While the past four or five months have been tough times for airlines and airports, the same has been true for suppliers to the industry. An example of this is the fuel suppliers which are on standby, ready to refuel aircraft in their often-short turnaround time. Early on in the pandemic, as OAG frequently reported, airlines struggled to plan schedules around travel restrictions imposed at short notice and plummeting demand.

Large industrial cities, like Detroit and Pittsburgh, have mostly been in decline over the last few decades, ushering in a new era of cities with a diverse set of industries and jobs. But in recent years that trend has reversed among technology hubs, like San Jose and Seattle. Their workforces have shifted so heavily toward engineering that they are now at risk of losing the diversity of thought that’s necessary for innovation.

With many students around the country going back to school remotely, the supply list is proving to be very different this back-to-school season. Sales of school supplies related categories within the office supplies industry, from pencils to spiral notebooks, are down as U.S. consumers delay these purchases. Instead they are investing in other categories such as technology and books to set up school environments at home, according to The NPD Group.

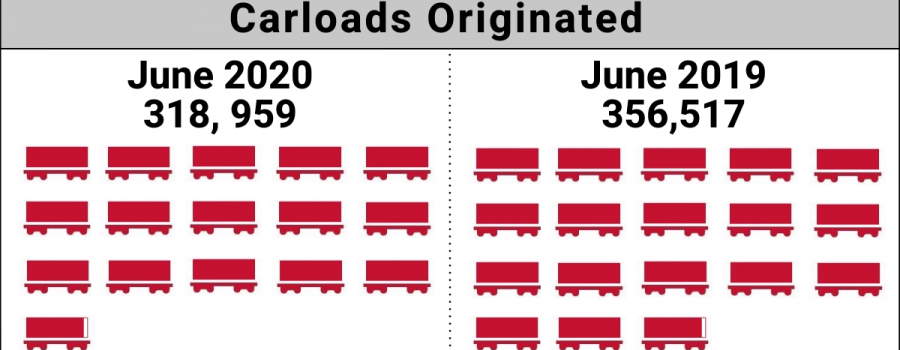

The number of carloads moved on short line and regional railroad in July 2020 was down compared to July 2019. Carloads originated decreased 12.3 percent, from 356,517 in July 2019 to 318,959 in July 2020. Grain Mill Products led gains with a 11.1 percent increase. Stone, Clay and Glass Products was up 7.8 percent, and Chemicals increased 2.0 percent. Nonmetallic Minerals led declines, down 43.6 percent.

In this Placer Bytes, we analyze Burlington’s up-and-down recovery, Ulta’s drive to normalcy and how Big Lots trends have differed from others in the space. When Burlington reopened stores, the visits started to flood back in and traffic had returned to just 35.7% down year over year in June. Yet, in July the retailer took a step back with visits down 40.2% year over year.

Cross-border institutional purchases have been one of the most resilient sources of capital in Asia Pacific in the first half of 2020, a surprising trend given that the practical advantages that domestic groups have during the Covid-19 pandemic. The volume of acquisitions by cross-border investors fell by 14% year-over-year, as compared with declines of around a half for listed and private entities.

The August CCIs have seen significant further credit deterioration for UK, EU and US Industrial companies. Credit quality continues to worsen month-on-month for UK Industrial companies, with a third consecutive month of decline. The CCI jumped down several points to register at 40.9 this month, down from 44.2 last month.

This week we’re wrapping up our weekly earnings coverage for the 2Q earnings season with an interesting mix of companies ranging from retail to software. Best Buy, Dick’s Sporting Goods, and Ulta Beauty are the companies on the retail side, while Intuit, Autodesk, and Salesforce are the companies we are focusing on in the software domain.

Sports are back—but they are far from normal. While many consumers are eager to sit back and watch a televised game, others aren’t as eager to jump into the distraction yet. How are consumers responding and what does that mean for advertising?

Ghost of Tsushima sold 1.9M digital units in July to become the fastest-selling new PlayStation IP. The game far outpaced the early sales of other new franchises launched on PlayStation 4: Horizon: Zero Dawn sold 1.9M units in its first two months on the market in early 2017, and Days Gone sold 1.3M units in its first two months after launching in late April 2019.

This week’s latest scheduled capacity data shows a further reduction with the loss of some 700,000 fewer seats reported this week. That’s a reduction of just one percent and exactly the same percentage of capacity at 50.6% of last year’s level as we reported for week thirty-one. This is now the third consecutive week of global capacity falling back; that seems like the beginning of a trend to me.

In this Placer Bytes, we dive into the insane momentum driving dollar stores and a similar power being revealed for Best Buy. The wider “dollar” space appeared among the most likely to see a longer-term boost from the pandemic. The sector is dominated by players with a wide range of goods and lower costs, positioning them well in a time where mission-oriented shopping and economic uncertainty reign.

It appears as though the Summer Slump continues on. In one more week, it will match the duration of the Reemergence Ramp. Traffic is mostly flat, aside from traffic to Nature & Outdoor venues (which has been cycling a bit with recent weather patterns) – and some signs of life among the lower trafficked categories, like hotels and movie theaters.

The past few weeks have brought some optimism as daily COVID-19 case counts have trended downward at a national level. However, regional trends in Kinsa data show that illness transmission (Rt) is rising again in many parts of the country — particularly in the southeast and central Plains regions — suggesting that this downward trend in new infections may plateau or even reverse in the coming weeks.

While audience traffic for certain categories are returning to normal, overall news consumption remains higher than pre-pandemic levels. Data suggest that millions of Americans continue to rely on media for vital information during the ongoing COVID-19 pandemic. Total visits to an aggregate of approximately 40 select news sites peaked during the week of April 13-19, 2020 with 8.5 billion total visits.

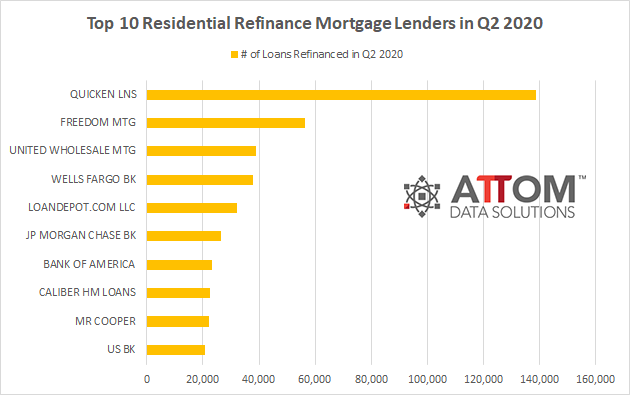

There were 1.69 million refinance mortgages secured by residential properties (1 to 4 units) in Q2 2020. That number is up almost 50 percent from Q1 2020 and more than 100 percent from Q2 2019, to the highest level in seven years. With interest rates hovering at historic lows of around 3 percent for a 30-year fixed-rate loan, refinance mortgages originated Q2 2020 represented an estimated $513 billion in total dollar volume.

"We originally started with Redshift as our data warehouse. Over time, we realized that there were some features that were missing that we weren’t able to take advantage of, so we looked at Snowflake and realized it was a much more current and modern cloud infrastructure to move to."

The pandemic is wreaking havoc on school reopenings as decisions around in class vs. remote learning vary by county and sometimes by week. It’s no surprise that the Back to School (B2S) spending season is feeling this impact. In this analysis, we analyzed spending at traditional B2S retailers (see our piece from last year) across the East South Central and Mountain states, which tend to have earlier start dates than the rest of the country.

COVID-19 has catalyzed sales growth in the telehealth industry, as patients turn to online doctors as a safer and more convenient way to receive medical advice. The industry has witnessed skyrocketing year-over-year growth since March 16, the week most states issued shelter-in-place orders, and has since sustained strong growth.

Everyone's talking about crypto again and I refuse to be left out (FOMO is a killer). In July, the top 10 crypto wallet apps increased net new installs approximately 81.4% YoY. July is the best performing month on record for this market, and August has the potential to beat it.