When we put together our expectations for who would dominate the coming holiday season one group that stood out were wholesale clubs. It seems that the unique nature of the current retail environment was well-suited to these brands. And while we felt like a surface-level analysis was good, a deeper drive was required to emphasize the point and provide a better lay of the land.

Not only has footfall into shops and stores declined during the pandemic, but customers are also visiting a less diverse mix of retailers as the crisis continues to drive change in retail behaviour. This new Huq Index measures the range of retail brands visited by customers within a category every week, and finds that loyalty increased by as much as 20% in the aftermath of the first lockdown.

In past races, paid advertising campaigns on social channels, specifically Facebook, (and, increasingly, Instagram), has been the top choice for candidates looking to reach a wide audience. This year, in the course of just three months (August-October 2020), we saw investments on YouTube from both candidates nearly triple their respective Facebook investment rates.

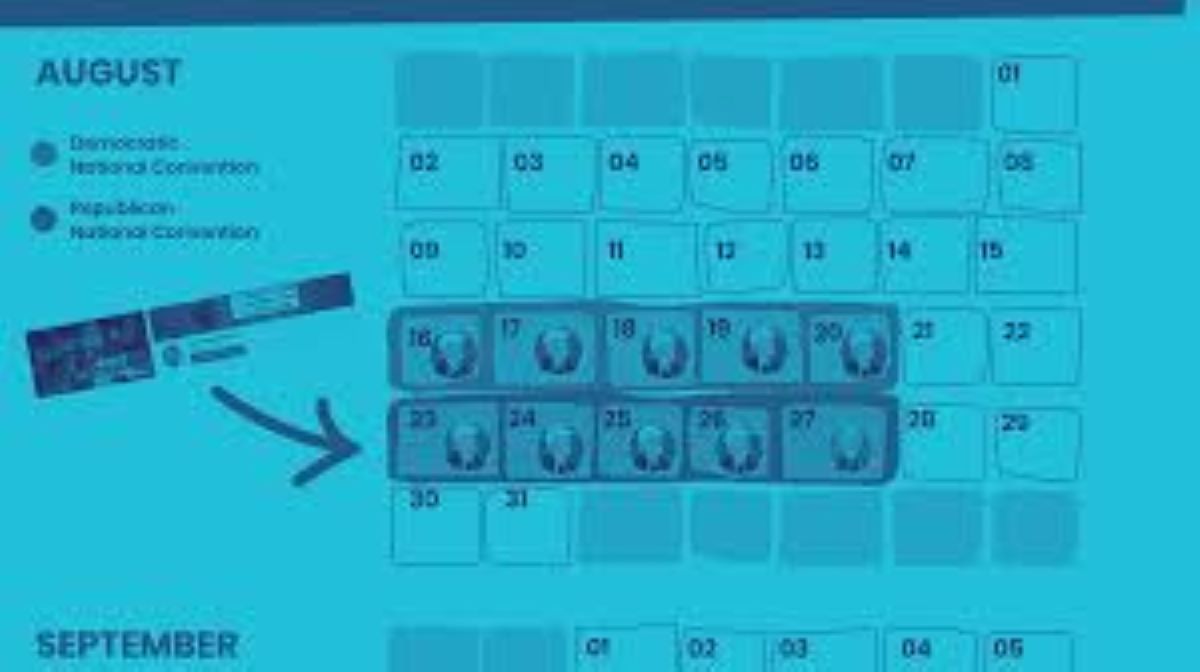

As we near Election Day 2020, Comscore took a closer look at the viewing trends in select battleground markets during this year’s unprecedented debate and election season to gain insights into where these viewers may be tuning in as results come in on election night.

If you live in the United States and spend any time in front of a screen during election season, you’ve seen them: political ads. Ads sponsored by PACs and the political candidates themselves are a dime a dozen—but only to viewers. The ads themselves represent billions of dollars of ad spend thrown into digital, print, and tv ads supporting specific parties and candidates.

National home prices increased 6.7% year over year in September 2020, according to the latest CoreLogic Home Price Index (HPI®) Report. The September 2020 HPI gain was up from the September 2019 gain of 3.5% and was the highest year-over-year gain since May 2014.

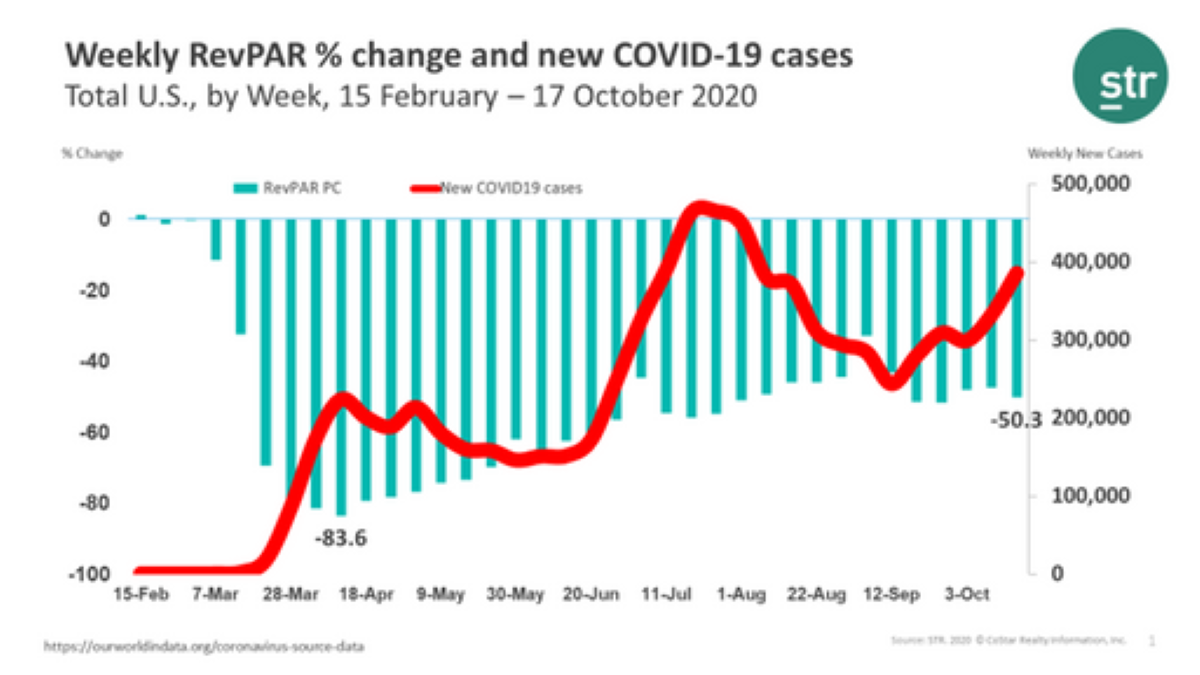

With new COVID cases on the rise and risk mitigation the name of the game, most companies will continue working from home and business travel will remain negligible, stymying further RevPAR improvement.

In this Placer Bytes we take a closer look at one of retail’s top performing brands in CVS, and dive into two that have experienced recent struggles in Tuesday Morning and Party City. A few weeks back we analyzed the pharmacy sector and saw CVS dominating against other brands. And, it looks like its recovery is showing no signs of slowing down.

Ahead of the Peloton and Hello Fresh quarterly earnings reports we have used our data to explore some insights into the online performance of the companies: Monthly unique visitors (MUVs) to Peloton’s login domains in the US, UK and Canada dropped QoQ. Hello Fresh in the US receives more monthly unique visitors (MUVs) to its site than competitors and experienced 37.5% YoY growth in the quarter

One of the most consequential elections in modern history, both the Presidential race and several Senate races could determine the course of the country for a generation. Moreover, the battle for votes has become a measurement of digital ad dollars. That makes Facebook, with over 190 million users, and Instagram, with 126 million users, prime territory for political ads.

The two Presidential candidates have little in common, from their stance on foreign policy and healthcare to their advertising strategies and messaging. One thing they do have in common, though? An affinity for mentioning one another in ads--Facebook ads, in particular.

At the end of the third quarter, the count and volume of deals across the three global zones has fallen back even further as the Covid-19 pandemic grinds on. In the Americas, deal volume through the end of September was 41% lower than the same point in 2019, and the deal count 34% lower.

In late August and early September 2020, STR conducted quantitative research using STR’s Traveler Panel. We set out to examine attitudes to travel in this ‘new COVID world’ and to evaluate early experiences among travelers at a time when many economies were reopening and the industry was seeking to capitalize on pent up demand.

In this Placer Bytes, we dive into the remarkable recovery of Planet Fitness, Hibbett’s positioning ahead of the holidays, and dive into why Gap might be moving out of malls. Planet Fitness has been leading a wave of top fitness chains that are enjoying a strong bounce back. And yet, the brand’s impressive performance may actually be even better than it appears at first glance.

The presence of customers across all consumer industries in Europe fallen sharply over the last two weeks as countries across the continent introduce measures consistent with those seen during the first lockdown. This effect is most keenly felt across discretionary industries – particularly hospitality, accommodation, leisure and apparel.

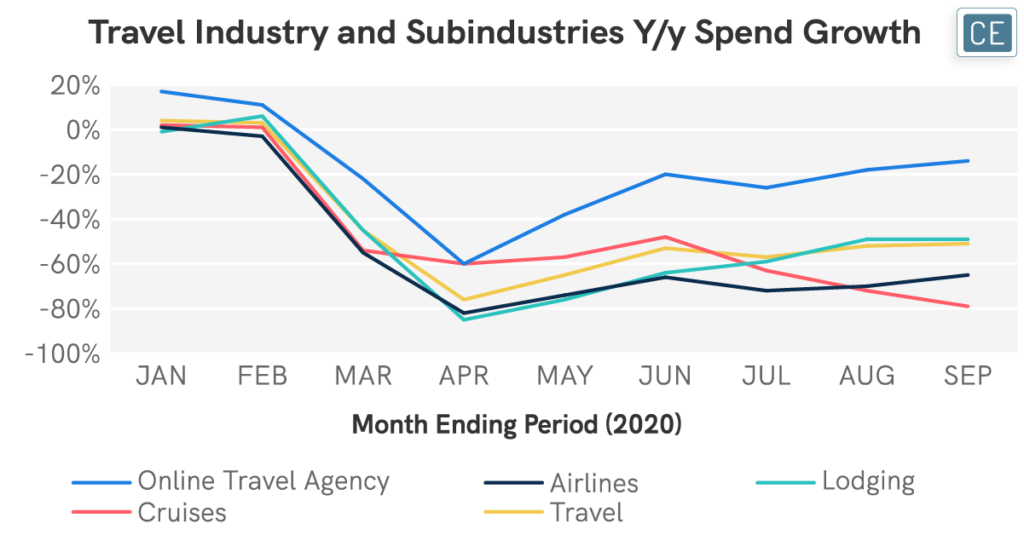

Although many sectors of the economy have seen declining sales due to the COVID-19 pandemic, the travel industry has arguably borne the worst of the declines. Cruises have been the worst-hit, with spend down -80% y/y in September. Airlines have not faired much better, with spend down almost two-thirds. Yet, other parts of the travel industry are doing comparably better.

Since The Queen’s Gambit debuted on Netflix, mobile chess games appearing at the top of app store search results, as a grouping, have increased their average daily downloads 63% in the United States and 11% worldwide. The percentage change looks at the average daily downloads of 10 days prior to debut compared with that of debut day plus 9 days after.

For the fifth straight year, Amazon Prime Day created excitement among consumers with discounted offerings for customers opening their wallets at the cloud cash register. While Amazon has not yet self-reported a final tally, according to Envestnet | Yodlee data, the event was a success, leading to an average spend per customer (or “ticket size”) of $76 during the event versus $74 a year ago.

Once again, no news may be good news for the US housing sector. There are positive forces, such as interest rates for mortgages at or near record lows, and a potential trend of buyers moving away from urban areas amongst other factors that may buoy demand for housing and support construction. Similar trends are occurring in the UK housing market, where mortgage demand is red hot.

Challenges in the energy sector are numerous and persistent. These challenges are perhaps most evident in the US energy sector, where strained prices and weakened demand have accompanied months of reduced travelling for professional and personal reasons. Bankruptcies are increasing. Some firms are doing better than others, yet few are in great shape.