When we last checked in with McDonald’s and Chipotle, both were outpacing their category peers and introducing new initiatives to help drive foot traffic and sales. With 2022 in the rearview, we dove into the quarterly performance of both chains and consider what might lie ahead for them in 2023. McDonald’s and Chipotle enjoyed impressive foot traffic growth all months analyzed. Much of this success is tied to the expansion both chains have undergone – Chipotle has grown from around 2,500 stores in 2019 to nearly 3,100 in 2022, and plans on opening an additional 250 locations in 2023.

3G has been a major legacy network overhead and consumer of spectrum bandwidth in the US. But as 5G moves into high gear the Big 3 wireless carriers needed to reallocate capacity to fully support the 5G network, and free up resource for the development of 6G and beyond. AT&T stopped 3G services in early 2022 and T-Mobile started to retire its older networks last summer. This month, Verizon became the last of the Big 3 to shut down its 3G network – meaning 3G has effectively ended in the US.

Beauty companies like Ulta Beauty (NASDAQ: ULTA) have been in the spotlight over the past several months, in response to rising cosmetic sales in the wake of high inflation and economic uncertainty (a phenomenon sometimes referred to as the “lipstick effect”). In fact, Ulta recently surpassed investors’ expectations in its third quarter earnings report and even boosted its holiday sales outlook. So how did the beauty retailer’s holiday sales fare? Using consumer transaction data, Bloomberg Second Measure analyzed holiday spending trends at Ulta and its LVMH-owned competitor Sephora.

FTX’s collapse has had a domino effect on the cryptocurrency market, leading to a series of crypto-related bankruptcies. As expected, these events have had negative impacts on workers across the crypto space. However, signs of decline appeared in the crypto workforce well before the 2022 crash. Attrition from crypto companies began to increase as early as July 2021. Meanwhile, employee sentiment in crypto companies started to decrease with the dip in crypto prices in January 2022.

The past couple of years haven’t been easy ones. But the uncertainty and stress brought on by the pandemic and the rising cost of living haven’t stopped consumers from seeking out fun things to do with friends and family – in fact, quite the opposite. Even though budgets are tight, many have a new post-pandemic appreciation for going out and continue to prioritize recreational activities as a way to de-stress and find joy and fulfillment. We analyzed foot traffic for three leading brands – Dave & Buster’s, Bowlero, and X-Golf – and broader entertainment categories in order to take a closer look at the impact demand for fun is having on visits.

Placer.ai’s Q4 Quarterly Index Report presents location intelligence data for beauty & self care brands, discount & dollar stores, superstores, grocery brands, malls, fitness chains, and offices. Using yearly, quarterly, and weekly visit patterns, the report reveals how these key categories fared in 2022 and what their performance tells us about consumer behavior and brick-and-mortar retail in the new normal.

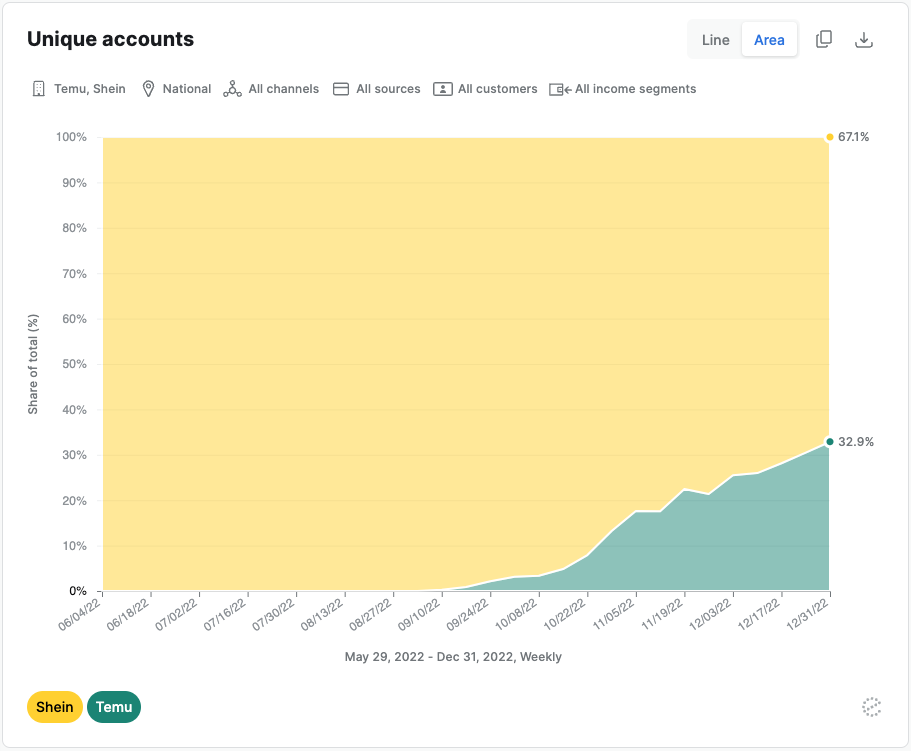

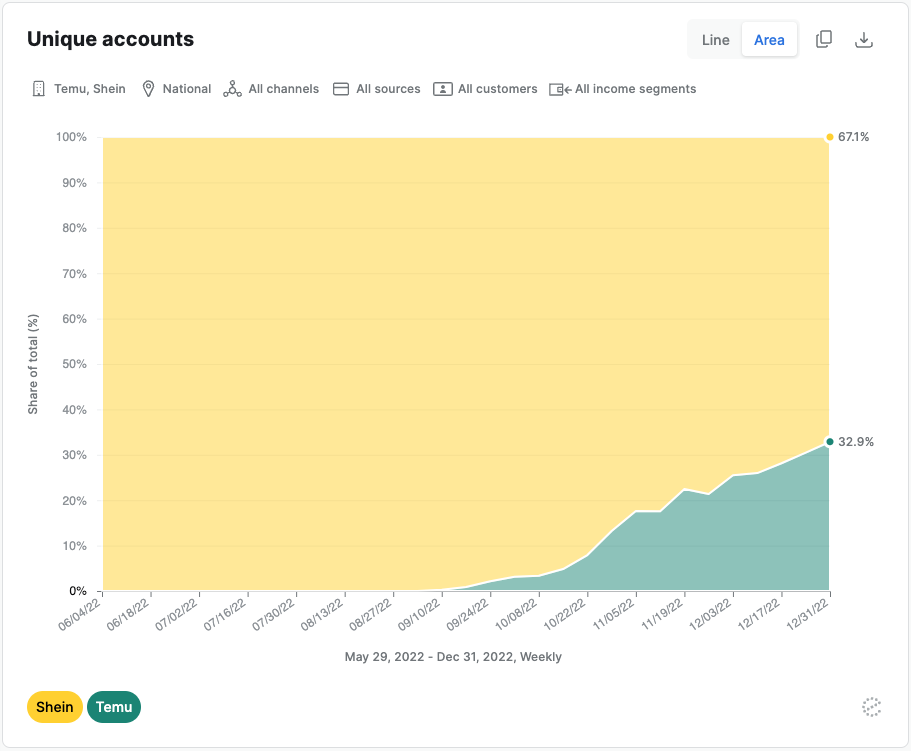

Chinese-owned discount online marketplace Temu reached half as many weekly active users as the largest US fast fashion brand Shein in only three months according to Earnest’s Vela transaction data. The Pinduoduo owned newcomer to the US market achieved customer growth levels that took Shein four years and a pandemic to reach. Temu offers basement bargains for everything from Lenovo earbuds to 99 cent holiday outfits. Its market entrance comes on the heels of hyper-discounted and social media hyped fast fashion brand Shein’s rise.

The top 10 quick-service restaurant apps in the U.S. were downloaded 11.6 million times in December, 1.4 percent more than those the month prior. Year-over-year in the month of December, downloads of the top 36 quick-service restaurant apps are up 6.6 percent. A download represents a new user and the first conversion on the mobile app customer’s journey.

Somehow, another year is gone. 2022 was a somewhat challenging period for the multifamily industry, especially relative to an historic 2021. With 2023 now ahead, some of the defining features of last year persist, and others have begun to fade. These changes, as well as new dynamics that will emerge this year, have the industry on a path to another fascinating year on the heels of three years that will be discussed well into the future.

Sandalwood China Auto Insurance data indicates below-seasonal level car deliveries of Tesla in December at 37,723 as of Dec 25. Hangover effects from strong November delivery and weak consumer demand despite additional subsidies are likely the main culprits. Model Y continues to take the lead. 27,480 and 10, 243 units of Model Y and Model 3 were delivered respectively MTD.

With 2022 in the rear-view mirror, we checked in to see how the grocery sector is faring at the start of the new year, zooming in on two chains that are outperforming industry averages: H-E-B and Trader Joe’s. Since H-E-B is located in Texas, we focused our analysis on the Lone Star State. Despite somewhat different strategies, both chains have succeeded in garnering highly devoted and loyal customer bases, thanks in part to their focus on in-store customer experience.

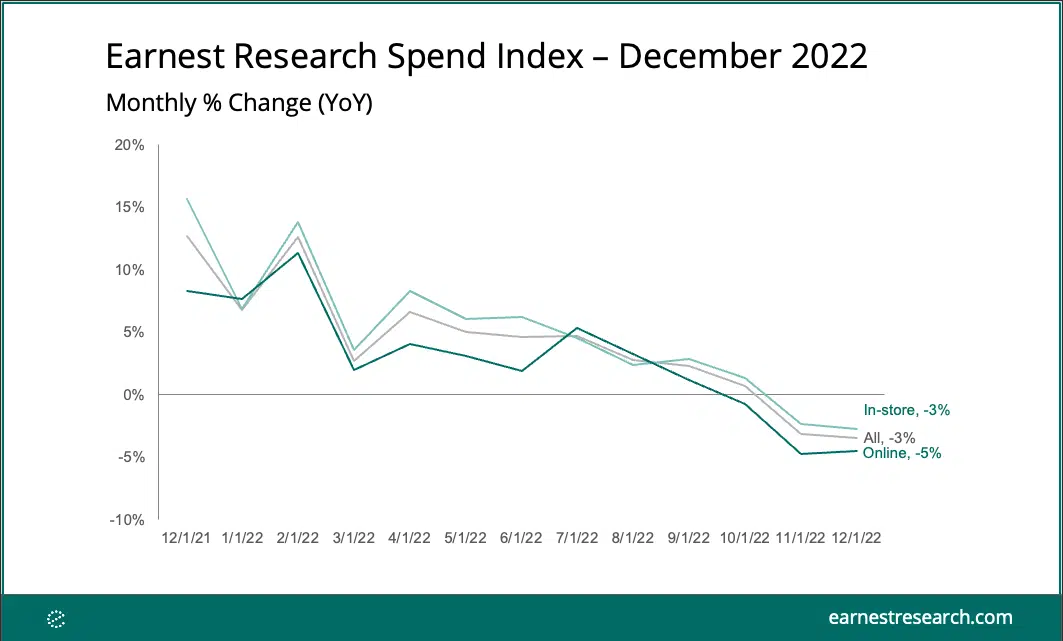

Earnest Analytics Spend Index powered by Orion transaction data decelerated in December, as a deceleration in In-store more than offset a slight Online acceleration. Gyms, Workout Classes, Garden & Outdoor, and Air Travel grew fastest in the month. Active & Athleisure, Off-Price Department Stores, Footwear, Sports Gear, and Casual Dining also stood out with the fastest acceleration since November.

On January 1st, California and Washington were the latest states to introduce pay transparency laws, which require all job postings to include a pay range. In collaboration with The Economist, we look at how employers responded in New York City and Colorado when the laws were introduced, in order to understand what California and Washington can expect. To what extent do job postings now include pay ranges that are actually informative?

Despite moves by some companies to cut down on remote work, a full-time return to the office still appears unlikely. But what will remote and hybrid work patterns look like in 2023? How many people are coming into the office each day, and what are their schedules? What trends can be identified in different major cities across the country? With the new year upon us, we dove into our office index data for 2022 to get a better understanding of evolving work habits.

Consumer holiday spending measured by the Vela credit and debit card data in Earnest Analytics Spend Index (EASI) increased 5.9% YoY in 2022, a stark contrast from the significant demand growth experienced in the 2021 holiday season but relatively in-line with historical periods as multi-decade high inflation continues to benefit nominal growth. In 2022, holiday spending growth was driven by similar levels of transaction and average ticket growth, though transaction growth was much lower than pre-pandemic levels, a potential sign that inflation continues to squeeze consumer budgets.

Until recently, luxury shopping in the US was typically concentrated in cities such as New York and Los Angeles. But now, a shift is underway as new wealth centers emerge across the country, including Sunbelt states. We took a closer look at some of these markets to see how demographic changes are creating new retail opportunities and understand what may lie ahead for the brick-and-mortar luxury sector.

The Dodge Momentum Index (DMI), issued by Dodge Construction Network, improved 6.6% (2000=100) in December to 222.2 from the revised November reading of 208.3. In December, the commercial component of the DMI rose 8.4%, and the institutional component ticked up 2.7%. “One of the key construction storylines for 2022 was the return of enthusiasm and optimism in prospects for nonresidential growth,” stated Richard Branch, chief economist for Dodge Construction Network.

HM.B-OME’s most recent sales report for 4Q2022, which ended in November, raised concerns that the Swedish fast fashion company isn’t moving fast enough to keep up with established rivals like Zara and newer entrants like Shein. In today’s Insight Flash, we take advantage of our newly launched Continental European data – tracking spend in Austria, France, Germany, Italy, and Spain – to understand the company’s performance across continents, digging into brand trends and how their higher priced brands are faring around the world.

Last year (2022) marked a significant opening up of retail as the wider landscape enjoyed the first true post-pandemic period. Yet, the upside of finally moving beyond pandemic-driven limitations was quickly offset by a myriad of economic challenges including inflation and high gas prices. Analyzing our Mall Indexes over the past year has shown the impressive resilience of top-tier malls across the three sub-segments throughout the year.

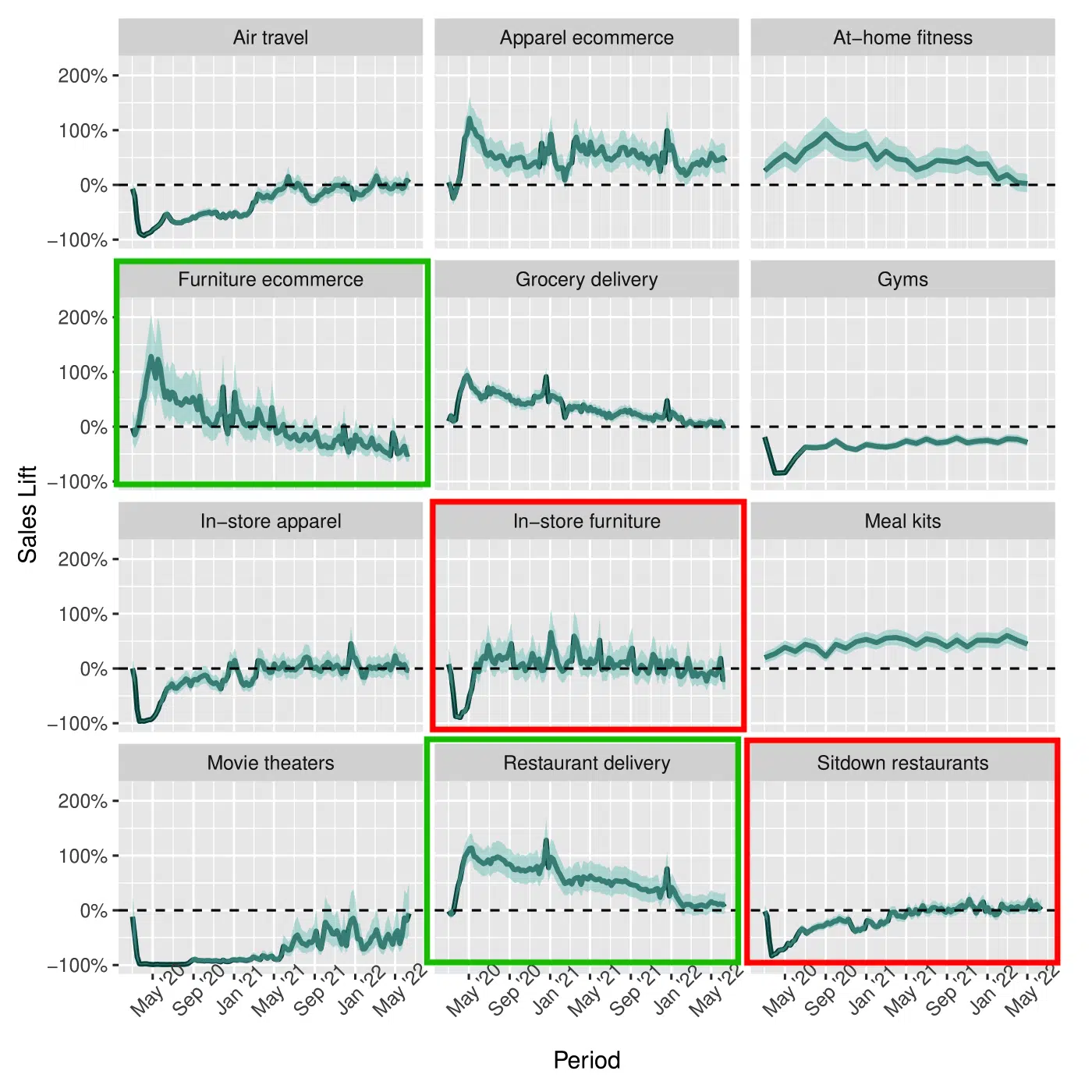

The COVID-19 pandemic disrupted consumer spending patterns in countless ways, driving us away from crowded venues and retail stores towards at-home alternatives such as delivery and e-commerce services. Our paper uncovers the short- and long-term impacts of COVID across 12 categories, revealing not only the effects of the pandemic immediately after its onset, but how those effects have evolved as we move into the “new normal.” We do so by first predicting what category-level activity would have been in the absence of the pandemic in these 12 categories, then comparing what consumers actually spent to this “no-pandemic baseline.”