While GameStop (NYSE: GME) has been in the news due to the recent Reddit-fueled buzz, trading activity, and stock volatility, transaction data reveals that its sales have decreased over the last two years—exacerbated by COVID-19 as well as the increase in gaming publishers’ and console manufacturers’ direct-to-consumer offerings. Over the last 12 months, GameStop’s average weekly year-over-year sales growth stood at -23 percent.

DIY destination Lowe’s has announced plans to hire at least 53,000 new employees ahead of the upcoming spring home improvement season. The retailer plans to hold hiring events in all of its more than 1,700 U.S. locations over the next three months in hopes of filling both full and part time openings for cashiers, stockers, loaders and merchandising associates.

There is no question that spend in the Grocery sector has been elevated as a result of the pandemic – the real questions are by how much, and how that will change in 2021. Fable Data tracks real-time consumer spending, allowing us to provide valuable insights into the Grocery sector. In 2020, Grocery spend was up c. +12% YoY. The highest growth for this sector was seen in Q2, with spend up c.+18% YoY, as lockdown restrictions were put in place.

First-time home buyers have been a growing share of the home buying population, a trend that accelerated in 2020. According to CoreLogic Fraud Consortium Loan Application data, the share of first-time buyers surged to 39% in 2020, up from 30% in 2016. While it may seem that first-time homebuyers have been highly encouraged by the onset of the pandemic and ensuing drop in mortgage interest rates, , our previous analysis suggests that the wave of first-time buyers was imminent irrespective of the pandemic as the largest cohort of millennials were settling down and approaching the median first-time home buying age of 32.

On a recent article published by Kate Gibson, Kroger, one of the most prominent grocers in the US, is expected to shut down two California stores to avoid offering workers ‘hazard pay’. Both of these stores are located in the Long Beach area, one is under the Ralph's franchise while the second one under Food 4 Less(both brands are Kroger subsidiaries). When big firms like Kroger decide to close a store, they are taking into consideration many parameters; the first one comes to mind is the profitability of the store itself.

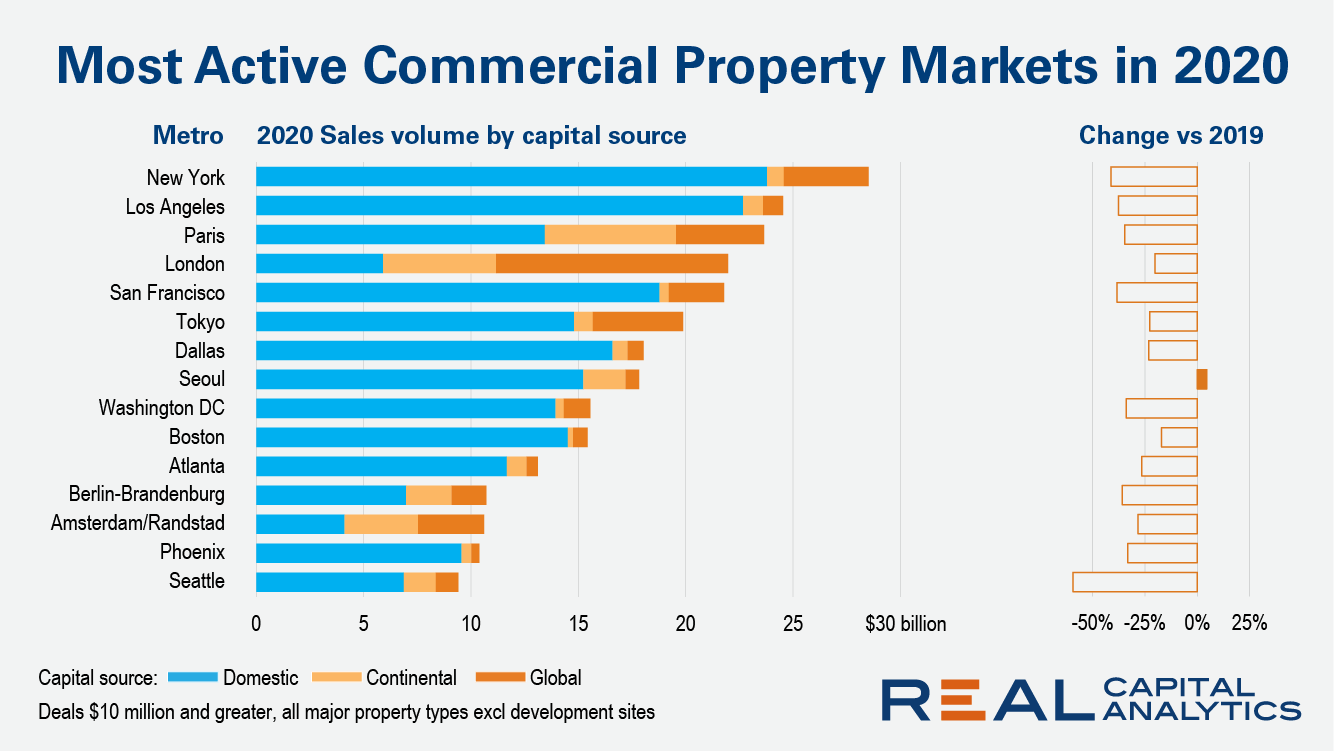

Just one of the top 15 most active global commercial real estate markets recorded an increase in sales volume in 2020 versus 2019. For the rest, the picture was one of falling transaction activity as the Covid-19 pandemic hampered dealmaking and soured the outlook for some commercial property types. In Seoul, volume crept up to an all-time high as domestic investors refocused on their home market. The Korean capital became the world’s largest retail transaction market in 2020 and second largest office market, behind Paris.

2020 was certainly not the greatest year ever for offline retail, but its effects may already be driving strength for some brands in 2021. While this year will hopefully be marked by a strong recovery amid COVID’s declining effects, some brands are already showing clear strength. Which retailers have had some of the fastest starts to 2021? We looked at the data to find out.

The share of mortgages that were 30 to 59 days past due – considered early-stage delinquencies – was 1.4% in November 2020, down sharply from a post-pandemic high of 4.2% in April 2020 and below the year ago rate of 2%. The share of mortgages 60 to 89 days past due was 0.6% in November 2020, unchanged from 0.6% in November 2019 and down from 2.8% in May 2020. The drop in early and mid-stage delinquencies from the spring indicates a lower share of mortgages entering delinquency after the initial surge after the start of the pandemic in the U.S.

Consumer Edge’s recently launched UK dataset has already proven to be very predictive for several company earnings reports. One such company is easyJet, where a strong correlation provides confidence in Consumer Edge airline data overall. In today’s Insight Flash, we take a deep dive into UK travel trends, digging into how low-cost players like easyJet are holding up.

Millennials are officially the nation’s largest generation, and spanning the ages of 24 to 39, they are now in their prime home-buying years. But for as long as they have been old enough to buy homes, millennials have lagged previous generations in fulfilling that goal. In this study, we combine data from the Census Bureau’s Current Population Survey and our annual Apartment List Renter Survey to assess whether millennials are catching up, or if they are truly less likely to attain homeownership than prior generations.

In this Placer Bytes, we dive into two retail segments that seem impervious to the pandemic’s effects – pets and shoes. While it may seem obvious that our pets hold center stage amid the pandemic, the results have still been impressive. The sector has ridden a similar wave to the rest of retail, with recoveries offset by a step back in November, yet this specific space is riding much higher levels of strength than most retail players.

Wow, where did that come from! A near 27% reduction in capacity and the loss of over 3.2 million domestic seats in one week has handed the United States the title as the world’s largest aviation market something no one probably expected. It may be a short-lived gift from China as part of their New Year festivities but nevertheless a dramatic turnaround in just seven days.

The impact of the pandemic on the travel industry, and aviation in particular, is laid bare in mobility data showing how outbound trips from the UK reduced by 75% throughout most of last year. High frequency data from Huq Industries shows how total trips abroad fell significantly during the first lockdown and have never recovered – currently languishing at 25 percent of 2019 levels.

In the ongoing fight against the COVID-19 pandemic, an additional $900B of stimulus relief funds were signed into law on December 27th, exactly nine months after and at roughly half the size of the original $2.2T stimulus package that Congress passed in March 2020. The new funds include direct stimulus payments of $600/$1200 to individuals/couples (vs. the first round’s $1200/$2400) plus an additional $600 per child (vs. the first round’s $500).

The construction of new homes is important to meet the shelter needs of America’s expanding population. CoreLogic public records data show that closings on single-family new-home sales were up 12% year-over-year in the six months before the pandemic hit. The pandemic derailed closings last spring, but only temporarily. Completions of one-family homes rebounded by summer, remained brisk the rest of 2020, and were the highest annual total since 2007.

January has historically been the Black Friday of the fitness industry, with New Year’s Resolutions spurring an increase in gym memberships and athletic equipment purchases. COVID-19 has changed the dynamics dramatically for these subindustries, but can January resolutions at least provide a temporary adrenaline boost for Athletic Clubs? In January 2021, the number of individuals paying for Athletic Clubs showed a dramatic decline of -45% y/y.

Don’t let the box score fool you. Tom Brady may have won another ring, but Super Bowl LV was hardly a replay for the brands who did (and didn’t) invest in commercials and sponsorships for the big game. For the first time, Comscore (NASDAQ: SCOR), a trusted partner for planning, transacting and evaluating media across platforms, joined forces with Hive, a leading provider of enterprise AI solutions, to analyze marketing within and around TV advertising’s biggest day.

It is no surprise that consumers have quickly adopted app banking over the last 10 years, which is available 24 hours a day with no waits. However, the retail banking app is just one facet of a wider revolution in mobile finance. Investing, payments, loans – all are being upended by agile new digital replacements. In 2020 – powered by COVID-19 stay-at-home orders – consumers embraced these new alternatives in record numbers.

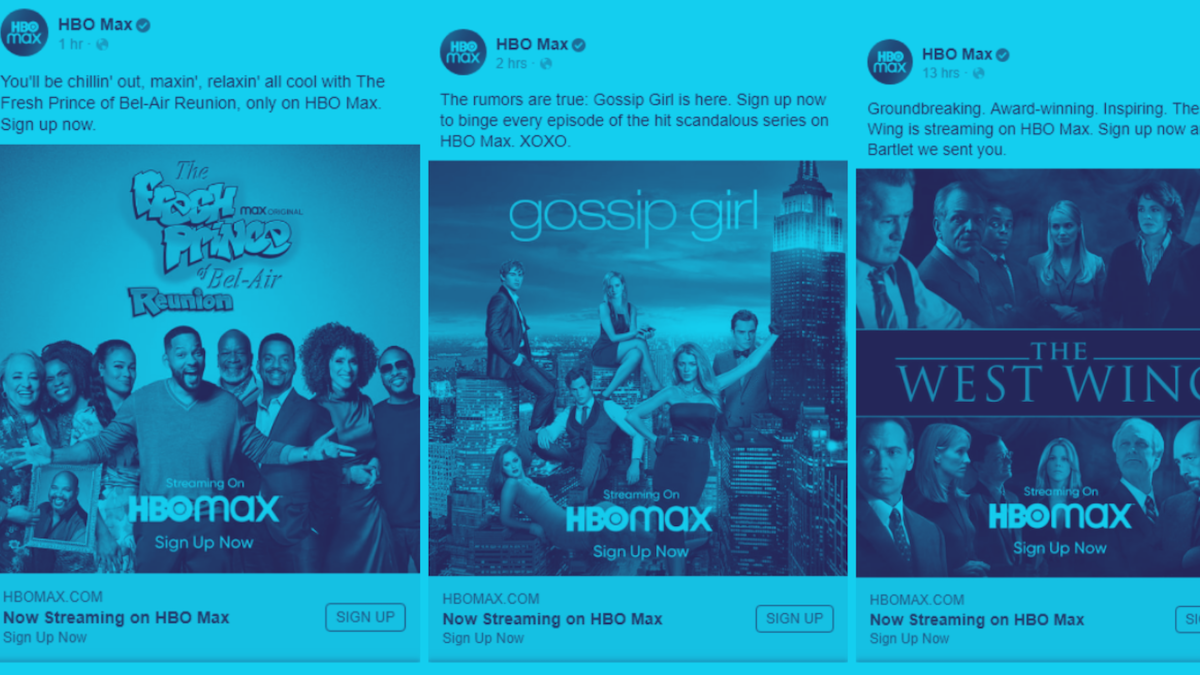

New streaming brands such as Peacock TV, Discovery Plus, Apple TV+, and Disney+ have hit the advertising circuit heavily since launching in 2020 — but none (including usual heavy hitters Netflix and Hulu) have spent more in 2021 than HBO Max. In fact, HBO invested 89% of its digital ad spend in January ($53M) in HBO Max ($47M). That’s nearly $20M more than the next highest ad spender of the month, LendingTree ($37M). It’s also more than what Amazon ($35M) spent on digital ads for its entire umbrella of subsidiaries, including Prime Video. And it’s even more than what Procter & Gamble spent last month ($32M) on its entire suite of CPG products.

The Dodge Momentum Index increased 3.1% in January to 139.4 (2000=100) from the revised December reading of 135.2. The Momentum Index, issued by Dodge Data & Analytics, is a monthly measure of the first (or initial) report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year. The commercial component of the Momentum Index moved 9.9% higher, offsetting an 11.7% decrease in the institutional component.