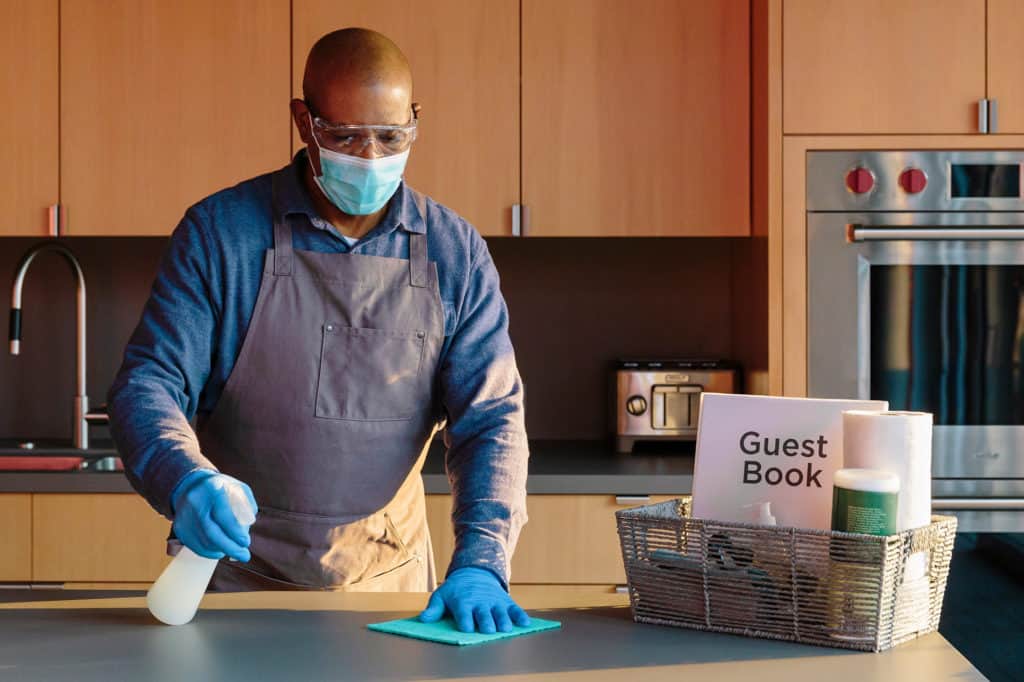

After a wildly successful IPO, Airbnb looks to continue to build on its COVID-driven momentum. As traditional travel has slowed, Airbnb has become the preferred method of lodging for many Americans looking for what seems to them a safer way to get away from it all. But is the company’s recent growth sustainable?

The recent work-from-home trends have made daytime pajamas the norm and led to declining sales (and in some cases bankruptcy) for many business casual clothing brands. One company that seems to be bucking the trend is Stitch Fix, which recently reported surprisingly strong sales trends.

In anticipation of DoorDash’s IPO, we reviewed statements made in the company’s S-1 and compared them with our spend data of millions of de-identified US consumers. In-line with what’s referenced in the S-1, our data shows DoorDash captured nearly 50% of the food delivery market, an impressive \~35 point increase since January 2018. Grubhub was the primary victim, with its share going from 49% to 19% over the same period.

The rumor mill began churning last Thursday with rumblings that software giant Salesforce had interest in acquiring work tools company, Slack. Official news is expected soon – and we all wait with bated breath to see how this will impact our inter-office GIF strategies.

More than half of U.S. advertising is expected to be spent on digital advertising this year—with the strongest growth in social media, video, eCommerce and search. Snapchat is one of the social media platforms seeing this growth in action. It’s been a while since we checked in with Snap. How did it perform during Q3 and have there been any significant changes among its advertisers due to the pandemic?

In anticipation of Airbnb’s IPO, we reviewed statements made in the company’s S-1 and compared them with our spend data of millions of de-identified US consumers. We’ve also added an appendix with a backtest of our data against the company reported GBV. Please reference for detail on biases and alignment with our data.

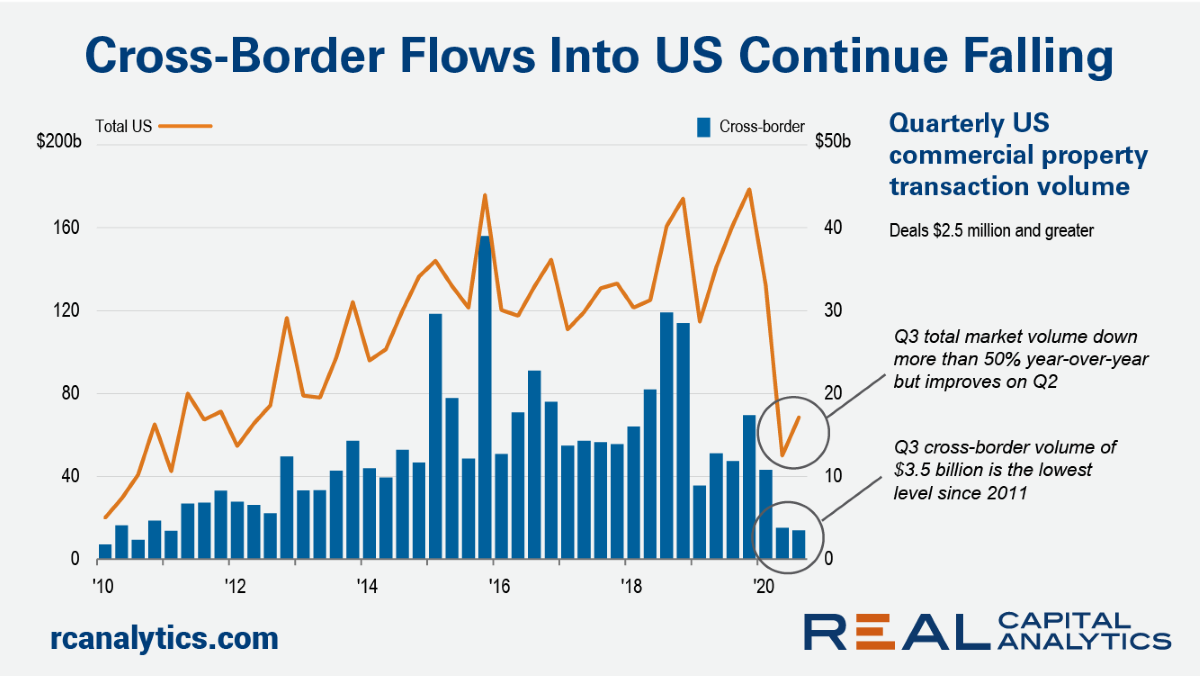

Total U.S. investment activity improved to some degree in Q3 2020, with sales volume up more relative to Q2 2020 than normal seasonal patterns would suggest. Not so for cross-border investment. Deal volume for cross-border buyers edged lower in the third quarter.

Ahead of the Peloton and Hello Fresh quarterly earnings reports we have used our data to explore some insights into the online performance of the companies: Monthly unique visitors (MUVs) to Peloton’s login domains in the US, UK and Canada dropped QoQ. Hello Fresh in the US receives more monthly unique visitors (MUVs) to its site than competitors and experienced 37.5% YoY growth in the quarter

Ahead of the Spotify and Wayfair quarterly earnings reports we have used our data to explore some insights into the online performance of the companies: Monthly unique visitors (MUVs) to open.spotify.com continued to grow in Q3. Strong YoY growth in visits to Wayfair’s payment page in all three international markets.

We are kicking off the Q3 earnings season with digital insights into Netflix and Twitter. Q3 is set to be a memorable one for Netflix. With the controversy surrounding the release of french movie “Cuties”, and the #CancelNetflix trending, expectations have been set low for the upcoming earnings report.

With the Asana IPO coming up this week we have explored some digital trends to gain insight into the company’s health. As part of the analysis we looked at trends in the number of monthly visits to the site globally and competition in the US.

In anticipation of Academy Sports & Outdoors’ upcoming IPO, we analyzed the retailer’s market share, channel performance, the impact of its geographic profile, and shopper cohorts including recipients of the federally granted stimulus check. Additionally, we looked at sporting goods’ wallet share among Academy’s most vs. least loyal customers. Here’s what we found.

Cloud data storage and analytics provider Snowflake set a new high bar on Wall Street this/last week with its IPO. The listing valued Snowflake at $70.4 billion – the largest in 2020, and the largest-ever for a software maker. It also earned the distinction as the biggest company to double its share price in a market debut. And although the company is not yet profitable, data sourced from our Cloud Infrastructure dataset indicates tremendous growth potential.

Credit Benchmark have released the September Credit Consensus Indicators (CCIs). The CCI is an index of forward-looking credit opinions for US, UK and EU Industrials based on the consensus views of over 30,000 credit analysts at 40 of the world’s leading financial institutions. The CCI tracks the total number of upgrades and downgrades made each month by credit analysts to chart the long-term trend in analyst sentiment for industrials.