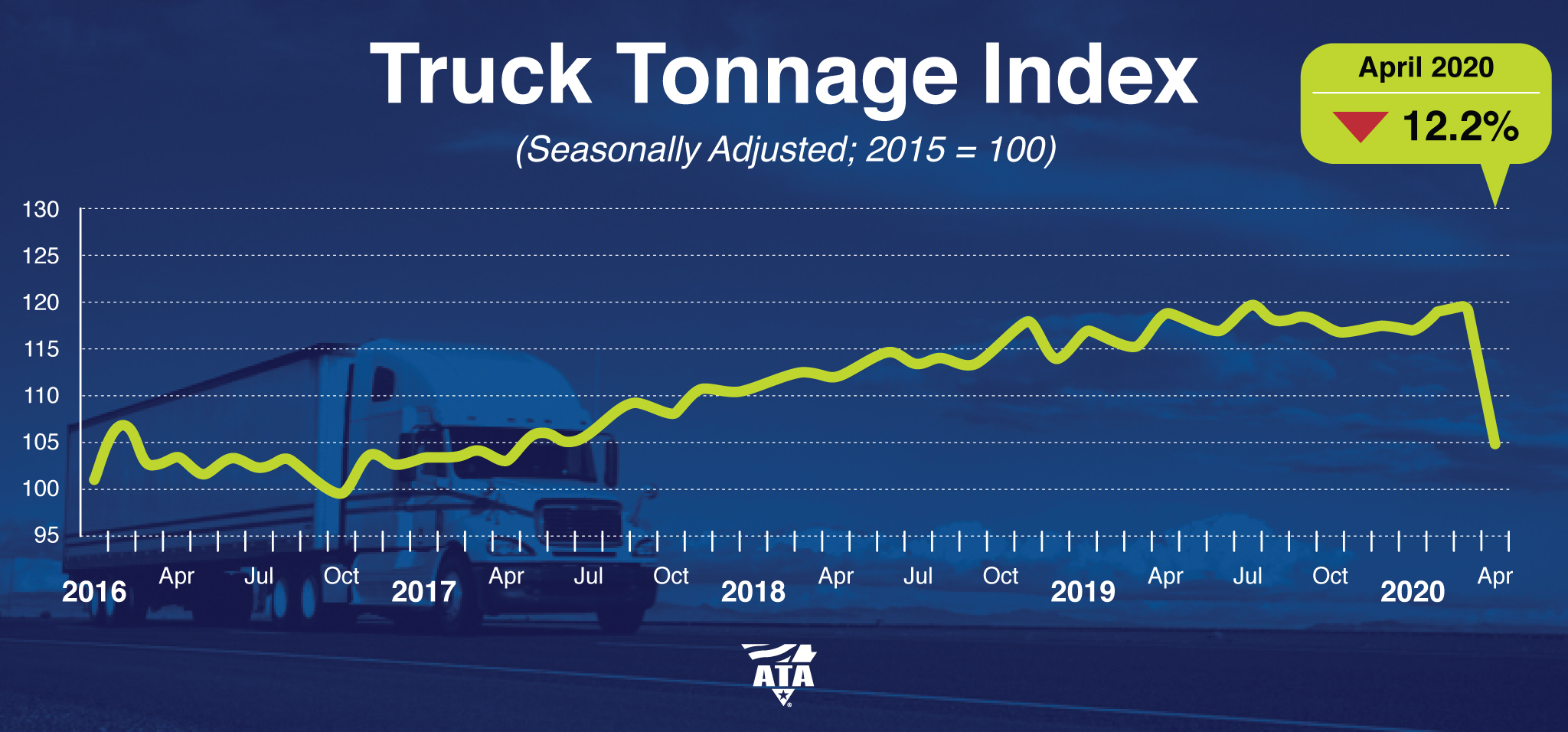

American Trucking Associations’ advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index contracted 12.2% in April after increasing 0.4% in March. In April, the index equaled 104.9 (2015=100) compared with 119.5 in March.

Global downloads of money remittance apps spiked in the second quarter from a 0.9% YoY decrease in the week ending March 22nd to a 37.9% increase last week. This increase is significantly higher than seen at any other period in the dataset. The data was provided by Apptopia which tracks downloads and usage across millions of mobile phone applications. This inflection point clearly shows a flood of new users looking for a way to quickly send or receive money.

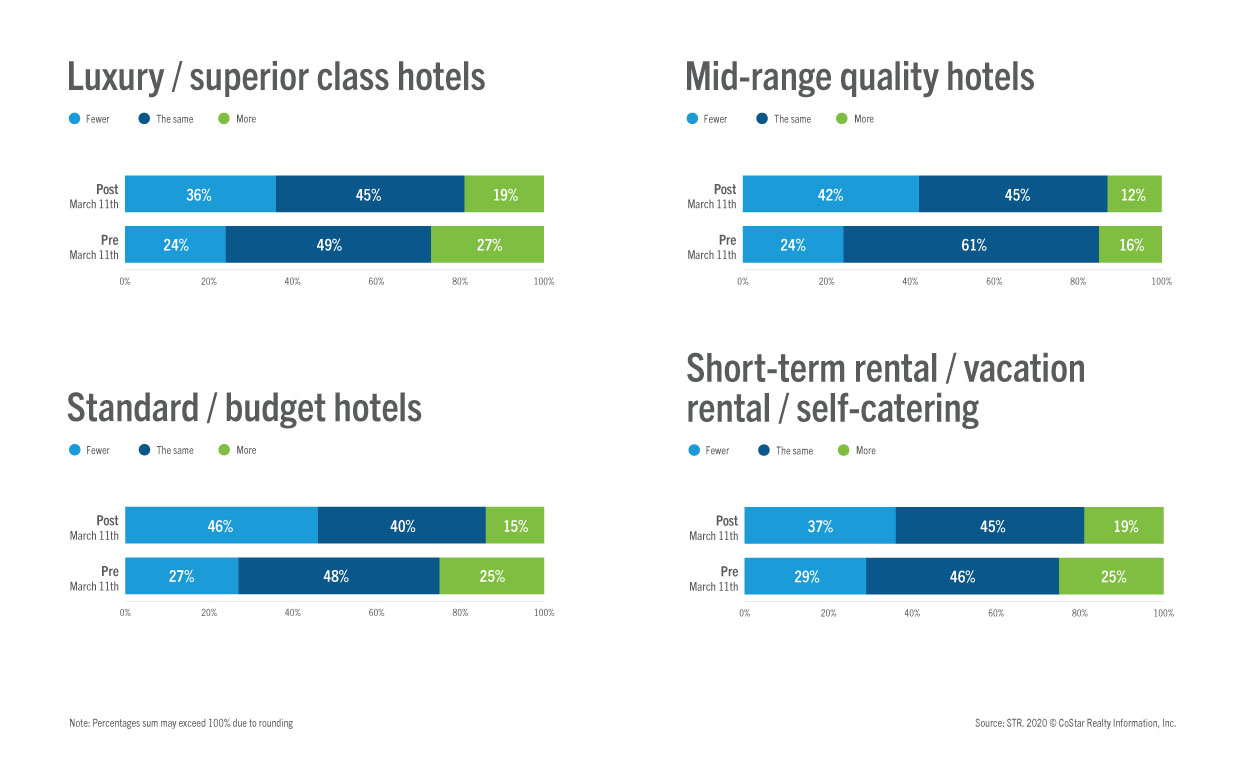

As the COVID-19 pandemic reshapes the world of travel, we investigated the impact on accommodation choices among international travellers. This piece builds on our analysis of propensity to travel in key English-speaking countries, in which we learned that desire for travel has declined but remains strong overall.

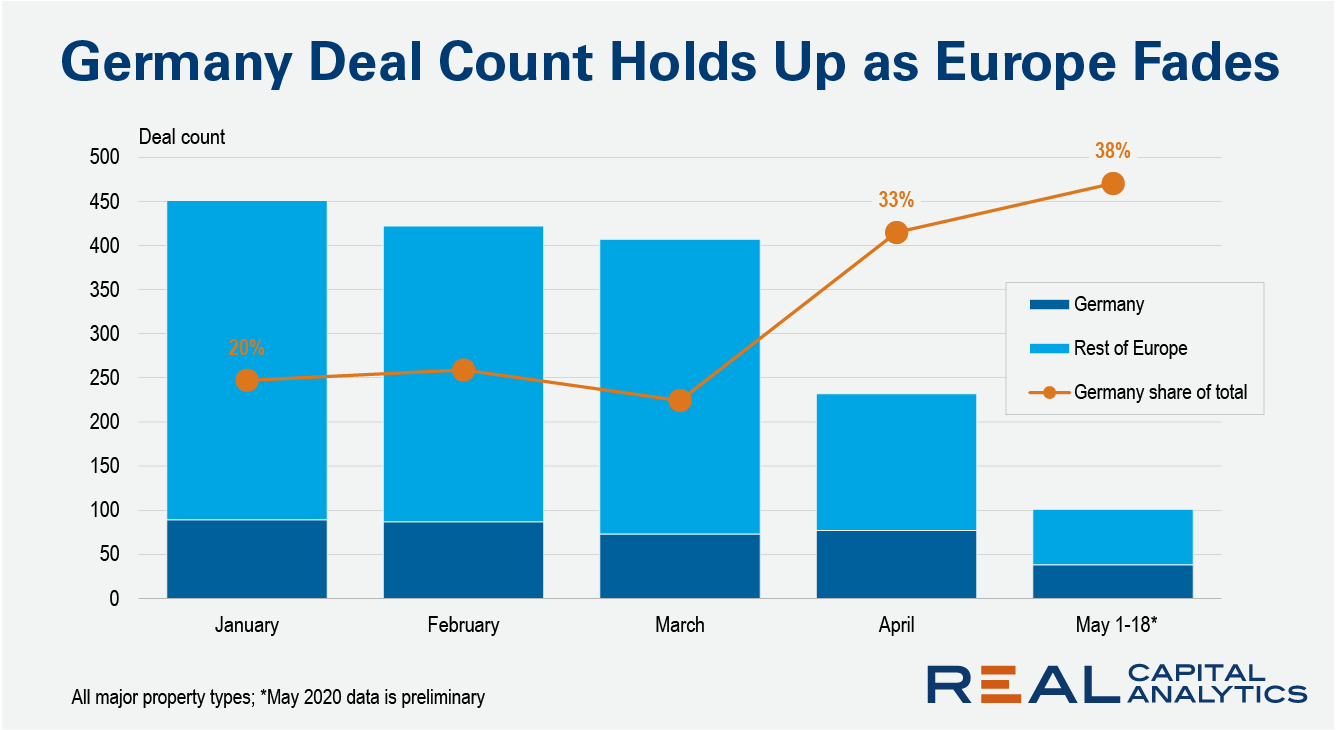

The count of commercial property deals in Europe has dropped sharply due to the impact of the Covid-19 crisis. So far, Real Capital Analytics has recorded some 230 deals for April, which is around one-third of the April 2019 figure.

ALN is conducting an ongoing survey of more than 60,000 conventional properties around the United States in effort to understand to what extent on-time full rent payments are being made and what measures properties are taking to work with their residents during this challenging and unprecedented period.

Our preliminary look at May data will focus on Texas and all numbers are derived from the responses of conventional properties with at least 50 units.

As businesses around the world locked down, Zoom (ZM) allowed employees to continue to connect and allowed commerce for online businesses to function with little disruption. Now that the company’s stock has run, where can investors turn to play the work from home theme?

Our national rent index remained essentially flat from March to April, following two months of gradual increases. This flattening is occurring at a time when rent growth is normally picking up steam due to seasonality in the market. From 2016 to 2019, month-over-month rent growth from March to April ranged from 0.2 percent to 0.7 percent. The fact that we’re seeing rents level off at a time when growth normally speeds up is likely reflective of the continued uncertainty surrounding the COVID-19 pandemic.

The volume of completed commercial real estate transactions shows activity slowing across all regions, the latest Real Capital Analytics data reading indicates. Looking at the count of closed deals the picture is even gloomier, as the Covid-19 crisis takes its toll on commercial property markets worldwide.

Its been a record breaking positive week for weekly capacity growth; we have broken through the 30 million weekly seat mark! That remains some 83 million seats below the same week last year or a “modest” 73% lower but with two weeks of consistent growth the numbers are at last growing; it must be spring!

COVID-19 reached its peak in the United States last month and the housing market felt the strain of the pandemic. A record number of houses were pulled off the market, new construction slowed, and existing home sales decreased.

Existing housing activity, which often sees a boost from property transactions, was no exception. Across the board, maintenance and remodeling—a subset of maintenance that includes renovations, additions, and alterations—declined drastically year over year.

The dominant story of 2020 across all markets continues to be COVID-19 and the fallout from both the virus and the response to it. The impact is being felt across the economy, and multifamily real estate is no exception. April was the first full month in which a majority of the country was locked down and provides a first full look at what that may look like for the apartment industry. We’ll use this space to highlight some markets that stood out in April.

Before we mention how the coronavirus pandemic impacts online ad spend, keep in mind the changing consumer behavior. We are seeing an unprecedented increase in people staying indoors.

This means people are spending a significant share of their lives online. And we will most likely see this behavior remain for a considerable amount of time when the pandemic ends.

According to data from mobile app data provider Apptopia, daily usage of mobile applications for major international hotel brands has recovered half of its COVID-19 loss. Shortly after China began locking down citizens, usage of mobile applications from companies such as Marriott, Hilton and Intercontinental dropped by nearly 20%. As of data as recent as May 17th it appears that these applications have recovered half of their lost usage.

The point of the Paycheck Protection Program (PPP) was to prevent businesses from having to lay off employees, adding to the country's already startlingly high unemployment. Writing the legislation was executed quickly and offered hope that the economy could survive the pandemic. Unfortunately, the execution continues to be lackluster.

According to the Q1 2020 Games Market Dynamics: U.S.* report from The NPD Group, overall total industry consumer spending on video gaming in the U.S. reached a record $10.86 billion in the first quarter of 2020 (Jan. – Mar.), an increase of 9 percent compared to the same time period last year.

Sales of video game content reached $9.58 billion in the first quarter, up 11 percent when compared to a year ago. Gains were seen across digital console and PC content, mobile and subscription spending, as well as across hardware and accessories categories.

STRONG growth in Newspaper ad spend is the common early COVID-19 ad spend trend across the Australian and New Zealand media markets, although total media market trends vary markedly in March.

Australian media Agency bookings are back 10.6% in March as a lower level than usual of late Digital bookings failed to push the market into a single digit decline, as had been expected.

Visitation to Events & Tickets category down 75 percent since February 2020, while visitation to Home Furnishings category surged more than 90 percent

Based on figures from 1010Data, a leading provider of consumer transaction data, we notice that Americans have begun venturing outside. Some have even returned to discretionary shopping.

As of mid-April, while state governments were still strongly recommending citizens to shelter-in-place, consumer activity had picked up noticeably. Visitors to big-box stores rose from a 51.2% YoY increase on April 18th to an 80.4% YoY increase on April 30th.

Americans have surprised the world with much of their behavior during the worst pandemic in the last hundred years. In the initial stages of the COVID outbreak things seemed to make more sense. At first it was masks and cleaning supplies that were in short supply. After that it was toilet paper, web cams and in-home workout equipment. Now the object of America’s desire is burgers.

We're looking at apps like Zillow, Redfin, Realtor.com, Apartments.com and more. Interest in shopping for homes and apartments took a hit when social distancing started. As states announce plans to open back up and as people have had time to purchase face masks and hand sanitizer, we're getting back into business.