Foot traffic analysis for hotels around the US showed vastly different trends over the holiday season. Compared to the first week of November, hotels in Florida saw a foot traffic uptick of 20% in the week of December 22 - 28, and up 40% in the week between Christmas and New Year, as Americans flocked to warmer climates.

The COVID-19 pandemic made housing affordability a persistent concern throughout 2020. And as we enter the new year, rent payments remain a financial obstacle for many families. According to our latest survey, 30 percent of renters did not make their January payment on-time at the start of the year. This is down just slightly from the mid-summer peak when unemployment was at its worst, but up significantly from historic baseline levels.

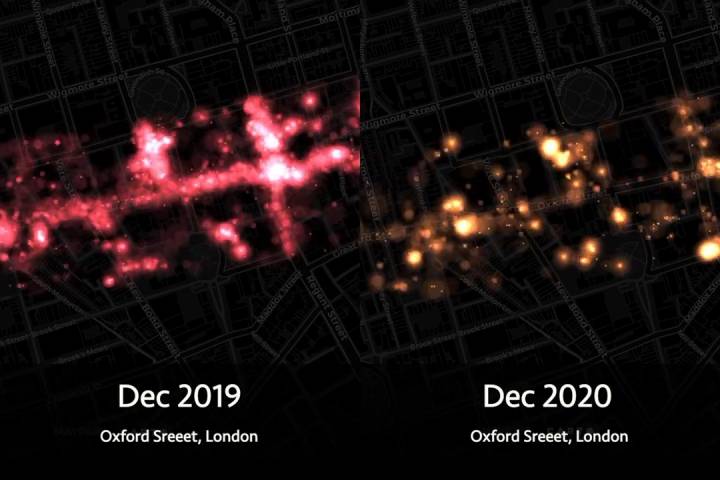

Foot traffic on London’s Oxford St paints a positive picture of what may come as pedestrian traffic touched pre-Covid levels between lockdowns ahead of Christmas. Having regained 80%+ of previous levels for much of the summer, the Indicator fell sharply during Lockdown #2 before peaking at 98pts ahead of Christmas on Dec 9th.

The Association of American Railroads (AAR) today reported U.S. rail traffic for the week ending January 9, 2021. For this week, total U.S. weekly rail traffic was 525,253 carloads and intermodal units, up 4.7 percent from the comparable week of 2020, which was Week 2 – ended January 11, 2020.

There is a line of thinking around the Covid-19 pandemic that developers can solve some of the problems caused by rising office vacancies in Midtown Manhattan. Developers are capable of amazing feats, but a stabilization of the office market will ultimately depend on a curtailment of the pandemic.

The COVID-19 pandemic and associated response measures made 2020 an unprecedented year in many ways. The resulting disruption to the economy and every aspect of life dramatically altered the status quo the multifamily industry had grown accustomed to during an unusually long business cycle. Entire books could, and likely will, be written on the topic. For this month’s newsletter, we’ll take a fairly broad view in an attempt to elucidate some general observations from the past year.

It was a holiday season those in retail will never forget, however they might try. Just as many retailers were moving ever closer to 2019 visit levels, the COVID pandemic not only made its impact felt, but actually surged just prior to a critical Black Friday weekend.But, what did this mean for the sector as a whole?

In the nine days since the Brexit transition period ended, high-frequency data from Huq Industries shows journeys through UK ports down 26% on January 2020. At the same time, the time spent transiting through UK ports has risen 10% since December 31st to read 112.6pts.

Aggregate consumer spending for the months of November and December declined \~5 and 6% YoY respectively, driven by foot traffic declines of \~14%, a drastic slowdown relative to the \~2% to 6% YoY sales growth exhibited in the same period in the last two years.

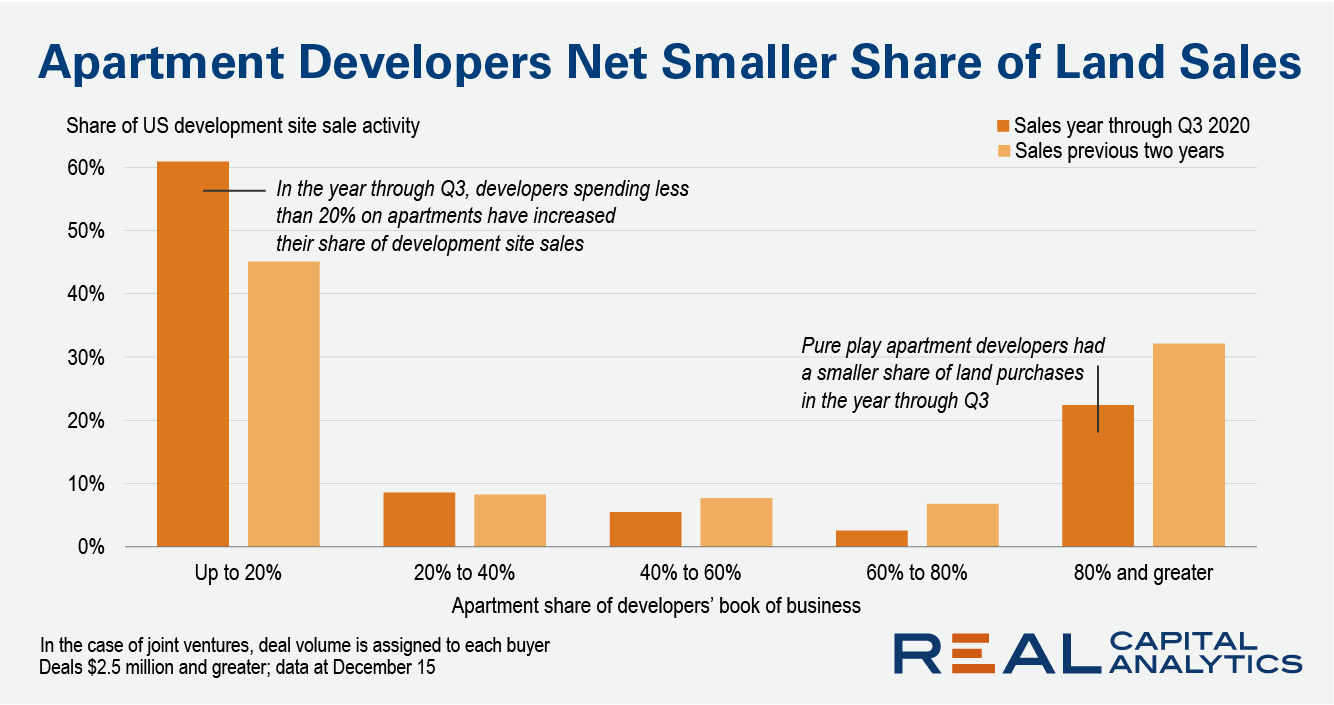

Development site sales were a bright spot for the U.S. market in 2020, with investment activity for the year through November down only 5% from a year earlier, according to Real Capital Analytics data. Who is buying these sites and the reasons why have changed from earlier in the cycle.

2020 saw nationwide job listings down 2% year-over-year. Surprisingly, given the overall economic turmoil incited by the pandemic, just 5 months last year saw decline, while 7 months showed growth. At the lowest point job openings were down 27%, but by the end of 2020 jobs were back up to 67% of pre-COVID levels.

The Dodge Momentum Index jumped 9.2% in December to 134.6 (2000=100) from the revised November reading of 123.3. The Momentum Index, issued by Dodge Data & Analytics, is a monthly measure of the first (or initial) report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year. The commercial component of the Momentum Index rose 14.0%, while the institutional component rose by 0.3%.

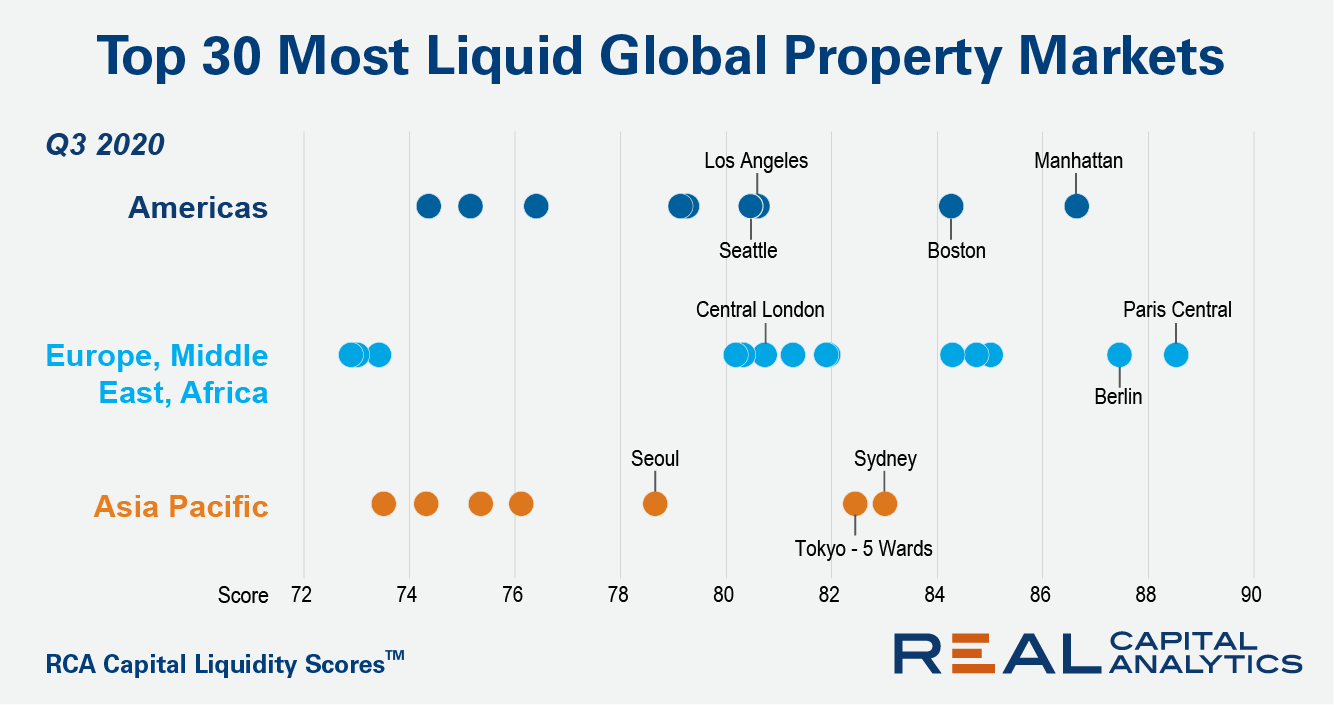

Europe’s biggest commercial real estate markets have maintained higher liquidity through the ongoing Covid-19 pandemic than markets in the Americas and Asia Pacific, according to the third quarter 2020 update of the RCA Capital Liquidity Scores.

The restaurant industry has been completely upended by COVID, though with dramatically different effects on sub-sectors. QSR restaurants benefitted from their strength in drive-thru, delivery, and takeaway allowing them to offset losses and even drive strength during the pandemic. And the year to come could be especially well suited for their offerings as economic uncertainty could further boost the appeal of their high-value offering.

With the festive season behind us and the new year begun, Huq looks back at high-street footfall during the Christmas shopping period between December 15-24th for Oxford Street, London and the Grand Vía, Madrid. We often provide outputs from our geolocaton dataset in the form of a time-series index as this is one of the most effective ways to highlight the information contained within the underlying mobility data.

The flattest seasonal holiday season has been reflected in the latest global capacity which has broadly remained around sixty million seats a week since the middle of December. The early Christmas present of breaking that sixty million, was just that, a present and this week’s 59.6 million is perhaps likely to be as good as we can expect in the next few weeks.

As the last housing market indicator in 2020, the S&P CoreLogic Case-Shiller Index finishes the year on a high note during this trying year. Home purchase activity remained consistently elevated through the end of the year, with some expected seasonal slowdown turning up as winter months approached. Still, the slowdown appears to be smaller than in a typical year.

The Association of American Railroads (AAR) today reported U.S. rail traffic for the week ending December 26, 2020. For this week, total U.S. weekly rail traffic was 405,111 carloads and intermodal units, up 8.4 percent compared with the same week last year.

Problems in the energy sector are far from new, and are continuing to worsen slightly each month. This is particularly true for the US and UK energy sectors which have seen a great deal of volatility and distress in the last year or so. The picture isn’t so dire for the EU energy sector however.

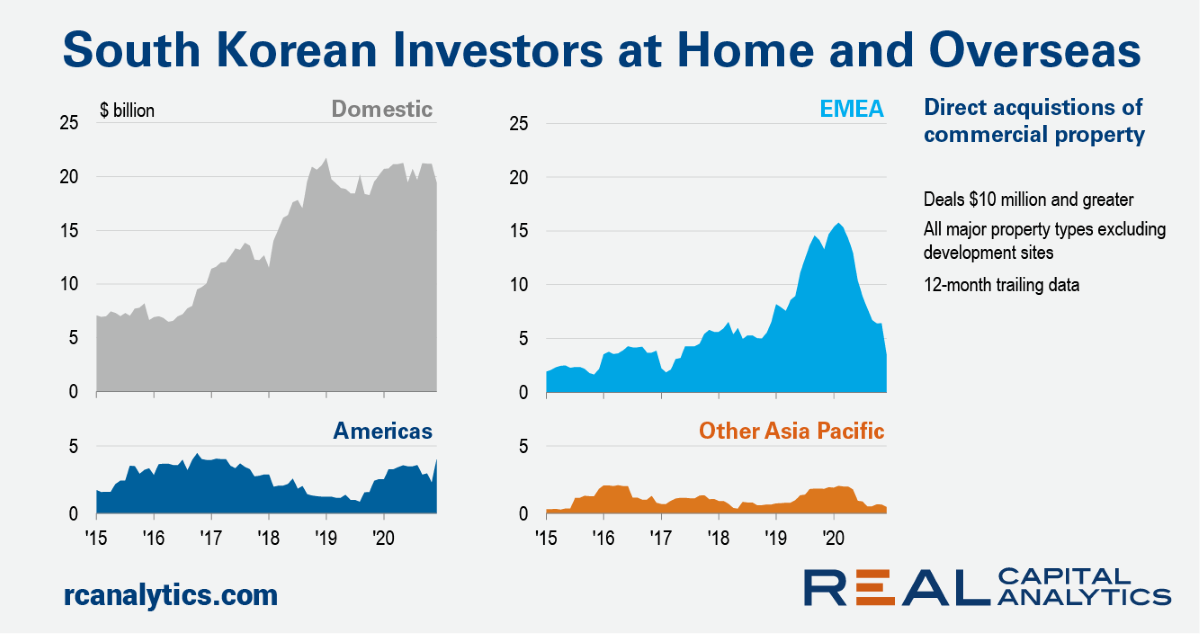

One of the biggest cross-border stories of 2019 was the outpouring of South Korean capital into Europe and the U.S. Towards the end of last year, there were signs that this trend was reaching its satiation point – asset managers had needed time to digest and syndicate the stakes in their newly acquired real estate assets back home.