Investment in the logistics sector reached a record high in Asia Pacific in 2020, with four of the region’s markets ranking in the top 10 biggest logistics markets globally in the year. The e-commerce revolution was already well underway before 2020, and the Covid-19 pandemic served to reinforce investor appetites for warehouses even further. Deal activity totaled $13.5 billion in 2020, according to preliminary Real Capital Analytics data, just eclipsing investment levels in 2018 and 2019.

In this Placer Bytes, we dive into Tractor Supply’s success and analyze what’s hurting IKEA. While Home Depot and Lowe’s get the bulk of the attention for the home improvement surge, one brand that has matched their impressive runs is Tractor Supply. The company has seen a huge surge since the onset of the pandemic, and the company seemingly got stronger as the year progressed.

In the most recent edition of our quarterly Economic Indicators Report, we see promising signs of recovery from the coronavirus pandemic. The fourth quarter of 2020 saw an increase in active job listings and a decrease in volatility. Overall, total active job listings increased more than 6% in Q4. This is almost an exact flip from the same period in the previous year–Q4 2019 saw active job listings down 5%. At the state level, the quarter showed widespread positive movement. An impressive 49 states saw gains over the quarter, leaving South Dakota as the only state with a loss in active listings.

The value of commercial and multifamily construction starts in the top 20 metropolitan areas of the U.S. lost 23% in 2020, falling to $111.1 billion according to Dodge Data & Analytics. Nationally, commercial and multifamily starts tumbled 20% over the year to $193.4 billion. Commercial and multifamily construction starts in the top 10 metro areas dropped 23% during the year with only one metro area — Phoenix AZ — reporting an increase.

The 2020 pandemic brought various forms of disruption, hardship and human tragedy. Governments and businesses around the world had to rely on trial and error to find the best response. There have been some high-profile corporate winners – companies that support home working, online delivery and logistics providers, packaging firms, some pharmaceuticals. But Covid has highlighted economic and social inequalities, and added “health poverty” to the lexicon.

In this Placer Bytes, we dive into the Q4 performances of McDonald’s and Whole Foods and one element that prepared Amazon for a stellar Q4. McDonald’s is among the best-positioned brands in 2021 with a high value offering that should be particularly appealing in a year likely to be defined by continued economic uncertainty. Whole Foods was among the few to face real and tangible struggles.

Another dire week for global aviation with more lockdowns, sudden suspensions of services and the threat of having to stay in a quarantine hotel at Heathrow looming for anyone brave enough to want to enter the United Kingdom. Can things get any worse; probably but let’s hope not and try to stay positive.

Last year was a dismal year for travel. But as vaccines and other safety measures roll out, change is already happening. Whether it’s cycling trips to tour sites important to the Civil Rights movement or an overdue visit to see grandparents, travel will be a meaningful part of 2021. As the industry recovers, advertisers can provide answers to the question at the top of many consumers’ minds: where to next?

Mobility levels in the big northern cities failed to recover to their pre-pandemic levels following lockdown in the summer, in contrast to their southern counterparts new data shows. Footfall in cities across the North and South dropped to just above half of their usual levels during the first lockdown recovered over a period of 8 weeks, according to Huq Industries’ high frequency mobile data.

Few industries have been impacted more severely by the COVID-19 pandemic than Travel & Leisure. According to Credit Benchmark, which captures the credit risk views of over 40 of the world’s leading financial institutions, 44% of companies in the global Travel & Leisure sector fell from investment grade to high yield between March and November of 2020. That means the consensus credit risk scores for these so-called ‘fallen angels’ fell below the bbb- threshold at some point during the pandemic.

2020 represented a dramatic shift from the type of multifamily performance industry participants had grown accustomed to in recent years. One theme was the particular difficulty experienced by the largest markets. Another was something of a flight to affordability made evident, in part, by the divergence in performance between the price classes.

Digital games closed out 2020 with $12.0B in December, which was a 15% growth from the prior year and the highest monthly revenue total ever. Mobile earnings were up 5% year-over-year and console earnings grew 16%. PC games revenue, however, jumped 40% largely thanks to the release of Cyberpunk 2077.

When lockdown orders went into effect during COVID-19, consumers increasingly turned to online retailers for necessities. For the beauty industry, this meant a renewed interest in beauty subscription boxes. DTC beauty box companies offer subscriptions (usually monthly or quarterly) and an additional ecommerce platform for purchasing beauty and makeup products.

As millions of Americans sheltered in place and shifted to working from home and remote learning during the COVID-19 pandemic, ongoing research from Comscore (Nasdaq: SCOR), a trusted partner for planning, transacting and evaluating media across platforms, found that overall in-home data usage levels throughout 2020 remained significantly higher than in 2019.

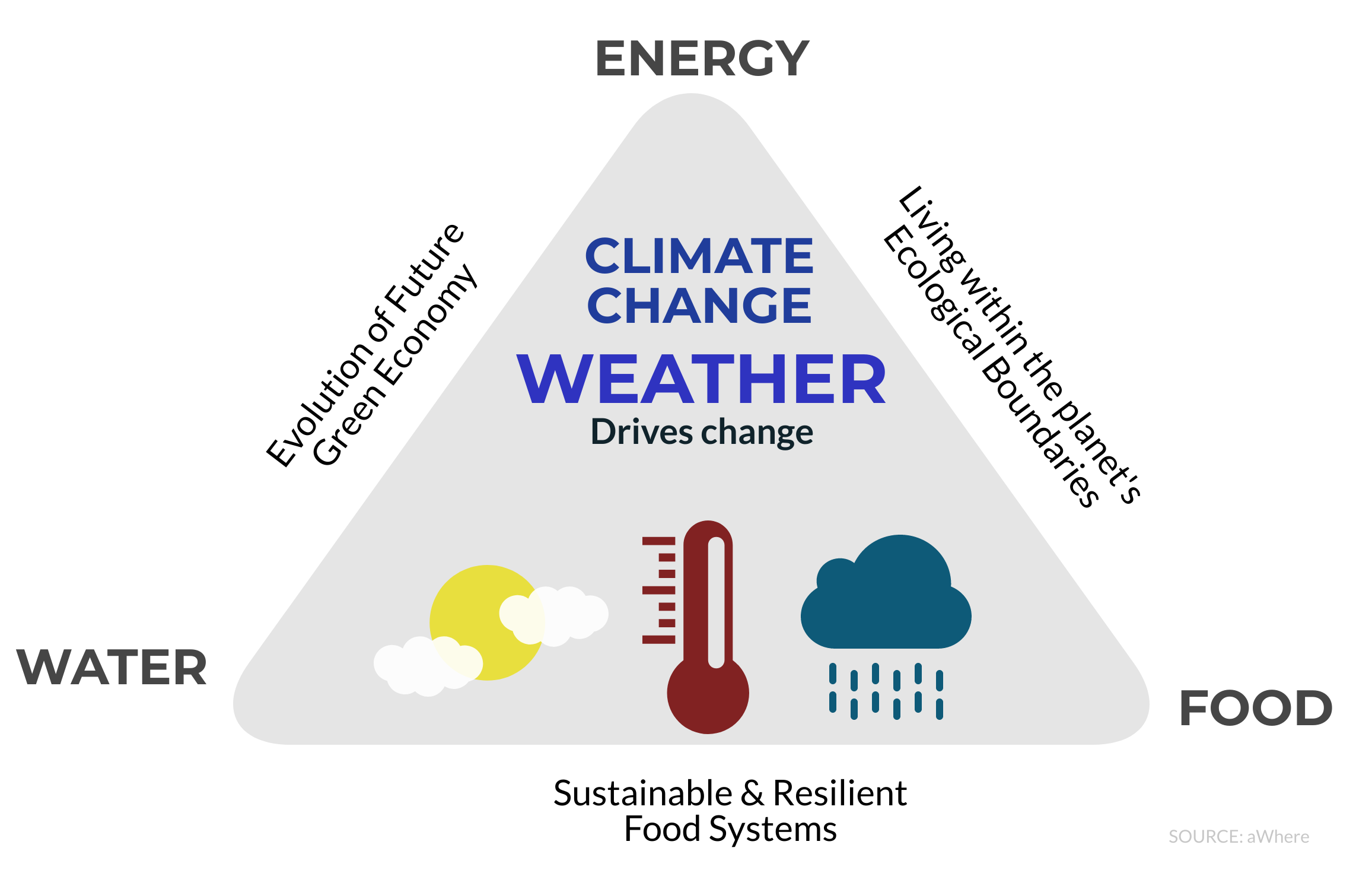

2020 was to be the year of Climate Action around the world by a wide range of organizations; at least that was the vision until COVID-19 caused a global pandemic. However, “2020 will likely be one of three warmest years on record,… Ocean heat is at record levels. Extreme heat, wildfires and floods, as well as a record-breaking Atlantic hurricane season, have affected millions of people.

According to ATTOM Data Solutions’ newly released Q4 2020 Special Coronavirus Report spotlighting county-level housing markets around the U.S. that are more or less vulnerable to the impact of the virus pandemic, pockets of the Northeast and other parts of the East Coast remained most at risk in Q4 2020, while the West continued to be less vulnerable.

With Warner Bros. announcing plans to release new movies on HBO Max in 2021 for no additional fee, we looked at how the news impacted subscriptions and the Video On Demand space more broadly.

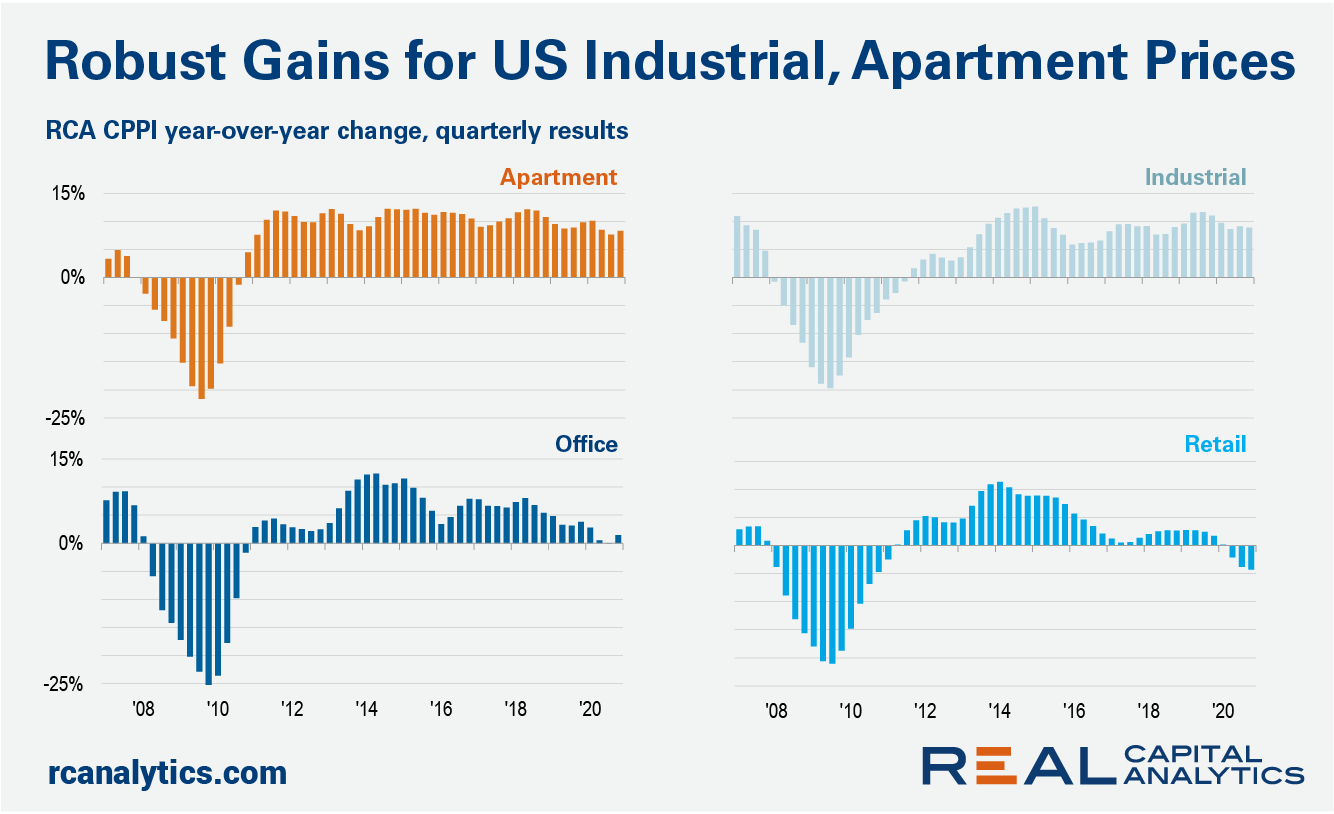

The headline rate of U.S. commercial property price growth accelerated into the last month of 2020, gathering strength on the back of robust apartment and industrial sector price increases. The US National All-Property Index grew 7.3% from a year earlier, the latest RCA CPPI: US summary report shows.

Looking at visits to Starbucks overall in 2020 saw a tremendous start with visits up 12.3% on average in January and February year over year. And post-shutdown, the brand was recovering strongly before being hit hard by a resurgence of COVID cases during an especially critical time. In 2019, Black Friday and Thursday, December 26th marked the two highest-visit days by far for the brand nationwide, and November and December were the two strongest months for visits overall.

As the COVID-19 global pandemic has created havoc in the global economy, millions of American homeowners are struggling to keep up with their mortgage payments. As a result, the mortgage delinquency rate has soared. The CoreLogic Loan Performance Insights Report analyzes mortgage performance for all home loans. Based on this report, the serious delinquency rate for October 2020 was 4.1 percent, representing a 2.8 percentage point increase compared with October 2019.