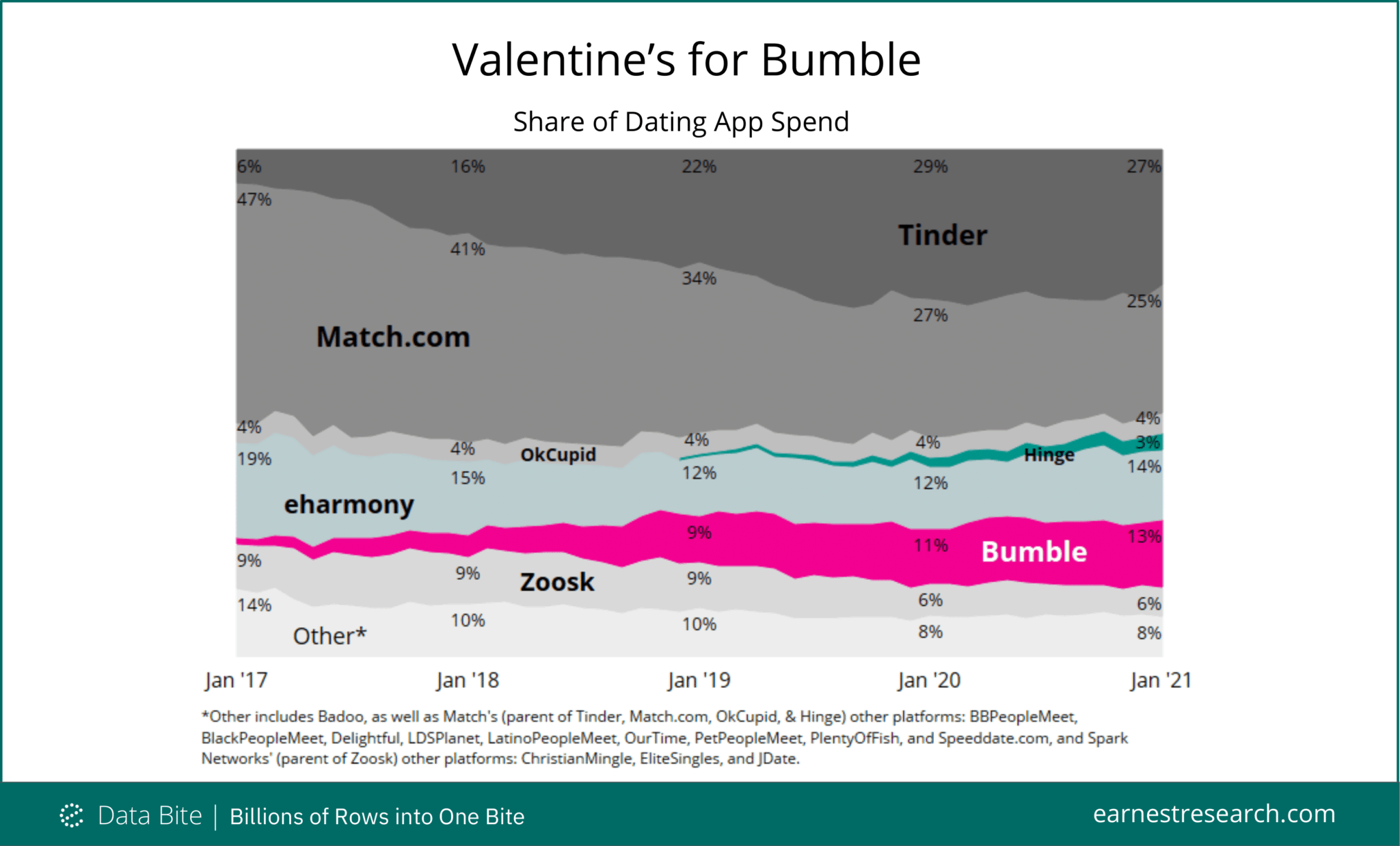

It seems that not even a global pandemic can keep people off dating apps – as female-marketed Bumble lands an $8B valuation in its IPO. In the last four years Bumble has grown from low single digits to capture 13% of the dating market by sales, while eharmony, Zoosk, and other* smaller services saw their shares decline.

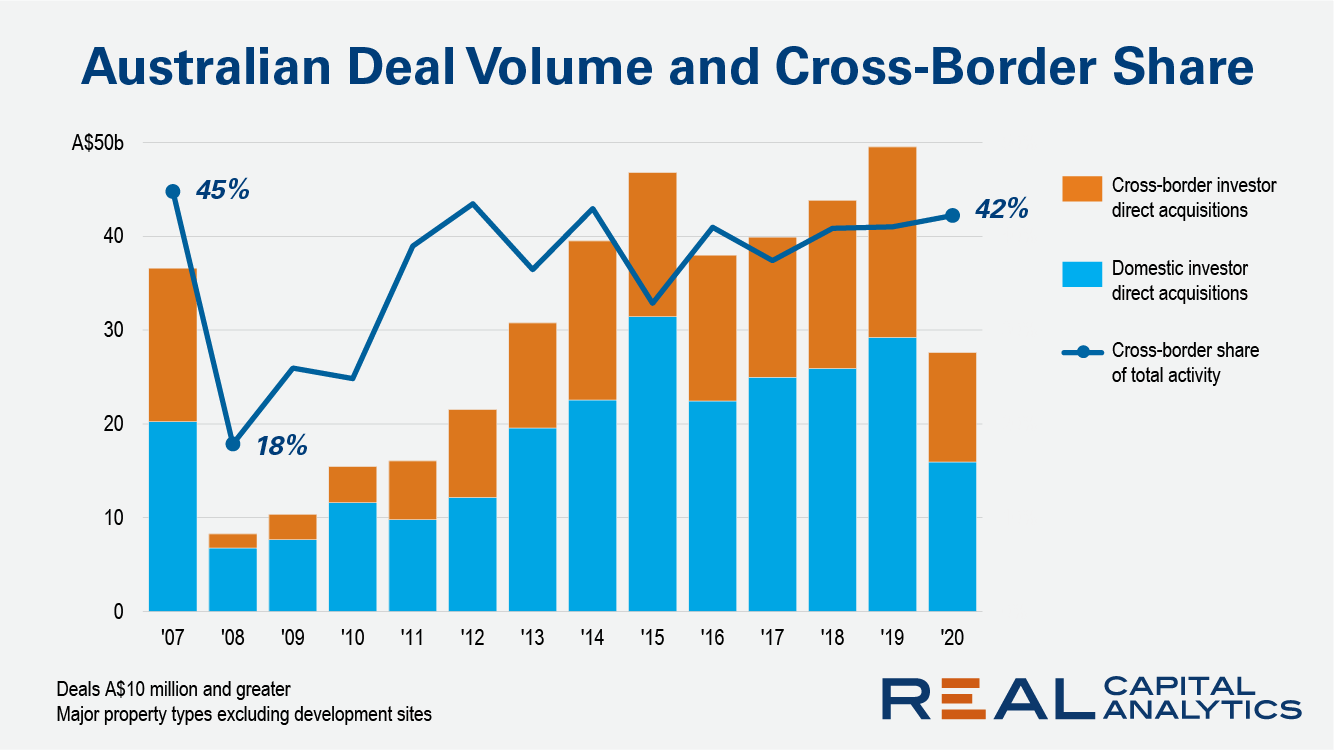

Cross-border flows into Australian commercial real estate sank in 2020, but the magnitude of the drop was moderated by a European champion: German institutional investment. Spending by groups headquartered in Germany alleviated fears that overseas investors would desert Australia, as occurred in the last global downturn. During the Global Financial Crisis (GFC), investors across the world retreated to the sanctuary of their home territories.

In contrast to what many anticipated in the earlier days of COVID, the off-price retail space has witnessed a significant recovery pattern throughout the pandemic, both in foot traffic and reported revenue. But as the sector quickly paves its way back to normalcy, leading off-price brands face new challenges and pandemic-driven shifts that can significantly impact their growth rate. In our latest Off-Price Retail Dive whitepaper, we dove into some of the significant shifts shaping the industry during the pandemic and their impact on its impressive rise. Below is a taste of what we found.

We start the year on a familiar trajectory with job listings increasing in the month of January, just as they did last year. (Here’s hoping this is where the similarities to 2020 end.) Nationwide, job listings are up 4.6% overall, with created job listings up 17.8%. January saw an impressive 82% of states’ job listings grow, with the most substantial increases in Alabama (9.73%), Alaska (8.55%), and Texas (8.44%). States with the most decline in job listings last month were Maine (-13.79%), Montana (-7.25%), and Vermont (-3.64%).

U.S. single-family rent growth strengthened in December 2020, increasing 3.8% year over year, showing solid improvement from the low of 1.4% reported for June 2020, and up from the 2.9% rate recorded for December 2019, according to the CoreLogic Single-Family Rent Index (SFRI). The index measures rent changes among single-family rental homes, including condominiums, using a repeat-rent analysis to measure the same rental properties over time.

Consumer Edge’s recently launched UK dataset is very complimentary to our existing US data, and has proven to be highly predictive for US-based companies, such as AMZN, in both markets. In today’s Insight Flash, we examine how trends in the two countries have differed, including spend growth, average ticket, and the importance of Prime Day.

It’s been a year now into full or partial lockdowns, social distancing rules and work from home as a result of the COVID crisis which unequivocally forced people to spend more time into their homes and consequently to change their shopping habits - reconsidering what is essential and therefore set new priorities on what to buy. One of the new essentials seems to be – not surprisingly – bedding products as people seek extra comfort at home. Mattress sales soared in the second half of 2020 since many Americans decided to upgrade their sleeping setup.

Unsurprisingly, Shopify (SHOP) is a clear COVID success story. The company has been on a tear since the pandemic, which sent demand for eCommerce solutions through the roof. Indeed, total revenue in Q3 was $767M, a 96% increase from the same quarter in 2019. Shares in SHOP are now up 172% on a one-year basis. But can the company, which enables anyone to set up and maintain an online store, sustain such dramatic growth?

Walmart (WMT) is heading into the fourth quarter on the back of a blowout Q3 and Q2 FY21 earnings report. And the star of the show is: eCommerce. The company’s U.S. eCommerce sales exploded 97% in Q2 and 79% in Q3, as customers continued to embrace online shopping during the pandemic. Q2 also received a boost from the first round of U.S. stimulus checks filtering down into increased spending on big-box retailers’ websites.

Walmart felt the same offline effects as other retailers in late 2020 as the holiday season was hit hard by a resurgence of COVID cases. The result was a November year-over-year visit gap of 13.8%, the largest since April. But December saw the visit gap shrink to 10.6%, and January saw that drop to just 7.2% year over year – the best since October’s mark of 6.7%. And while this is a success in and of itself, when combined with the mission-driven shopping trend that has boosted basket size, the impact could be even more significant.

It was only ever likely to be for a week, but China has snatched back the title of the world’s largest aviation market from the United States with a stellar 32% increase in capacity week on week and a more modest 4% growth in the last two weeks. Total weekly capacity is now back at 52.6 million although that only takes us to just above half the capacity levels reported before Covid-19.

Footfall across British clothes shops has been lower than the rest of Europe for the entire pandemic as tough lockdown measures push customers to online retailers. While footfall across UK clothing retailers has flatlined during this second lockdown, it’s significant to note that equivalent levels in Europe have been tracking at 30pts since early December.

The Oil & Gas sector was in trouble even before the first Covid lockdown, and it was one of the worst credit performers in 2020. A perfect storm of falling oil prices, the spectacular rise of alternative energy sources, and the effective collapse of global tourism took many oil companies to the brink of bankruptcy and pushed some of them over the edge. Recent agency downgrades have cited climate change and permanently higher oil price volatility; agency ratings for some of the US majors are now aligned with the more conservative bank consensus.

As the pandemic wears on, the nation’s unemployment rate remains at elevated levels. With unemployment rate at 6.7% at the end of 2020, millions of people have likely been out of work for as long as nine months since April. And without a regular income, many homeowners who sought payment forbearance assistance under the CARES Act are likely to find themselves in an extended stay in forbearance.

While apartment demand was dismal through the first half of last year, absorption rebounded in the third and fourth quarters. Over the last few months many markets, in particular those across California and Florida, managed to significantly surpass their demand performance from the same period a year ago. The resurgence in national absorption has been timely as new projects continue to be added to the new construction pipeline at a rapid pace. All told, ALN is tracking more than 2.5 million pipeline units, though more than half of that total have yet to break ground.

In this Placer Bytes, we dive into pharmacy giant CVS and one of the biggest surprises in retail, Floor & Decor. With CVS beginning in-store vaccinations, there is reason to be excited about the brand’s prospects in the coming months. But this is especially true considering the strength it’s already shown. Visits to CVS locations were down just 0.1% in October before a surge in COVID cases drove the visit gap to 6.8% in November. Yet, even with that challenge, visits rebounded in December and were down just 3.6% year over year that month.

We just published LinkUp’s 2020 Jobs Report, within which we explore the impact of the coronavirus pandemic on labor market conditions, as well as how jobs and industries have shifted in response and how far we’ve traveled on the road to recovery. In this new report we also showcase our S&P 500® LinkUp Jobs Index and share a graph of how each sector index changed last year.

Lex Machina’s analysis of employment litigation in federal district courts revealed an increase in employment cases caused by COVID-19 (“COVID Employment Cases”) during November to December of 2020. There was a significant increase in the number of total employment cases filed in federal district courts in November and December of 2020 compared to the same months in 2019 and 2018.

A second round of stimulus checks issued by the US government has led to a boost in spending across the US economy. In today’s Insight Flash, we dig into trends by income level in order to understand where the biggest impact has been – by shopper, by geography, and by subindustry. An analysis of overall spending by income group shows that the stimulus really hit its mark.

Mobile retail scales new heights in 2020 as COVID closes physical stores. Consumers also begin experimenting with next-gen smartphone shopping habits: social commerce and livestream shopping. It's become a cliche to talk about how 2020 accelerated consumers towards a new (digital) normal. But this was never more true than in retail. In our State of Mobile 2021 report, we showcase how 2020 came to be the biggest mobile shopping year to date. Global time spent in shopping apps (outside of China) grew 45% year over year.