Consumer spending data reveals that home furniture sales have grown during the pandemic. While traditional furniture retailers have experienced modest sales growth since summer 2020, DTC furniture companies are experiencing greater growth and capturing an increasing percentage of market share. This is likely due to both the closure of brick and mortar stores and homeownership being on the rise.

The number of British residents travelling overseas has risen by more than 30% so far in May with the cautious reopening of international on Monday 17th. This rise is even more pronounced among ‘green-list’ countries, where quarantining on return is not required, showing a 2.5x increase in trips made from the UK over the same period.

The industry achieved stronger 2-year sales for the second consecutive month in April. Same-store sales growth was 6.8% on a 2-year basis in April, an improvement of 4.6 percentage points from the 2.3% 2-year growth reported for March. This is optimistic news for the industry as April became the best month for restaurants based on sales growth in over three years. Although sales have recovered to pre-pandemic levels, 2-year same-store traffic growth was -4.2% in April.

With just under half the US population inoculated as of May 17th, we looked at the state of food spending across the US, particularly across Restaurant Delivery Aggregators, Online Grocers, Indoor Dining and Supermarket In-Store sales. Note that parts of this analysis calculate growth relative to two years prior – written throughout as “Yo2Y” – in order to benchmark current performance against “normal” spend levels.

Thanks to the coronavirus vaccine rollout, the market is shifting once again. So what does that mean for the industries most influenced by the pandemic lockdowns? This report delves into online trends in sectors and industries from SaaS to travel. How are we doing this?

The flight to the suburbs coupled with a fear of human contact has been a boom for online auto sales. Although some may have anticipated a post-pandemic slowdown, VRM’s recent strong performance indicates otherwise. In today’s CE Web Insight Flash, we compare VRM performance (including our unique ability to split out eCommerce vs. TDA) to that of CVNA and SFT in terms of unit growth, ASP, and vehicle model year trends.

As European football continues to expand its international footprint, leagues are exploring ways to create expanded fan engagements outside of the arena. English and European clubs presented a 28.9 billion euro market opportunity prior to pandemic shutdowns. Today, mobile presents a valuable opportunity for viewing games, team communications and engaging experiences such as timely promotions and gamified experiences.

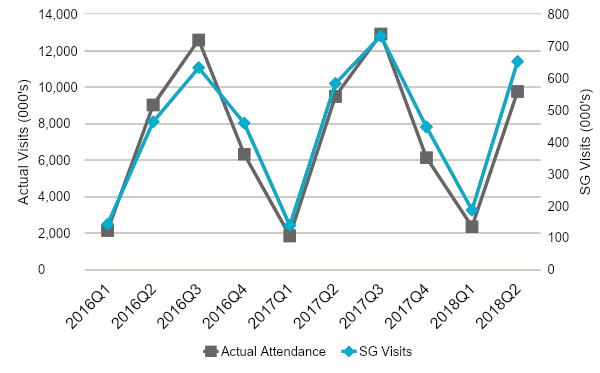

People eat more ice cream in the summertime. As statements go, that one isn’t likely to make an anthology of insightful wisdom anytime soon. It turns out, however, that it actually has significant implications for how we assess general liability (GL) risk. The risk of most GL perils like slip, trip, and fall (ST&F) is directly related to the number of people who are exposed to the peril. The more people that walk over a patch of ice, the greater the chance that someone will slip on it.

In this Placer Bytes we dive into three leading beauty brands – Ulta, Sephora and Bath & Body Works.COVID-related restrictions certainly had a significant impact on visits to all three brands, yet they all have been in the midst of significant recoveries since the summer of 2020. In early 2021, Ulta saw the year-over-year visit gap drop to as low as 3.0% in January, with Sephora seeing a gap of just 27.3%. Bath & Body Works continued an impressive run with visits actually up 7.9% year over year in January.

Office properties and office leasing companies like WeWork are watching very closely the speed with which employees return to the office. The question at large remains: is the work from home (WFH) phenomenon here to stay, or will it prove to be only temporary for most? Using Advan’s mobile phone location data, these questions can be answered.

Fitness centers and gyms in many states are reopening as vaccination rates continue to increase. However, while gym facilities were closed early in the pandemic, many people turned to home fitness companies for workout equipment. Sales growth skyrocketed for home fitness brands over the past year, and one emerging player in the industry, Mirror, was recently acquired by Lululemon.

While every sector has its doubters, off-price leaders were the focus of a high level of concern during COVID because of their reliance on physical locations. And while the ultimate success of the sector, especially relative to the wider apparel space, was hardly impossible to predict, the performances of top brands in the space were truly impressive. So where do things stand and how might these leaders progress deeper into 2021?

Digital advertising plays an essential role in the modern-day brand’s success, from revenue and customer growth to driving brand awareness throughout a company’s lifecycle. After a tumultuous year, several technology companies entered 2021 with plans for an IPO. One of the most anticipated brands to go public in 2021 was Coinbase, the largest cryptocurrency exchange in America.

The competitive landscape of the food delivery market in Asia has changed a lot in 2021. Previously our reports showed how major food delivery companies in Asia were performing during covid (Read The Roller Coaster Goes On: Food-Delivery Companies in Asia). After a year of pandemic, the battle goes on, and is heating up in one of the most densely populated markets – Hong Kong.

This blog post discusses changes in federal district court litigation due to the COVID-19 pandemic in 2020. Lex Machina monitors and reports on how courts are affected by the social changes due to the pandemic with our COVID-19 blog posts, the COVID-19 Impact Analyzer tool that is publicly accessible, and in-product case tagging for litigation caused by COVID-19.

April marked an important month for retail recovery, but one sector that may be less thrilled to see the coming spring is home improvement. The brands in the space have seen incredible strength throughout the pandemic, with Q1 marking another strong quarter. Yet, unlike most sectors that will benefit from 2020 weakness to emphasize 2021 strength, home improvement leaders will be compared to their unique peak during the pandemic.

Facebook is the leading social media platform by many counts—but when it comes to popularity among Gen Z users, Snapchat is overtaking the giant. Gen Z is getting older and about to be a huge buying power. How are advertisers using the two platforms? And which brands spending big on Snapchat represent opportunities for other publishers?

Activity levels across the UK’s hotels, B&Bs and guest houses are showing a pre-emptive rise in traffic, with the presence of staff, workers (and a number of outdoor drinkers) behind a 35% rise in presence beginning April 12th. Analysis of when hotels have been busiest during the period since April 12th reveals that activity is highly concentrated in working hours, with up to 15% more attendance taking place between 9am and 5pm.

The occupancy doldrums remained in place with U.S. occupancy falling to an eight-week low (56.7%) during 2-8 May 2021. Using STR’s total-room-inventory (TRI) methodology, which considers hotels that are temporarily closed, occupancy dropped to 54.2%. Demand, however, increased slightly and remained above 21 million as it has since mid-March. The decrease in occupancy was a result of increased hotel openings.

At the beginning of the year, ad tech leaders were talking about what they expected from programmatic in 2021. A big part of the discussion was how programmatic would become central to the media planning process and how buyers would need to adopt a ‘test and learn’ mindset. Not only that, but IAB predicted that programmatic’s “meteoric rise” in ad spend would reach $98 billion and account for 68% of all digital advertising in the US.