U.S. commercial property price growth continued apace in February as all four major property types posted double-digit annual price growth. The US National All-Property Index rose 19.4% from a year ago and 0.8% from January, the latest _RCA CPPI: US_ report shows. Industrial prices climbed 28.5% from a year prior, the fastest annual rate among the major property sectors in February and a record for any property type since the inception of the RCA CPPI. In June 2021 industrial price growth surpassed its previous high, seen prior to the Global Financial Crisis, and growth has accelerated every month since.

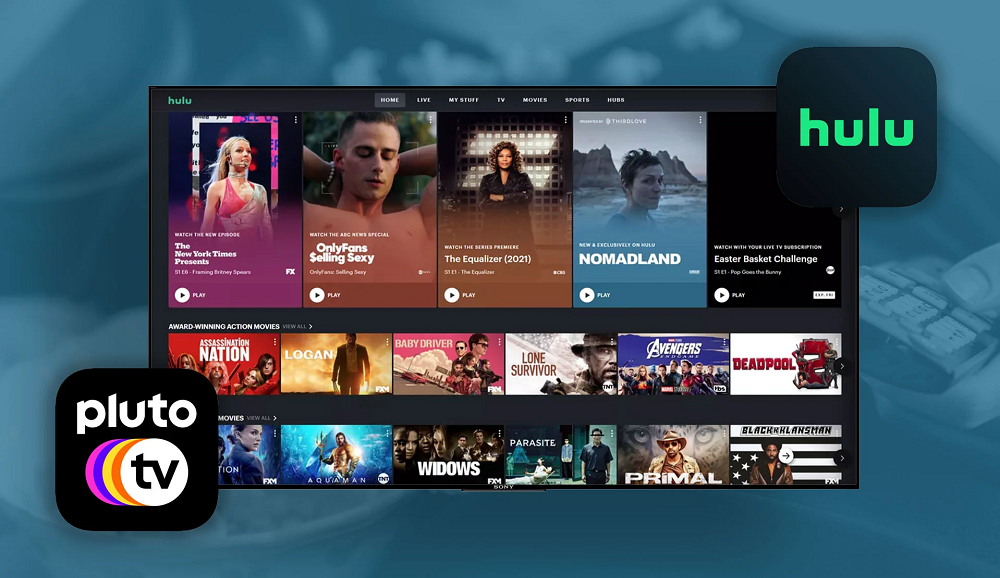

As traditional linear TV consumption continues to decline, OTT streaming providers such as Hulu, Pluto TV, Tubi, Peacock, and Paramount+ have seen significant growth, making them a go-to for advertisers and brands to reach audiences as they cut the cord. Pathmatics now tracks and breaks out this unique data, which shows—at a high level—that U.S. advertisers spend a combined average of $1 billion per month in their effort to reach consumers via OTT channels. Our new State of OTT Advertising in the U.S. report provides an in-depth analysis of the latest advertising trends on OTT, including those in the Financial Services and Food & Beverage categories specifically.

Beauty retailer Ulta recently highlighted a strategic initiative to onboard a larger number of popular brands into its stores. But if you offer them, will customers come? In today’s Insight Flash, we analyze the potential benefits of partnerships with brands like Fenty, Olaplex, and Supergoop by seeing what market share has been for large multibrand beauty retailers over time, what cross-shop looks like between DTC shoppers of these brands and Ulta, and how much DTC brand sales overlap with Ulta when it comes to purchase sizes.

In this Placer Bytes, we dive into two companies that dominated headlines in recent weeks – Starbucks and Dollar General. Earlier this month, Starbucks announced that it would be expanding its physical footprint and that CEO Kevin Johnson would be retiring. The announcement comes at a particularly interesting time for a company that has proven incredibly resilient in the face of COVID and the corresponding disruptions to normal routines and shifts to hybrid work.

The headline numbers for data.ai’s State of Mobile Gaming 2022 Report reveal the extraordinary success of the mobile gaming space over the 'COVID' period. If we look at the figures for 2018 to 2021, they show that consumer spend on mobile games rose from $73.8 billion to $116 billion. That's a rise of 60%. Over the same period, downloads grew from 63.7 billion to hit 82.98 billion – a rise of 30%.

Leisure travel continues to be particularly strong in the U.S. as spring kicks into gear, and the biggest hotel performance wins recently have come in those U.S. markets that are traditional Spring Break destinations. At the same time, major urban centers are seeing some return of transient business demand along with increases in group bookings. Since last month’s update, travelers have continued to seek relief and respite in warmer or winter-fun locales, as shown by hotel performance data for the four weeks ending 12 March 2022.

This week we turn to female leadership and its effects on a company's workforce. We focus on Inc 5000 companies, tracking the share of CEOs who are women for these fastest growing private businesses we see that the vast majority are run by men. Notably, the Software industry is the most skewed toward male CEOs. It probably doesn’t come as a surprise since female enrollment in CS degrees just reached around 20 percent recently.

On Tuesday, March 15th 2022, we hosted Billy Taubman, President and COO of Taubman Centers, and Placer’s Ben Witten, Senior Solutions Engineer, for a webinar entitled “Mall Update: Yearly Review and What Lies Ahead.” Taubman is a major REIT that owns, manages, and leases 20 premier regional, super-regional, and outlet shopping malls throughout the U.S. Combining Billy Taubman and Ben Witten’s on-the-ground perspective with our data-driven understanding of the mall sector yielded valuable insights, some of which are summarized below.

Retention rates for crypto apps remain steadily higher than stock trading apps in Q3 and Q4 of 2021. For example, crypto app retention sits at 32% on Day 1 in Q3 in 2021, while stock trading apps average at 19%. In our most recent report, Fintech deep dive: digital currencies 2022 playbook, we collaborated with marketing analytics platform, Adjust to dive into the key drivers of cryptocurrency app adoption in 2021.

We took a look at some of the leading steakhouse chains in the US to find out how the sector is recovering and what the future might hold. Indoor dining was one of the industries most affected by the Covid-19 pandemic. Despite two years of lockdowns, restrictions, and lingering limits on indoor dining, visits to Texas Roadhouse and Longhorn Steakhouse are on the rise. Even amidst the overall decrease in dining trends nationwide over the past two years, these two chains have maintained their overall growth pattern.

One of the advantages of CE Vision is that it can help companies find unlikely matches for partnerships beyond their space. Over the past four weeks we have highlighted some of these unlikely matches and what our data shows about how much better it is when companies work together. To start, we take coffee dates to a new level, showing how Black Rifle could achieve synergies by swiping right on Bumble. The average Black Rifle shopper spends 1.75 times as much as our panel average on Bumble as a share of their overall wallet.

The sneaker app market has witnessed a massive uptick since the summer of 2020, with both monthly downloads and monthly active users (MAU) seeing sizable increases of nearly 20%. This increase in popularity of sneaker apps (thanks to the spunky marketing that struck right when the pandemic iron was hot) has been characterized by two major trends: From the beginning of 2019 until mid-2020, monthly downloads for the top sneaker apps fluctuated around the 4 million mark, with the MAU reaching 16.3 million.

The streaming market has grown increasingly saturated during the pandemic, as TV networks like NBCUniversal and Discovery launched their own streaming platforms to compete with more established streaming services like Netflix (NASDAQ: NFLX) and Hulu. At the same time, several streaming services—especially those launched by TV networks—have been experimenting with lower-priced plans that are supported by ad revenue. Bloomberg Second Measure’s transaction data reveals that even as new competitors have entered the streaming wars, Netflix and the Disney+ bundle had the highest overall average customer retention rates in 2021.

Footwear retailers showed a surprising resilience throughout the Covid-19 pandemic. We took a closer look at some of the best-performing shoe retailers to find out how the sector is faring and what we can expect to see in the near future. Despite the increase in online shopping over the past two years, physical shoe stores appear to be holding their own – and the strength is especially apparent for the value-priced footwear chains. Since the spring of 2021, leading footwear retailers in this category have seen a dramatic year-over-two-year (Yo2Y) increase in visits as consumers returned to in-person shopping.

In response to the outbreak of COVID-19 and the resulting economic shocks experienced by the U.S. and global economies, the Federal Reserve slashed its target interest rate to nearly zero and kept it between 0% and 0.25% from March 15, 2020, until March 16, 2022, when the Fed announced it will raise the target interest rate by 25 basis points to 0.25-0.5%. For existing homeowners, the resulting low interest rates meant opportunities for billions of dollars of savings in mortgage interest, prompting millions of homeowners to refinance their existing mortgage for a lower rate.

We recently released Travel Trendlines, which features data stories on the top Travel apps* over the last year, including which are the fastest-growing and why. Today, grab your sunnies – we are going through the U.S. performance data for Airline, Car Rental and Online Travel Agency (OTA) apps from the lens of Spring Breakers. Let’s set the scene first. This is not a typical Spring Break or family vacation year. Last February and March, students of all grades were taking classes from home.

Dick’s Sporting Goods is taking its omnichannel strategy to the next level by adding an experiential component to its already strong digital and brick and mortar presence. We analyzed some of the brand’s recent ventures to see what we can learn from this omnichannel pioneer. Dick’s Sporting Goods has been working to make its technology and physical stores complement and elevate each other for almost a decade. The company started shipping online orders directly from its stores in 2013 and launched “Buy Online Pick-up In Stores” (BOPIS) already in 2014 – long before the pandemic made BOPIS widespread.

Consumer credit and debit spending grew YoY in February, despite the systemic shock of the Ukraine-Russia War. However spending decelerated 3 points from February to the preliminary period between March 1st and 9th. This suggests that US consumers could already be adjusting their behavior based on the economic outlook of the war. Spending growth across most major subcategories decelerated from February to the preliminary March period (1-9), with one notable exception.

One of the unfortunate fallouts of Russia’s war with the Ukraine is rising gas prices in the US as oil embargoes take root. Which US consumers are most affected and which businesses could see the biggest decline in sales as consumer discretionary wallets shrink? In today’s Insight Flash, we analyze gas price increases to date, which demographics and geographies are most affected, and which companies are most likely to feel fallout effect based on cross-purchase rates.

February TV engagement always lags January, which shines as the heaviest viewing month of the year. This year was no exception, despite the trifecta of the Super Bowl, the Winter Olympics and the increased demand for news of Russia’s invasion of Ukraine late in the month. January 2022 was a five-week month, including the heavy usage week right after Christmas, which amplified its TV viewing prowess, resulting in an even bigger dip in February 2022 TV viewing than average: viewing was down 5.7% from January, below the 5% average over the past five years.