For an industry that was among the hardest hit by the pandemic, September brought some welcome good news. The sales recovery continued into September, which at -8.1% same-store sales growth, became the best performing month since February (before the pandemic hit restaurant sales at a national scale).

Total construction starts dipped 18% in September to a seasonally adjusted annual rate of $667.7 billion, essentially taking back August’s gain. While some of this decline is certainly payback from several large projects entering start in August, the drop in activity brought total construction starts below levels seen in June and July. Nonresidential starts fell 24%, while residential building dropped 21% over the month.

In 2019 there were 4.54 billion scheduled passengers worldwide. Analysts expected 2020 to set a new record of over 4.72 billion passengers, but instead, the coronavirus pandemic spread its tentacles across the globe, practically bringing international travel to a standstill.

Console gamers have not been sitting on the sidelines, patiently awaiting next generation Xbox and PlayStation systems to arrive. Envestnet | Yodlee COVID-19 Spending trends have shown that console spending has continued to maintain high levels throughout the pandemic.

The latest data from Real Capital Analytics shows that the European logistics sector continues to attract plenty of capital amid the myriad of uncertainties caused by the Covid-19 crisis. The flow of investment into logistics properties has buttressed the industrial sector overall and it is the only major property type to register higher deal activity so far this year than 2019.

Since the Great Recession of 2008, the real estate market has rebounded nicely to say the least. In fact, as home prices continue to climb, it has become increasingly difficult for the average American to afford to purchase a home. Simply put, home prices are increasing at a faster rate than income.

The holiday season approaches, and another quarter is in the books. The second quarter was a rough one for multifamily, as with the broader economy, but some positive signs emerged in the last few months. This month we take a closer look at Q3 performance and, as always, numbers will refer to conventional properties of at least 50 units.

The Association of American Railroads (AAR) today reported U.S. rail traffic for the week ending October 10, 2020. For this week, total U.S. weekly rail traffic was 520,452 carloads and intermodal units, up 1.9 percent compared with the same week last year.

Voodoo was the hypercasual games publisher with the most new installs of its games in Q3 2020, having its games downloaded 105% more than its closest competitor in Lion Studios. The bottom half of the top 10 are grouped pretty close together but after #10, Rollic Games, there is a bit of a dropoff to Kwalee with 63 million installs. As a grouping, the top 10 hypercasual game publishers grew downloads 31% YoY. Only two of the top 10 declined during this period.

Europe’s hoteliers enjoyed a far stronger post-lockdown recovery than those in the UK over summer, with hotels on the continent experiencing guest levels comparable to 2019 whilst the UK struggled to muster much more than 70%.

Tesla’s CEO Elon Musk has, on more than one occasion, promoted the idea that the automotive company is uninterested in pedigree. In a noteworthy string of tweets in February, Musk wrote, “Don’t care if you even graduated high school… Educational background is irrelevant, but all must pass hardcore coding test.”

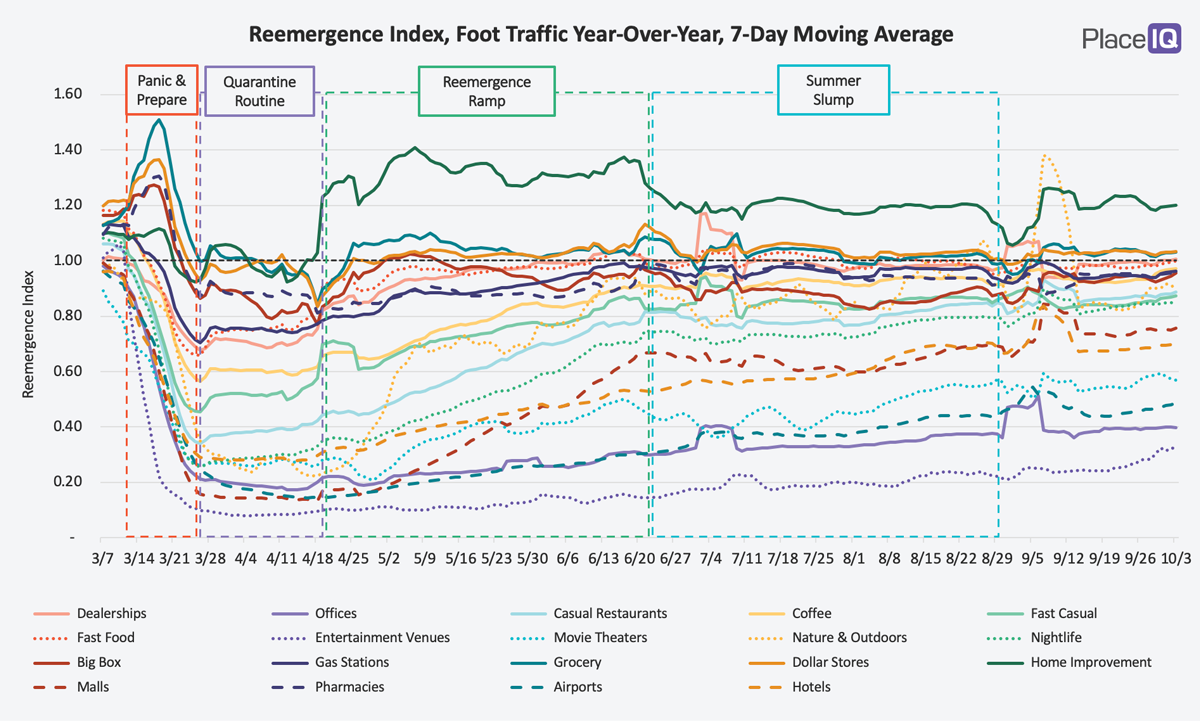

We are now into Fall, but the phase after the Summer Slump defies definition. It is a slowww crawl upwards for most categories – barely above a flatline.

In April, we made the argument that fitness could be one of the sectors to bounce back fastest – a bold claim at the time. The idea was that an extended period of being “stuck at home” could actually increase our longing for the gym. But, after months of watching the sector struggle as a whole, we backtracked and left even the strongest players off of our updated expected 2020 winners list.

We probably don’t have to tell you that social media is a big deal. The average person spends 2 ½ hours per day on social media. 3.8 billion people use social media worldwide. 84% of people with Internet access use social media. So with stats like those, advertising on social media is a no brainer. Let’s pull some insight to see which social media sites are the cream of the ad crop.

While the vast majority of civil contractors (73%) are experiencing delays with their projects due to the COVID-19 pandemic, contactors are still seeing high levels of backlog and remain relatively optimistic about the state of the civil construction market, according to new data from Dodge Data & Analytics.

If you have over 100 aircraft scheduled for delivery in 2020/21 and a further 106 that are currently inactive then you have plenty of capacity. But where do you operate those aircraft? Southwest seems to have found part of the solution with their recent announcement of entering the Chicago O’Hare (ORD) and Houston Intercontinental (IAH) markets from early next year.

The twists and turns of the COVID-19 pandemic have contributed to seismic changes in tourism, which has included the cessation of international travel for some countries. As a whole, we have witnessed long-lasting shifts in consumer behavior and attitudes, producing an increase in active travel, soaring levels of e-commerce and, yes, even ballooning rates of pet ownership.

While the early pandemic months dealt a blow to auto sales industry-wide in the U.S., online shopper interest in the new vehicle market has clawed back from double digit year-over-year (YOY) losses in the spring of this year to just a few percentage points shy of last year’s shopper interest in the summer (and was even up YOY in July!).

Traditionally the next week is one of the most impressive displays of the success of the airline industry, the Big Three US carriers announce their third quarter earnings which cover the July to September period; the peak months of travel in many markets. Last year United Airlines reported net income of US$1.0 Billion, Delta Air Lines adjusted revenues of US$12.6 Billion and American Airlines paid some US$44 million in dividends in the quarter.

Worker presence at food manufacturing plants across Europe has dropped to just 16pts of equivalent levels last year, a low not seen since countries began to re-emerge from the first lockdown at the end of April.