The COVID-19 pandemic and associated response measures made 2020 an unprecedented year in many ways. The resulting disruption to the economy and every aspect of life dramatically altered the status quo the multifamily industry had grown accustomed to during an unusually long business cycle. Entire books could, and likely will, be written on the topic. For this month’s newsletter, we’ll take a fairly broad view in an attempt to elucidate some general observations from the past year.

It was a holiday season those in retail will never forget, however they might try. Just as many retailers were moving ever closer to 2019 visit levels, the COVID pandemic not only made its impact felt, but actually surged just prior to a critical Black Friday weekend.But, what did this mean for the sector as a whole?

In the nine days since the Brexit transition period ended, high-frequency data from Huq Industries shows journeys through UK ports down 26% on January 2020. At the same time, the time spent transiting through UK ports has risen 10% since December 31st to read 112.6pts.

Applications by prospective tenants for a rental home generally pick-up each spring. The President’s declaration of a national emergency on March 13 triggered Shelter-In-Place restrictions and disrupted the seasonal rise. By the end of March applications for rental homes were down 42% from the same period one year earlier.

Even amidst an unprecedented pandemic, Americans still traveled for the holidays, just at lower numbers than usual. That’s according to Envestnet | Yodlee’s Income and Spending trends, as well as recent news reports. Airports saw depressed numbers for holiday season. According to the Transportation Security Administration (TSA), there were over 600,000 people screened at airport security checkpoints on Christmas Day, or roughly 23% of the number vs a year ago.

Aggregate consumer spending for the months of November and December declined \~5 and 6% YoY respectively, driven by foot traffic declines of \~14%, a drastic slowdown relative to the \~2% to 6% YoY sales growth exhibited in the same period in the last two years.

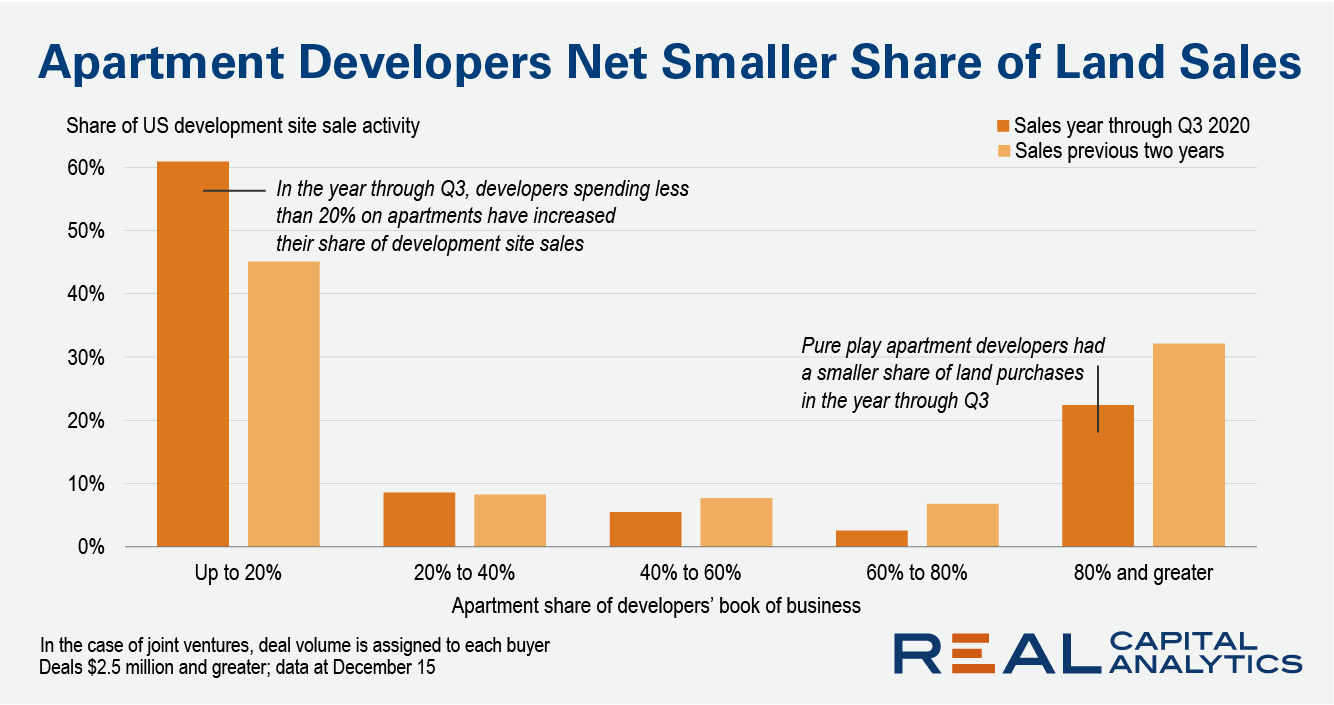

Development site sales were a bright spot for the U.S. market in 2020, with investment activity for the year through November down only 5% from a year earlier, according to Real Capital Analytics data. Who is buying these sites and the reasons why have changed from earlier in the cycle.

2020 saw nationwide job listings down 2% year-over-year. Surprisingly, given the overall economic turmoil incited by the pandemic, just 5 months last year saw decline, while 7 months showed growth. At the lowest point job openings were down 27%, but by the end of 2020 jobs were back up to 67% of pre-COVID levels.

There is still a little time left on the clock, but a week before Christmas 2020 and right at the start of the 2021 NBA season, Nike continues to dominate Adidas in the COVID-19 recovery game. Since we last checked in mid-June, Nike has widened the gap, with total foot traffic at their outlet locations back to within 30% of 2019 levels. That’s up from -55% when we last checked the brand score.

The Dodge Momentum Index jumped 9.2% in December to 134.6 (2000=100) from the revised November reading of 123.3. The Momentum Index, issued by Dodge Data & Analytics, is a monthly measure of the first (or initial) report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year. The commercial component of the Momentum Index rose 14.0%, while the institutional component rose by 0.3%.

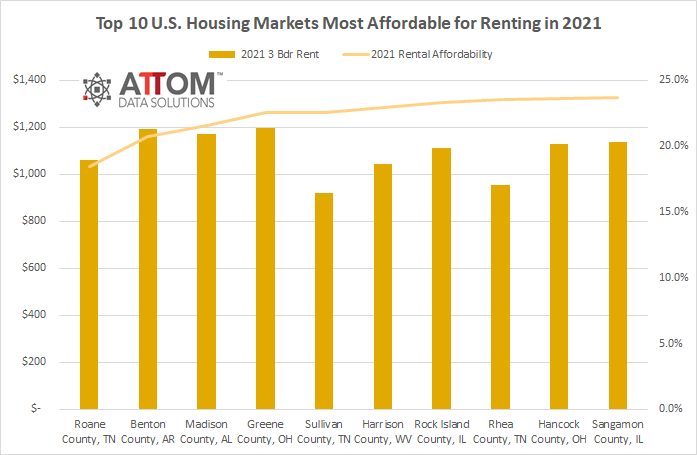

According to ATTOM Data Solutions’ newly released 2021 Rental Affordability Report, owning a median-priced three-bedroom home is more affordable than renting a three-bedroom property in 63 percent of the U.S. counties analyzed. The annual report noted this trend is occurring despite median home prices increasing more than average rents over the past year in 83 percent of those counties and rising more than wages in almost two-thirds of the nation.

Among the list of COVID-19 winners and losers, Wine & Liquor stores stand out as clear winners. Brick-and-mortar locations were considered essential businesses in many states and were allowed to stay open while other retailers shuttered, and both online and offline outlets benefitted from the closure of restaurants for seated dining.

Black Friday did not produce surges of their usual magnitude. Super Saturday weekend was strong but the day itself still lower than 2019 levels, and even Turkey Wednesday fell short for many grocers. Yet, like they have proven all year, the grocery sector is uniquely capable of adapting to the current challenges. And once again, even where other days fell short, the sector found another boost.

SuperData, a Nielsen company, today is releasing its 2020 Year in Review report focusing on the health of digital games and interactive media market, the impact of COVID-19 on games and brands, and likely gaming trends in 2021. Overall, digital games alone earned $126.6B in 2020, up 12% year-over-year in a year where audiences were forced to stay home and interact remotely.

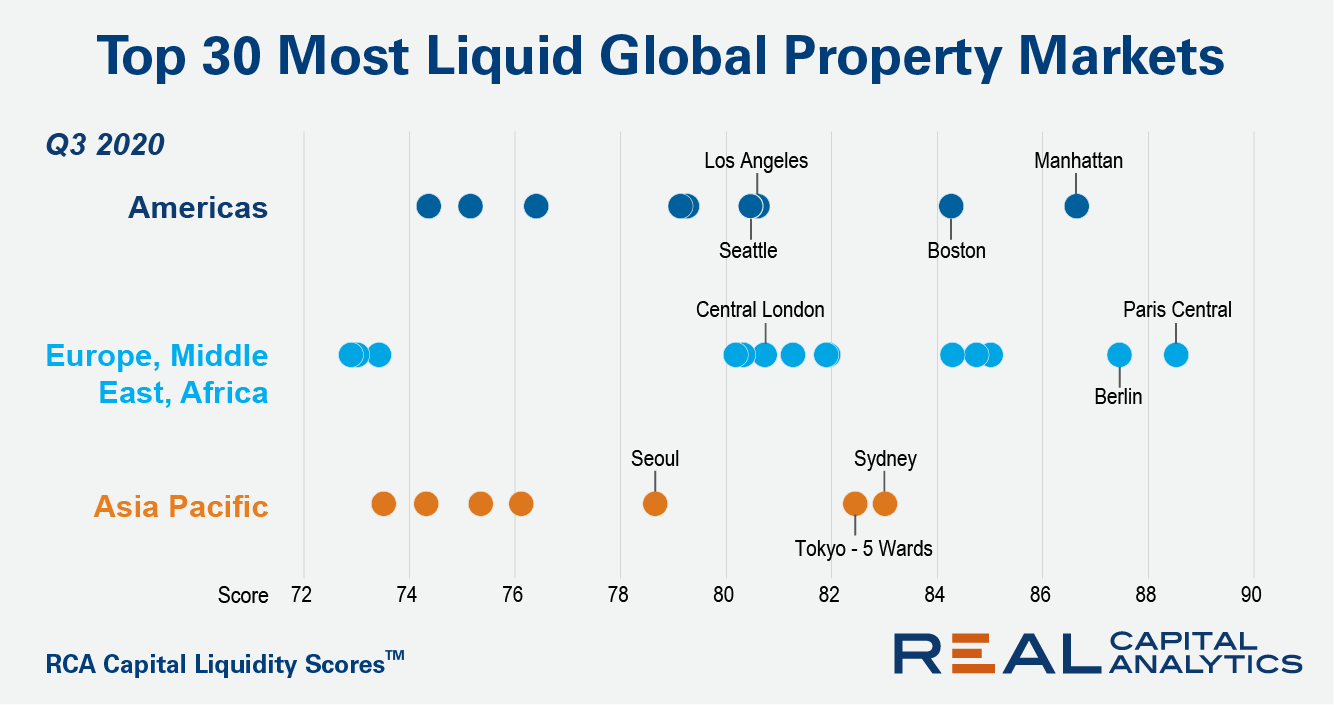

Europe’s biggest commercial real estate markets have maintained higher liquidity through the ongoing Covid-19 pandemic than markets in the Americas and Asia Pacific, according to the third quarter 2020 update of the RCA Capital Liquidity Scores.

The restaurant industry has been completely upended by COVID, though with dramatically different effects on sub-sectors. QSR restaurants benefitted from their strength in drive-thru, delivery, and takeaway allowing them to offset losses and even drive strength during the pandemic. And the year to come could be especially well suited for their offerings as economic uncertainty could further boost the appeal of their high-value offering.

Energy use, especially in how it relates to climate change and global reform, is a big issue. But after a year of big issues—it’s easy to overlook changes in the energy sector in favor of those that seem more urgent. However, many of these issues are closely related. Pandemics share many of the same root issues as climate change. Plus, COVID-19 impacted climate change in complicated ways.

Citi Bike is New York City’s bike share system, and the largest in the United States. Citi Bike launched in May 2013 and has over 1,000 docking stations across Manhattan, Brooklyn, Queens and Jersey City. It currently has over 17,000 bikes in service. With the help of a $100 million investment from Lyft over the next 4 years, the number of bikes and miles serviced is expected to double to 40,000 and 35, respectively. While there are many different patterns across locals, tourist, age groups and genders one trend is clear, New York City has embraced Citi Bike and ridership is rising.

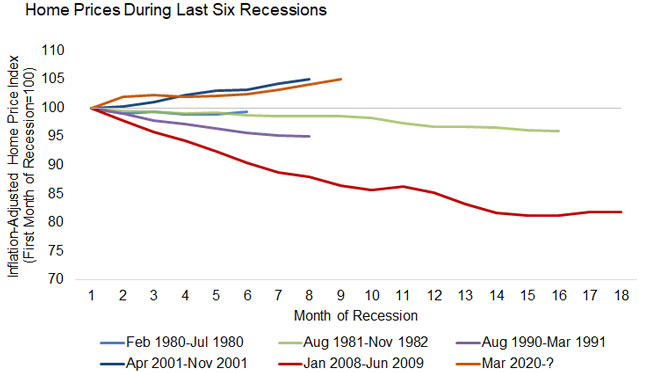

National home prices increased 8.2% year over year in November 2020, according to the latest CoreLogic Home Price Index (HPI®) Report. The November 2020 HPI gain was up from the November 2019 gain of 3.7% and was the highest year-over-year gain since March 2014. Home sales for the year are expected to register above 2019 levels. Meanwhile, the availability of for-sale homes has dwindled as demand increased and coronavirus (COVID-19) outbreaks continued across the country, which delayed some sellers from putting their homes on the market.

2020 has come and gone in a flash. It feels like yesterday we were introducing this year’s Super Bowl ads and obsessing over March Madness. Now, we’re talking about the biggest Cyber Week on record and the art of copywriting during the pandemic. The year was filled with highs and lows, advertising campaigns never to be forgotten, and ones you wish you could (looking at you, moldy Whopper). Without further ado, check out a few of advertising’s winners and losers of 2020.