Roughly twice as many Americans retired in the first fifteen months of the pandemic than they did in 2019. Some of these retirements were by choice—driven by increased investments and a refocus on what matters in life. Others were involuntary—people in struggling industries were laid off and didn’t return to work. While there is a “Great Resignation” happening across all working age groups, Baby Boomers are leaping into early retirement—ready or not. And financial planners have found themselves in demand. How are we seeing financial services bring customers in?

US President Biden announced this week that the country will lift restrictions for vaccinated international travelers looking to come to the US. But if you lift restrictions, will travelers come? In today’s Insight Flash, we compare travel trends in the US and UK to see how spend from overseas might shift with more travel options open. Consumer Edge Data has been very prescient in the US, and caught July’s deceleration in spend well ahead of the companies lowering revenue guidance:

Welcome to the October Apartment List National Rent Report. Our national index increased by 2.1 percent from August to September. Although month-over-month growth has slowed slightly from its July peak, rents are still growing much faster than the pre-pandemic trend. Since January of this year, the national median rent has increased by a staggering 16.4 percent. To put that in context, rent growth from January to September averaged just 3.4 percent in the pre-pandemic years from 2017-2019.

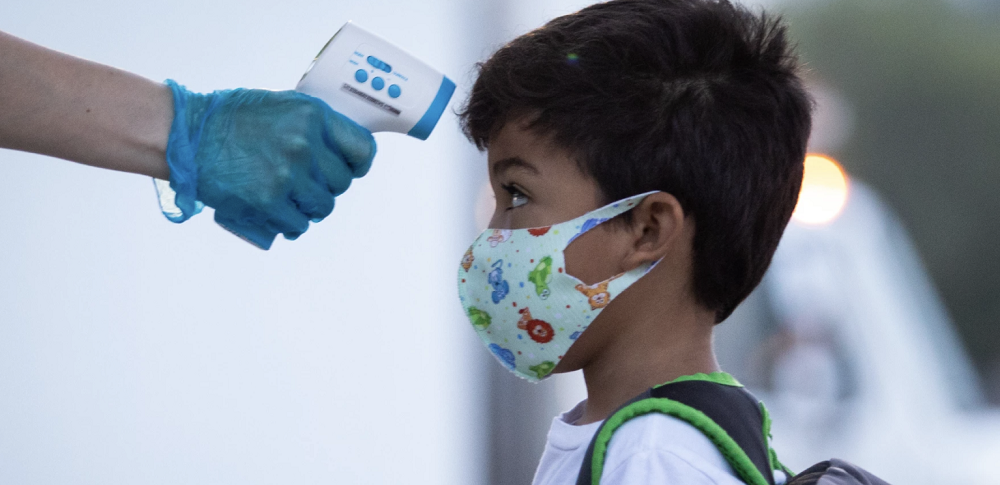

This back-to-school season marks the first time that many students across the U.S. are returning to the classroom since schools transitioned to remote instruction in March 2020 amid the coronavirus pandemic. Interestingly, August 2021 consumer sales for office supply company Office Depot (which includes stores under the Office Depot and OfficeMax brands) were lower than sales for August 2020 and August 2019. Consumer transaction data also shows that Office Depot’s August 2021 sales patterns varied by metro area

Last December, Kohl’s and Sephora announced a long-term strategic partnership to revitalize Kohl’s beauty offerings by opening Sephora shops-in-shop at select Kohl’s locations throughout the country. The plan involved launching 200 “Sephora at Kohl’s” locations by the fall of 2021, for a total of at least 850 Kohl’s with a Sephora store-in-storeby the end of 2023.

The Midwest and Mid-Atlantic states are getting ill fast. Since Labor Day, most states in these regions have seen rapid increases in fevers, Kinsa data show. Since confirmed COVID-19 cases did not increase at the same rate within that period, the increase in fevers is likely due to another infectious illness, like RSV. The CDC reports that flu cases remain low across the country, ruling it out as a likely culprit. Regardless of the root cause for rising illness levels

On Thursday September 23, 2021 Darden Restaurants, Inc. (DRI) posted better-than-expected revenues of $2.31bn beating the consensus estimate of $2.24bn (-3.1%) and in the same direction as Advan's forecasted sales. The revenue was +51.2% YoY - Advan's foot traffic data captured an increase in foot traffic of +56.4% YoY at its restaurants for Q1 2022. As a result of beating the sales and EPS, the stock opened at $159.34, up +6% from its previous day's closing price and set an all-time high of $164.28 during the trading session.

In an unexpected turn, U.S. demand and occupancy advanced in the latest week of reporting (12-18 September 2021) to the best levels of the past four weeks. Weekly demand increased 1.2 million rooms to 24.3 million, which was the largest weekly gain of the past nine weeks, pushing occupancy to 63.0%. Subdued demand was expected this week due to the mid-week observance of Yom Kippur. Daily occupancy advanced every day of the week, except Sunday, growing week on week and day on day, culminating in a level of 78% on Saturday.

As the team of data scientists and analysts at ForwardKeys keep a vigilant eye on travel recovery around the world, an unexpected twist keeps on appearing: the creation of quarantine travel hubs. We don’t wish to call it a trend, rather, it’s more of an example of the lengths people are willing to take to get to certain long-haul destinations – even with tricky travel restrictions in place. And it has continued to play a role in travel and tourism since the onslaught of the pandemic.

The full back-to-school (B2S) season saw no growth relative to 2019 (Yo2Y), an improvement from last year’s stunted season, but still shy of the 4% Yo2Y growth levels pre-pandemic. In-store spending declined 10% Yo2Y while online spending grew 27%. Foot traffic data to malls reflected a 16% decline this season compared to 2019; still a ways towards full recovery. Majority of states saw lower levels of spending relative to pre-pandemic, like D.C. and Louisiana (20+ points lower), California and Texas (10+ points) and New York (6+ points).

The composition of lenders in the U.S. commercial mortgage market has largely returned to its form before the Covid-19 crisis struck, the latest US Capital Trends report shows. CMBS originators, who had been particularly hard hit in the second quarter of 2020, captured an 18% share of the commercial mortgage market in the past quarter, which put them behind only regional/local banks as the largest source of financing. The rebound reflects an easing of the uncertainty in the lending market, which had limited CMBS originators to just a 1% share of lending a year ago.

Finally, good news for every scheduled airline CEO in Europe and the United States; the US will allow double vaccinated travellers to enter from a date in early November. Quite why regulators can’t state the precise date always seems to be odd, but it appears to have been a catching trend through the pandemic. This announcement is great news and perhaps, fingers crossed, an indication that a recovery is underway in the industry - just China, South East Asia, Australia, New Zealand and Africa to go! So, just how much of a Christmas gift will the reopening of services be to those airlines operating?

B2B advertisers shifted much of their budget to digital last year. But only a small portion of that shift went to Facebook. This summer, 11% of B2B digital advertisers bought placements on Facebook. Even though the platform allows marketers to build highly specific audiences, B2B marketers are slow to use the social media site. When we take a deeper look, Facebook B2B advertising is growing but not at the expense of traditional formats—and the creative from major companies shows us how.

Apples to apples? In this market, it might make more sense to compare Apples to unicorns. Currently, that exchange rate is right around 1 to every 800. There are now more than [800 “unicorns](https://www.cbinsights.com/research-unicorn-companies?utm_source=chartr)” or private startup companies worth more than $1 billion (like Stripe, SpaceX, Reddit, Instacart, Warby Parker, and Discord to name just a few). Combine those 800 with yet another 800 super promising companies and you wind up with a total combined valuation of $2.6 trillion. A staggering figure that, remarkably, is almost equal to what the world’s most valuable company

Unlike the bumpy Singapore and Hong Kong Air Travel Bubble (ATB) that was scrapped after two postponements, the newly launched Vaccinated Travel Lane (VTL) between Singapore and Germany has been distinctively smooth. For travel-starved residents in Singapore who have been kept at home by the pandemic since March last year, the pilot scheme’s significance lies in Germany being the first quarantine-free, long-haul destination for the fully vaccinated.

Looking at data on employees at public companies in Northern America, the plot below tracks the rolling mean of monthly hiring rates of women and men. Although the numbers look similar until fairly recently, we observe a widening gap between hiring rates of men and women in the recent past, especially during the pandemic. It is hard to disentangle whether this dip in women taking up new roles is driven by labor supply, or labor demand.

Our latest whitepaper analyzes the tourism and travel recovery following a year and a half of extraordinary challenges. We dove into foot traffic data for cities, states, hotels, airports, and tourist attractions across the countries to understand how the pandemic impacted – and continues to impact – these critical industries. For this whitepaper, we supplemented our usual data streams with data from Placer.ai’s free COVID Recovery Dashboard, which measures retail and domestic tourism visits across every state, county, city, and zip code in the United States.

Still the top category in digital advertising, CPG takes on aspects of nearly every other vertical, with multiple sub-categories and products that span the entire digital landscape. We analyzed the top 5 CPG advertisers over the last 3 years, for seasonal, spend, and creative trends, to explain what keeps it at the top of the (individually wrapped) food chain.

The food delivery industry hasn’t stopped evolving since its birth. 2020 was a big year for change, with unprecedented changes introduced across the food delivery market. This year promises more of the same, as many wonder whether a post-COVID drop may be in store for the industry. To understand how the pandemic has impacted the food delivery market, as well as see consumer spending habits are shaping up in 2021, Edison Trends examined over 3.3 million de-identified food delivery transactions worldwide.

The return of the pumpkin spice latte—or “PSL” to its loyal fans—is heralded as the unofficial start of fall. Starbucks and Dunkin are two of the largest coffee chains known for selling this seasonal treat. But does the return of the PSL affect sales at these two companies? Consumer transaction data found no major changes in week-over-week sales when Dunkin introduced its fall 2021 beverages, while Starbucks experienced a modest sales bump the same week that PSLs returned to its menu.