DoorDash’s recent IPO made a big splash as the stock shot up on the first day. But is the company positioned for success? In today’s post, we examine several key components of DoorDash’s performance, which may provide insights for competitors and potential restaurant partners, but also any business thinking about expanding its delivery offering amidst the recent e-commerce boom.

The holiday season is here and, thankfully, 2020 is almost in the rear view mirror. This year has certainly been one of disruption, but one area of relative normalcy was new construction. This was true whether referring to the level of new supply or to the unit mix of product entering the market. The latter will be the focus of this month’s newsletter.

As expected, U.S. consumers migrated to online retail in the face of COVID-19 for their holiday shopping this year. Overall, visitation to retail websites during the week of Thanksgiving (Monday, Nov. 23 through Sunday, Nov. 29) was up 22 percent vs. the same week in 2019.

Shares in Lululemon have surged 57% year-to-date. That’s versus 14% for the S&P 500. Ahead of the Lululemon earnings call the big question for investors is: is there more room left to run? Here we explore LULU’s key digital trends to gain insight into its online health.

Amazon (30%), Walmart (24%) and Target (21%) also increased their year-over-year sales during this period. Online spend at department store Black Friday to Cyber Monday sales across Nordstrom, Macy’s, Kohl’s, and JCPenney combined fell 5% this year compared to last year. Due to the ongoing pandemic, the 2020 holiday shopping season has been unique.

The key takeaways from ATTOM Data Solutions’ newly released November 2020 U.S. Foreclosure Market Report revealed that foreclosure filings were down 14 percent from October 2020, Florida posted the highest foreclosure rate and greatest number of REOs, and while foreclosure starts were down across the nation, a few states did see monthly increases in November 2020.

Footfall to UK restaurants has risen sharply following the end of the second national lockdown, but levels remain around a fifth of what they usually are at this time of year. The Huq Index suggests that the recovery of restaurant trade could be taking more of a ‘V’ shape than the gradual recovery seen after the first national lockdown ended on 4 July

Today, INRIX released a new study that analyzed the impact of COVID-19 on vehicle collisions across the nation’s busiest and riskiest roadways. Using INRIX IQ, the Riskiest Roads report evaluated and compared road conditions on National Interstates, freeways and expressways and arterial streets in the Top 25 US metros during COVID-19 to determine the impact of vehicle miles traveled (VMT) reductions on travel speeds and collisions.

Mortgage rates have hit record lows in 2020, generating a refinance boom as borrowers seek to save on their mortgage payments. CoreLogic has been monitoring the share of outstanding mortgage debt with interest rates above the current market rates and found that a large share of current mortgage borrowers could benefit from a refinance.

U.S. consumer spending has been altered by the coronavirus pandemic. Our data reveals that consumers are changing the way they pay for goods and services, with some industries seeing spending shift toward online purchases. Additionally, the pandemic has changed the types of purchases consumers are making, with stimulus recipients increasing their spending on big-ticket items.

As millions of consumers are buying new homes and renovating their current homes during the COVID-19 pandemic, the retail home furnishings category has seen tremendous growth in both site traffic and spend.

The restaurant industry’s sales stumbled again in November as the number of COVID cases rose rapidly and colder weather started to become an obstacle for outdoor dining in many areas of the country. Same-store sales growth was -10.3%, which represented a 3.8 percentage point drop from October’s year over year sales growth rate. November’s -16.3% same-store traffic fell by 3.3 percentage points compared to the previous month’s performance.

10,042 U.S. Properties Received a Foreclosure Filing in November 2020, Down 14 Percent from Last Month; Florida tops out with the highest foreclosure rate, leading the nation in REO filings; Foreclosure Starts Uptick Monthly in Missouri, Indiana and Georgia

December 11, 2020

/

Business

Mall Update

Analyzing Black Friday data shows that a resurgence of COVID cases has clearly affected the wider retail economy. Whether it be a typical indoor mall, or outlet center, and whether the location be in New York or California, every type and every region has been affected.

The market for RVs experienced a surge in demand this past summer as months quarantined at home and concerns about the potential hazards of travel led would-be vacationers to rethink their travel plans and incorporate RVs.

Similar to categories like toilet paper, there have been meat shortages across the U.S. in the COVID-19 era. In response, many Americans turned to DTC meat companies, which experienced strong sales increases early in the pandemic.

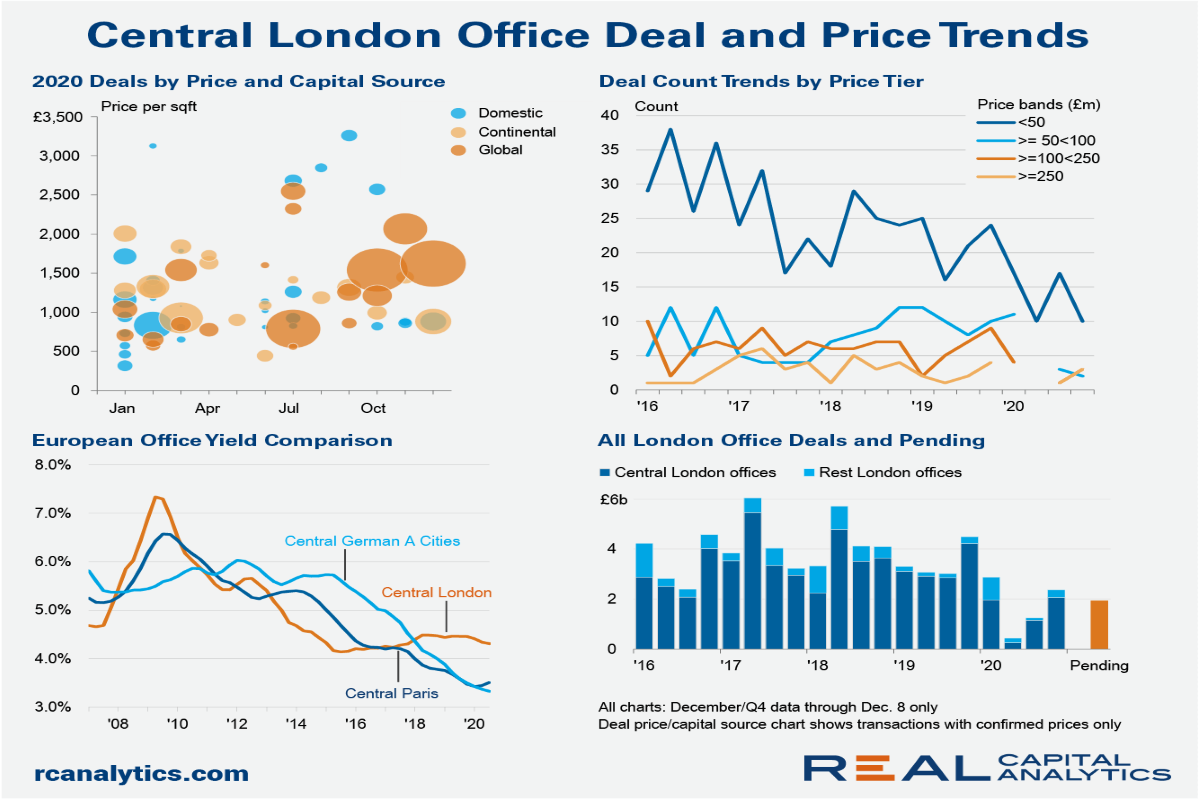

Dealmaking for Central London offices froze in the second quarter of 2020 with the onset of the pandemic. Only 10 properties changed hands, making it the weakest quarter on record, worse even than the depths of the Global Financial Crisis.

Advan analysis of footfall at US airports shows a gradual upward trend in traveller numbers, although volumes still remain significantly depressed compared to March. Comparison with TSA screened passengers shows a very high correlation over time, of over 99%.

Black Friday is traditionally associated with shoppers flocking to brick and mortar stores for blockbuster deals. However, this year online sales as a percentage of total purchases surged, suggesting shoppers mostly stayed home. Notably, 57% of Apparel & Accessories and Department Store sales occurred online during the Thanksgiving shopping period ended the following Wednesday, up from 46% in 2019.

In true 2020 fashion, just a few short months have brought dramatic changes in the labor market. Job listings have shifted from a gradual slowdown to a steady downhill slide. While the -4% decline in job listings we saw in November is the first drop in total job listings since recovery began in May,