While U.S. job openings on company websites globally rose 2% in September, continuing the steady recovery in U.S. labor demand that began in May, the rate of increase was the slowest in the past 4 months.

Visits to clothing and shoe shops across the UK has declined 26% from a post-lockdown peak of 65pts on August 29th. Following a good start to the year with visits up 60% for January sales and a stable February, footfall fell sharply to residual levels from March 22nd before regaining 50% of normal levels by July 2nd and remain so for much of the summer. Recovering to to 65pts in August 29th – a date that coincides with the end of the summer and start of the school year – visits to clothing shops have since followed an even trajectory downwards to present levels of 39%, a fall of 26% in just 4 weeks.

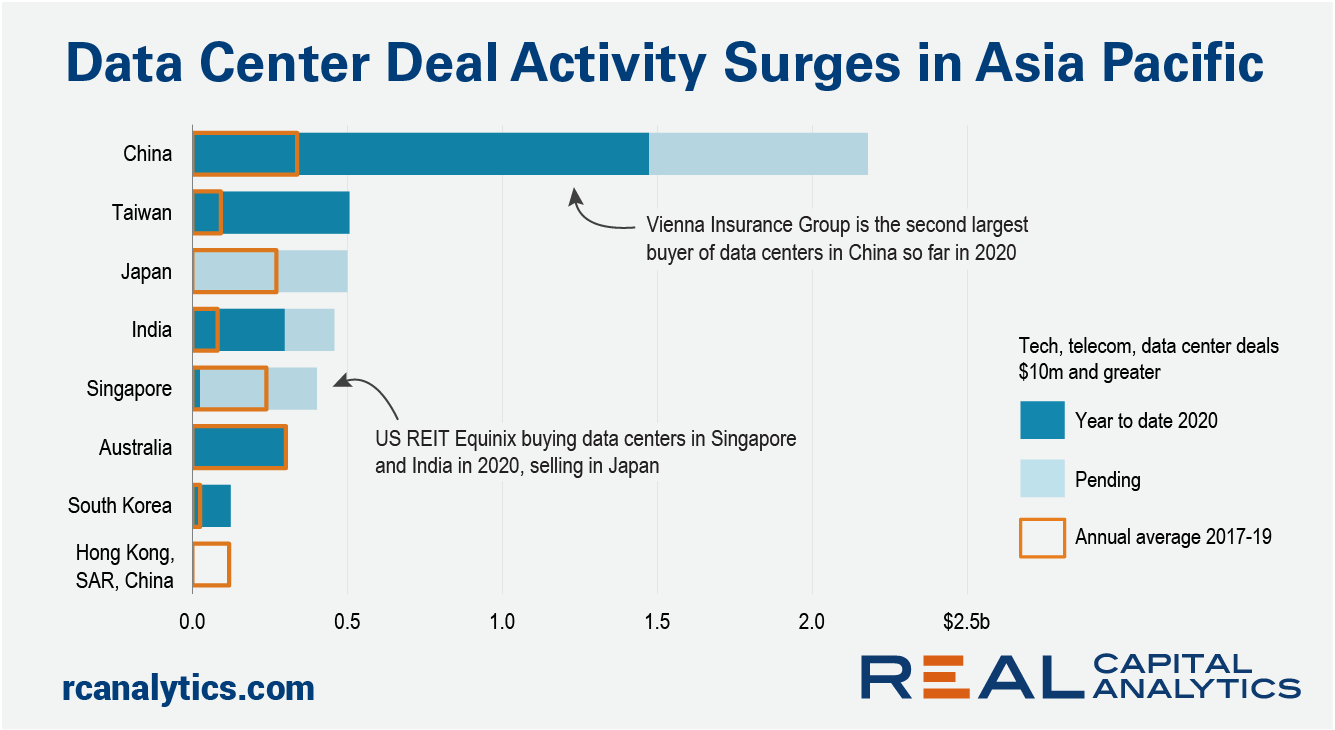

News of the planned sale of a Beijing data center campus for half a billion dollars may have come as a surprise to some. However, the deal — which, if it closes, would be the largest industrial deal in the Asia Pacific region in 2020 — is just one of a bundle of pending data center transactions in the region.

To say that 2020 has been a year like no other would be a staggering understatement. Our health, well being and livelihoods have been stress-tested in ways we couldn’t have imagined just one year ago. In order to make sense of the chaos, and search for some sign of light at the end of the tunnel, we took a deeper look at our jobs data to see what it can tell us about the labor market and economy amid the global pandemic.

Are you back in the office? It’s a question many of us find ourselves asking our friends and peers. The answer is, it depends. Each has their own comfort level, and it also depends largely on their role and their employer.

In early May, we noted the unique potential of the off-price apparel sector to buck the trend of the wider space and drive significant returns. And now, deep into the recovery, we are seeing that the return is even more impressive than expected, especially considering the ups and downs being driven by COVID resurgences across the country.

In the face of COVID‐19, the commercial automotive market experienced a nosedive. However, the push for new energy-efficient vehicles provides optimism for market recovery. This pivot comes at a time when few people are leaving their homes and many are relying on businesses to bring the outside world to them in the form of packages and food deliveries, making reliable fleet vehicles even more important.

ATTOM Data Solutions’ most recent U.S. Home Sales Report shows that homeowners who sold in the second quarter of 2020 had owned their homes an average of 7.95 years. According to the report, that number is up slightly from 7.85 years in Q1 2020, and nearly the same as the peak of 7.96 years in Q4 2019.

Covid-19 and its influence on government decisions regarding its national borders, airports, and flights have dented the once strong international tourism sector. International arrival numbers are down by -94% worldwide with Asia seeing the dip at -97.4% – the hardest-hit region is clearly heavily reliant on air travel as the main source of tourism. However, the recent resurgence of the domestic market in Asia suddenly paints the future for hoteliers, tour operators, duty-free stores, and airlines with some promising colours.

Back in July, LinkUp wrote an article testing the hypothesis that government stimulus was preventing workers from returning to work. The prevailing narrative was that some workers were receiving more compensation through the CARES Act than they would by returning to many low-paying jobs, so those workers were opting out and low-paying jobs were going unfilled. In our article, we concluded that LinkUp’s data did not support this claim at that time.

The latest CoreLogic® Home Price Index (HPI) for the U.S. recorded an acceleration in annual price growth to 5.5% for July, about two percentage points faster than the prior July – despite much higher unemployment. The gain reflected rising demand and a supply shortage; Record low mortgage rates fueled homebuyer activity, especially for first-time buyers, and the health risks engendered by the pandemic persuaded many older home sellers to delay their listing to a later, healthier time.

Food producers in Europe are scaling up their staffing levels as the second wave of Covid-19 bites across the region. Huq’s European Industrial ‘Big-6’ Indicator shows a growth of 19% in the 4 weeks to date from August 31st. This contrasts with just a 10% rise in worker presence between February 20th and March 5th, it’s pre-lockdown high

With emergency government funding set to expire at the end of September, US Airlines are planning mass layoffs after a more than 80% collapse in revenues. The more cash rich carriers – such as SouthWest and Delta – have avoided Federal loans so far, hoping to tough it out until a vaccine arrives, with the prospect of a large increase in market shares for the survivors.

When examining the top five most booked destinations in the Caribbean over summer, we noticed that the same countries also are faring best in terms of forward-bookings and flight searches too. The lucky five are the US Virgin Islands, the Dominican Republic, Aruba, Puerto Rico, and Jamaica.

As summer transitions to fall, we exit what is traditionally peak moving season. But of course, nothing about this season has been traditional -- from March through June of this year, our national rent index fell quickly during the months when rents generally rise fastest.

As some U.S. employers consider expanding the role of telework at their companies, many Americans may be working remotely indefinitely and have the freedom to flee COVID-19 hot zones in favor of greener pastures. By using grocery spending as a proxy for residency, transaction data reveals which of the states hardest hit by the pandemic are most likely to see residents leaving—and where they might be headed.

For decades, many states feared that they were losing their best talent to other states with prestigious universities. This “brain drain” as it’s been known to be called, has in part been attributed to the trend of people finding work close to where they attend school. By tracking individuals who provide information about their high school education, their college education, and their first job, we see a remarkable reversal of this trend.

COVID-19 and the lockdowns have led to a boom for the console and computer games industry as shown in our July Edison Trends report. With pre-sales for the new Playstation 5 and Xbox Series X consoles having already begun ahead of a November launch and anticipated wave of COVID-19 in Autumn and Winter, the upward trend in spend is expected by most to continue.

The transatlantic for many airlines is a very lucrative source of revenue and with the IATA Winter Season now four weeks away we’ve looked at the typical revenue generated across the season. However, since Covid-19 was already bugging demand in January we’ve used Winter 2018/19 as a reference point.

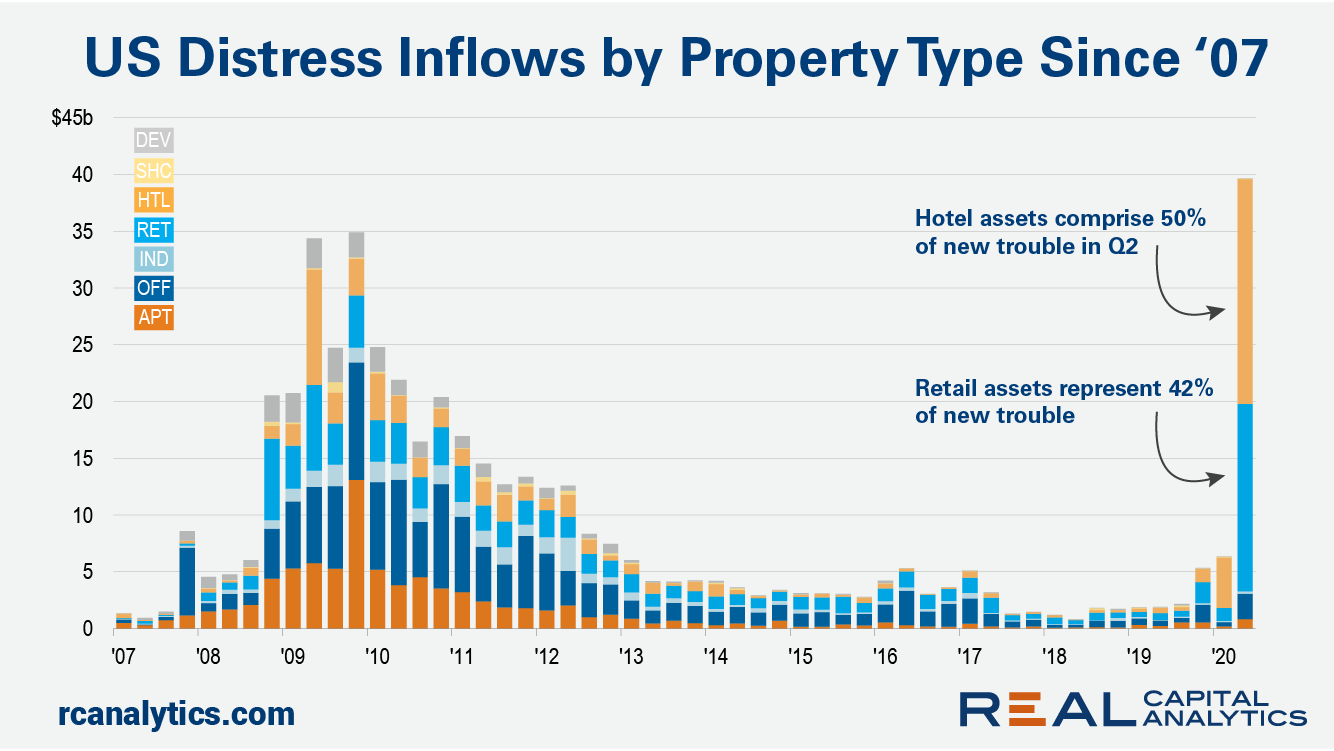

Given news headlines, it’s to be expected that retail and hotel properties would represent a large share of newly troubled assets since the start of this Covid-19 recession. The magnitude of their shares may be more surprising. Retail and hotel assets combined represented 92% of new trouble in the second quarter of 2020. In the depths of the GFC, these two sectors were behind only about half the total distress.