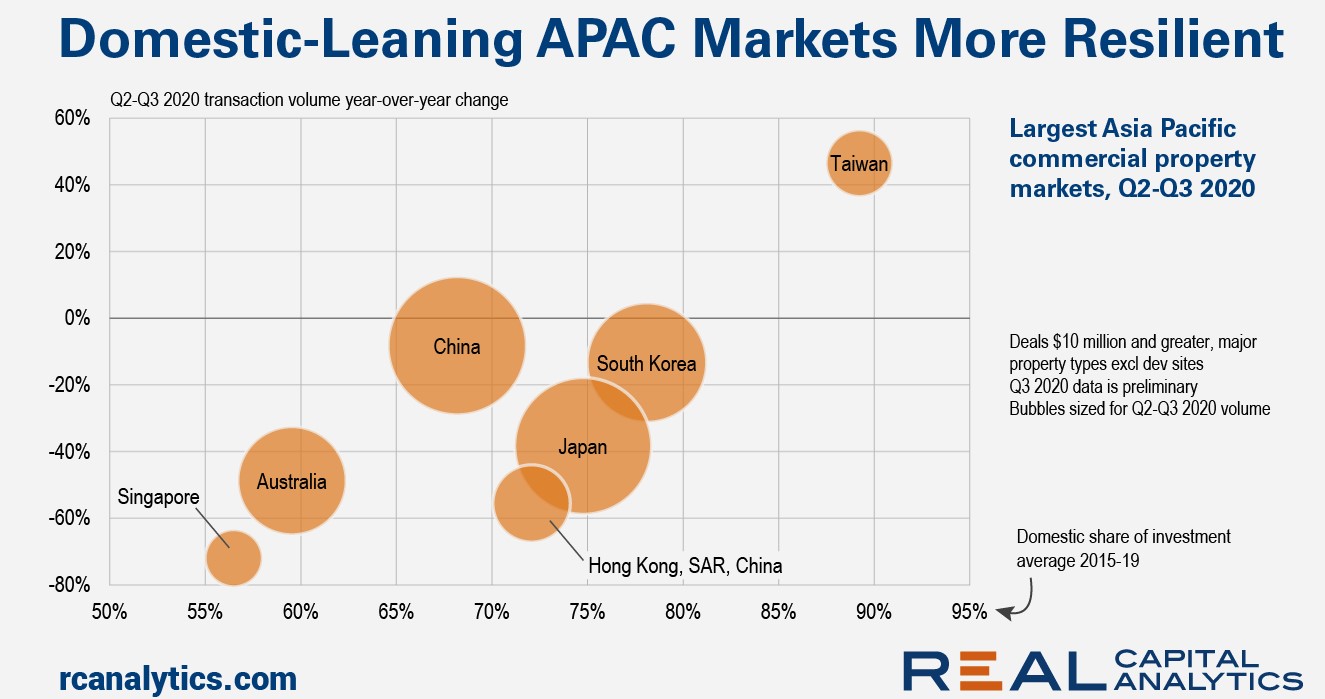

Global and regional cross-border investors pulled back from new Asia Pacific deals in Q3 2020 at almost double the rate that domestic buyers retreated, preliminary Real Capital Analytics data shows. Investment by domestic buyers was higher in the third quarter than the second quarter of 2020, though the level was down significantly versus a year ago.

Data is one of the most valuable resources today. The companies that own and store the world's largest and most valuable data wield enormous influence. Yet despite their power, these companies are increasingly vulnerable to data breaches, a costly and reputationally damaging affair.

In this Placer Bytes we dive into the Yum! Brands’s portfolio and fast-food giant, Wendys. Yum! Brands’s portfolio consists of fast-food players such as KFC, Pizza Hut, Taco Bell and the recently acquired Habit Grill. And, when looking at the first three, there were reasons to be optimistic at the beginning of 2020.

The winners and losers in the virus crisis are becoming clearer. China reports a strong economic rebound while Western economies continue to struggle. Hotels and airlines fight for their survival while online fulfilment and delivery logistics firms cannot hire staff quickly enough. And real estate is seeing a “race for space” in residential markets, but serious viability issues in some commercial lines – Bloomberg report that Land Securities will sell a quarter of their total portfolio, mainly lightening up on retail and leisure.

As the holidays approach, consumers and brands alike are filled with uncertainty. What does a Halloween celebration look like in a world of masks and social distancing? With the holiday just a week away, we take a look at how consumers are approaching Halloween and how ad spend has changed this year.

Black Friday and Cyber Monday have been the biggest retail shopping days in recent history. With Prime Day, Amazon made a move to spur another shopping spike in July, which was this year delayed until October 13 and 14 due to the coronavirus pandemic. Not wanting to miss out on the hype, Best Buy announced that it also would offer massive discounts at the same time, calling its version Early Black Friday. So how did these two retail giants compare in terms of their advertising strategies for these first huge retail events of 2020?

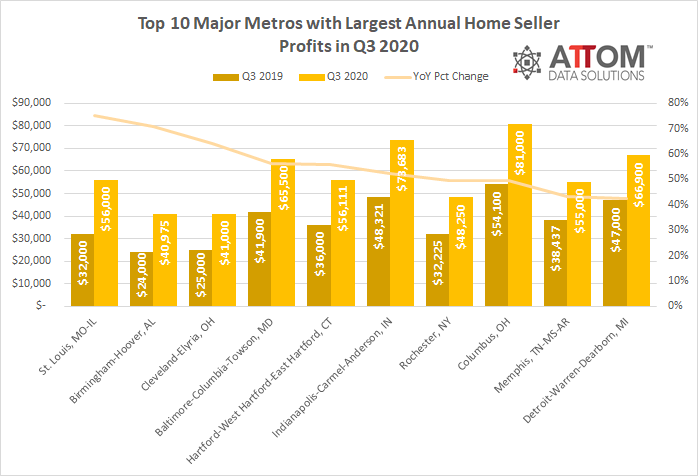

ATTOM Data Solutions’ just released Q3 2020 U.S. Home Sales Report reveals that both the raw-profit and return-on-investment figures recorded from the typical home sale in the U.S. in third quarter of 2020, stand at the highest points since the U.S. economy began recovering from the Great Recession in 2012.

In this Placer Bytes, we take a look at the recent performance of Dunkin’, Starbucks, and Sprouts as they push deeper into the recovery period.

The Huq Index shows the decline in footfall across the UK’s foodservice outlets levelling off at 25pts following a wave of new restrictions across the country. Despite suffering a 35% loss from its summer peak on the 31st August, it is good news for the industry that it looks like the floor is close to here, and not some 20pts lower as it was during April and June this year.

Ahead of the Spotify and Wayfair quarterly earnings reports we have used our data to explore some insights into the online performance of the companies: Monthly unique visitors (MUVs) to open.spotify.com continued to grow in Q3. Strong YoY growth in visits to Wayfair’s payment page in all three international markets.

INRIX released its report on activity around COVID-related street closures last week. As part of that study, which used anonymous GPS mobile app data to better understand utilization and user demographics of restricted streets, INRIX looked at specific types of streets programs in New York. The City’s Open Streets implementation is one of the largest and most interesting cases we studied due to the size of the Open Street: Restaurant program.

Credit Benchmark have released the October Credit Consensus Indicators (CCIs). The CCI is an index of forward-looking credit opinions for US, UK and EU Industrials based on the consensus views of over 30,000 credit analysts at 40 of the world’s leading financial institutions.

In our recent webinar, we spent some time looking into foot traffic trends at airports in America and Europe. Location data is a very reliable proxy for airline passengers, since there are few reasons to be at an airport other than to board a plane. Precise mapping can filter out people who have come to collect or drop off passengers from those who have passed security in order to catch a flight.

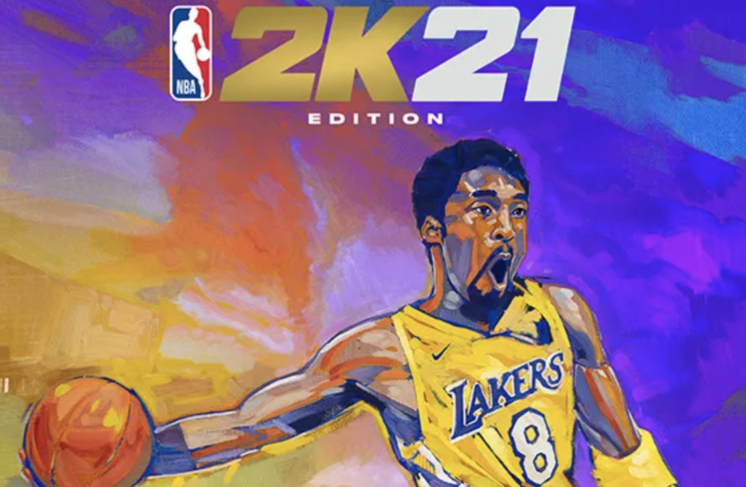

Digital games earned $10.7B in September 2020, up 14% year-over-year. Games earned more across all platform types than during the same period in 2019. Mobile revenue was up 9%, PC rose by 8% and console earnings increased 40% as major fall titles began to hit the market.

Loan application volume, mortgage rates, and lenders underwriting standards have been impacted by the COVID-19 pandemic. For example, the mortgage interest rate is at a record low and purchase loan application trend highlights strong demand for home buying. Lenders may have changed their underwriting standards in response to these trends and economic uncertainty.

Londoners are shying from big brand retailers in favour of shopping at independent outlets, with independent and single-site retailers consistently outpacing chains throughout the autumn.

The COVID-19 pandemic has done more than change consumer habits; it has resulted in a mass migration out of urban centers across the country. Using our Foot Traffic data, we analyzed migration patterns in and out of cities before and during the pandemic to understand just how this exodus occurred.

Prime Day is a pinnacle for online shopping, yet in recent years the offline impact has been significant and growing. Brands like Walmart, Target, and Best Buy have aligned deals to take advantage of the excitement surrounding Prime Day to drive offline and online visits. Even Amazon entities like Whole Foods have gotten into the mix, utilizing the buzz and cross-channel deals to drive interest in stores.

When U.S. cities and states faced shelter-in-place orders to limit the spread of the coronavirus, Americans’ reduced mobility resulted in plummeting sales at rideshare companies. As rideshare is continuing to bounce back, in September, Uber and Lyft sales were both down 67 percent year-over-year.

The world of work is always changing, but 2020 has brought unimaginable shifts in where and how many of us do our jobs. Although only 8% of employees worked remotely full-time prior to COVID-19, this number quadrupled to 35% by May 2020. So what have we learned from this massive experiment in working from home and how can these remote work insights shape the future of work?