The widening pandemic led President Trump to declare a national emergency on March 13, sparking shelter-in-place directives across many communities. The shuttering of commercial establishments subsequently put many American workers out of work. As such, many homeowners affected by sudden job loss were ill prepared to maintain payments on their home mortgage loans.

Residents in Birmingham, Bristol and Sheffield have been some of the fastest to return to workplaces, with office attendance climbing to almost 50% of YOY levels in each city. However, working from home appears to have become a new way of life for Londoners, as levels at languish around 20%. Commuting in cities outside London have been witnessing a fast recovery since the start of July as offices and workplaces were allowed to open up again.

53,621 single-family homes and condominiums in the United States were flipped in the second quarter. Those transactions represented 6.7 percent of all home sales in the second quarter of 2020, or one in 15 transactions. That figure was down from 7.5 percent of all home sales in the nation during the prior quarter, or one in 13, but up from 6.1 percent, or one in 17 sales, in the second quarter of last year.

The coronavirus outbreak is prompting many Americans to forgo gatherings and non-essential activities, which is expected to lead to a drop in sales for ride-hailing and scooter companies. But, through February, sales data shows, it was largely business as usual.

Movie theaters were struggling before the pandemic and now they’re on life support. After Disney had delayed the March 2020 launch of Mulan three times, it decided to take a shot at earning back the $200M spent on the movie’s creation via a digital launch. On September 4th, Mulan launched on Disney+. This is a one-time purchase that enables users to watch the movie for as long as they have access to the streaming service. To be clear, you cannot purchase the movie without also purchasing or already having a Disney+ subscription.

Through what has been an unusual year, to say the least, the multifamily industry has in many ways been on the front lines of the disruption to lives and livelihoods. This impact has been borne out across multiple metrics, but nowhere so clearly as in multifamily demand. Through the first eight months of 2020 apartment demand fell by 42% compared to the same period last year – even as new deliveries were almost on par with last year’s volume.

As we mark half a year of grappling with COVID, one industry that has weathered major turmoil is Food Service. Looking at the data to determine the shape of the industry today, we see both positive and negative signs. Noted in our recent monthly recap, Accommodation and Food Services was the industry that saw the biggest decline in August, down -9.29% for the month. (Utilities was the only other industry down, while the other 87% of industries saw improvement.)

Year-over-year small business credit card application volume shrunk 41% in Q2 2020, but increased search activity signals renewed hope for the second half of 2020. New research found indications that interest from small businesses in small business credit cards may be rebounding after a loss in momentum in the first half of 2020.

In this Placer Bytes, we dive into the impressive rebound of Trader Joe’s, the potential for American Dream’s reopening, and Home Depot’s two-month-long Black Friday. In March, we noted the unique struggles that Trader Joe’s would likely face during COVID. The brand’s pricing, lack of online orientation, and perception as ‘part’ of the grocery picture as opposed to a one-stop-shop, were factors that we felt would limit success.

Maize farmers across Europe face a range of production challenges. Fungal diseases on maize grain impacts yield, quality and in some cases create toxins such as aflatoxin in the case the Aspergillus flavus in maize that are extremely carcinogenic. Tools to monitor and mitigate the risk of these fungal diseases are key to ensuring food safety across Europe.

Equity markets used to ignore credit risk, but COVID has changed all that. There is a growing demand to understand corporate and financial credit risk at all levels, from single issuers and corporate families to sectors, industries and countries. How far do equity market movements reflect credit developments during the COVID crisis?

Data from the TSA and Opentable show that the Travel and Hospitality sectors have not recovered to pre-COVID levels. Given that the small improvement took place during the spring and summer months when the weather was more favorable and people typically travel for vacation, it is highly likely that a larger recovery is not seen until spring 2021. Data from TSA show that total travelers passing through TSA checkpoints at US airports is still at only 35% of the numbers recorded last year.

How does Europe compare to other regions in the recovery cycle? China hit a 69.4% occupancy level on 18 August, the highest level during the time of the pandemic. Since that date, however, China has started to fall back a bit. During the first weekend of September (4-6 September), the market posted 57.6%, 57.5% and 57.9% occupancy levels, respectively.

The popularity of alcohol delivery services has skyrocketed with the introduction of pandemic-driven social distancing policies. Given the closure of bars across the country, consumers are turning towards more convenient alternatives to get their happy hour beverages. Within the alcohol delivery market, Drizly has set itself apart from the crowd.

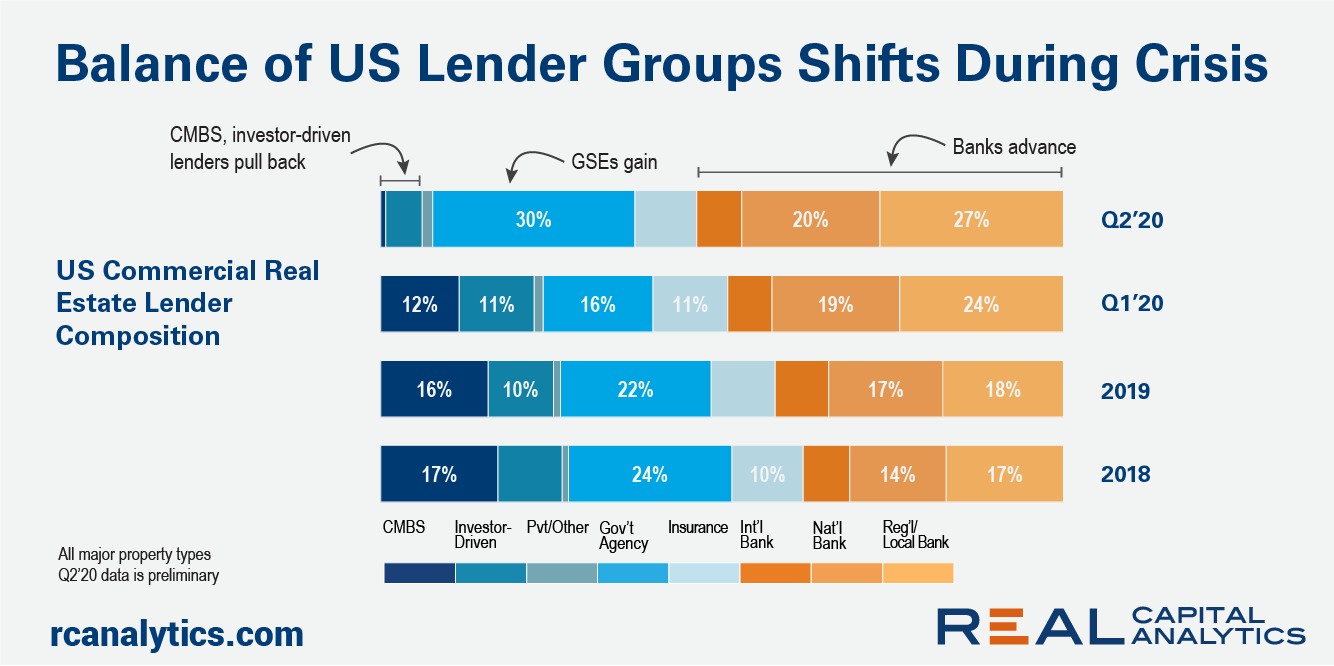

The debt portion of the U.S. capital stack has seen a tumultuous 2020. Key industry participants have pulled back on mortgage originations in response to the uncertainty around the Covid-19 recession. Commercial mortgage originations in the second quarter of 2020 were supported by banks and the GSEs. The debt portion of the capital stack is more stable today than it was in the last downturn.

In second quarter 2020 the full impact of the COVID pandemic on the ad marketplace was felt globally. According to Standard Media Index (SMI), second quarter ad spend dropped by an average of -37.1% across five major Anglo markets, the United States, Canada, United Kingdom, Australia and New Zealand, year-over-year. SMI reports ad spend declines had continued and even accelerated throughout second quarter after the pandemic first hit in mid-March.

Overall, Envestnet | Yodlee COVID-19 Income and Spending trends data shows that consumer spending in the summer resort category has recovered since bottoming out in April 2020. For this analysis, we looked at spending in resort towns during summer to see if the pandemic affected areas that would usually be bustling during vacation months. In our analysis, we took a closer look at U.S. towns like Truckee, California; Aspen, Colorado; Jackson Hole, Wyoming; and others.

Indications show that the recovery of the UK Health & Fitness sector bounced back rapidly following the end of lockdown, with gyms, spas and fitness studios across the UK seeing up to 65% of last year’s levels consistently throughout much of August and September. According to Huq’s ‘Big 6 Consumer Index’, gyms, spas and fitness studios across the UK dropped quickly and firmly to negligible attendance during lockdown, followed by a sharp increase when they were allowed to open once again in late July.

Total construction starts rose 19% in August to a seasonally adjusted annual rate of $793.3 billion. Gains were seen in all three major building sectors: nonresidential building starts rose 16% and residential building climbed 12%, while nonbuilding construction jumped 40% over the month. While large projects certainly influenced the August gains, removing those projects would still have resulted in a gain for the month.

Despite the recent slowdown in hiring, the race for premier talent is only heating up. Top tech companies are aggressively competing for AI engineers to secure their future from the pervasive risks of automation. Skills in Artificial Intelligence, Machine Learning, and Deep Neural Networks are reaching new levels of demand as industries are preparing for the next industrial revolution.