Lack of availability of homes for sale has been the Achilles’ heel of many housing markets across the country even prior to 2020, and the COVID-19 pandemic has only exacerbated the shortfall. Since the Great Recession, the inventory of homes for sale has been on a decline and has reached its lowest recorded levels in recent months. From the 1980s to early 2000s, the annual number of homes for sale averaged 1.9 million. In 2020, the number fell below 1 million.

When Colonial Pipeline was hit with a ransomware attack that forced it to shut down operations, millions of consumers on the East Coast were faced with long lines at gas stations and skyrocketing fuel prices. Although the press was awash in pictures of people hoarding gas in plastic shopping bags, how much impact did the shutdown really have?

When U.S. cities and states faced shelter-in-place orders to limit the spread of the coronavirus, Americans’ reduced mobility resulted in plummeting sales at rideshare companies. With the exception of a late 2020 dip, sales have been gradually recovering since April 2020. Uber sales were up 380 percent year-over-year and Lyft sales were up 359 percent year-over-year as of April 2021.

Consumer spending data reveals that home furniture sales have grown during the pandemic. While traditional furniture retailers have experienced modest sales growth since summer 2020, DTC furniture companies are experiencing greater growth and capturing an increasing percentage of market share. This is likely due to both the closure of brick and mortar stores and homeownership being on the rise.

Crypto has been dominating headlines lately, from Dogecoin to Bitcoin the digital asset has become THE hot topic for news and media outlets. It’s not just media outlets that have latched on to the crypto craze, large institutions are also starting to explore the possibilities of this technology. Naturally we were curious as well, so in this post we use Linkup’s Raw dataset to take a look at who has job listings in this area.

The number of British residents travelling overseas has risen by more than 30% so far in May with the cautious reopening of international on Monday 17th. This rise is even more pronounced among ‘green-list’ countries, where quarantining on return is not required, showing a 2.5x increase in trips made from the UK over the same period.

The industry achieved stronger 2-year sales for the second consecutive month in April. Same-store sales growth was 6.8% on a 2-year basis in April, an improvement of 4.6 percentage points from the 2.3% 2-year growth reported for March. This is optimistic news for the industry as April became the best month for restaurants based on sales growth in over three years. Although sales have recovered to pre-pandemic levels, 2-year same-store traffic growth was -4.2% in April.

With just under half the US population inoculated as of May 17th, we looked at the state of food spending across the US, particularly across Restaurant Delivery Aggregators, Online Grocers, Indoor Dining and Supermarket In-Store sales. Note that parts of this analysis calculate growth relative to two years prior – written throughout as “Yo2Y” – in order to benchmark current performance against “normal” spend levels.

Thanks to the coronavirus vaccine rollout, the market is shifting once again. So what does that mean for the industries most influenced by the pandemic lockdowns? This report delves into online trends in sectors and industries from SaaS to travel. How are we doing this?

Three important factors in mortgage underwriting are debt-to-income (DTI) ratios, loan-to-value (LTV) ratios and credit scores. Over the course of the pandemic, we have seen a decrease in the average DTI and LTV as well as an increase in the average credit score of loan applicants. There are two possible reasons for this change: either the risk attributes of applicants have changed, or lenders’ credit underwriting standards have changed due to an uncertain economic outlook.

The flight to the suburbs coupled with a fear of human contact has been a boom for online auto sales. Although some may have anticipated a post-pandemic slowdown, VRM’s recent strong performance indicates otherwise. In today’s CE Web Insight Flash, we compare VRM performance (including our unique ability to split out eCommerce vs. TDA) to that of CVNA and SFT in terms of unit growth, ASP, and vehicle model year trends.

As European football continues to expand its international footprint, leagues are exploring ways to create expanded fan engagements outside of the arena. English and European clubs presented a 28.9 billion euro market opportunity prior to pandemic shutdowns. Today, mobile presents a valuable opportunity for viewing games, team communications and engaging experiences such as timely promotions and gamified experiences.

U.S. consumer spending has been altered by the coronavirus pandemic. Our data reveals that consumers are changing the way they pay for goods and services, with some industries seeing spending shift toward online purchases. Additionally, the pandemic has changed the types of purchases consumers are making, with stimulus recipients increasing their spending on big-ticket items.

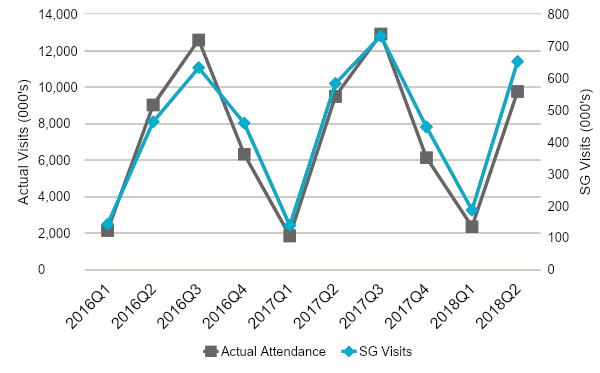

People eat more ice cream in the summertime. As statements go, that one isn’t likely to make an anthology of insightful wisdom anytime soon. It turns out, however, that it actually has significant implications for how we assess general liability (GL) risk. The risk of most GL perils like slip, trip, and fall (ST&F) is directly related to the number of people who are exposed to the peril. The more people that walk over a patch of ice, the greater the chance that someone will slip on it.

In this Placer Bytes we dive into three leading beauty brands – Ulta, Sephora and Bath & Body Works.COVID-related restrictions certainly had a significant impact on visits to all three brands, yet they all have been in the midst of significant recoveries since the summer of 2020. In early 2021, Ulta saw the year-over-year visit gap drop to as low as 3.0% in January, with Sephora seeing a gap of just 27.3%. Bath & Body Works continued an impressive run with visits actually up 7.9% year over year in January.

Publicans hoping for packed beer gardens after reopening last month have found punters being held back by an uninvited guest – the rain – with geo-data revealing how one of the wettest late springs on record might have subdued the sector’s recovery. The number of people visiting pubs in England more than doubled from Friday 16 April to Thursday 22 April, from around 16% of the levels we saw in January 2020 to almost 35%.

Office properties and office leasing companies like WeWork are watching very closely the speed with which employees return to the office. The question at large remains: is the work from home (WFH) phenomenon here to stay, or will it prove to be only temporary for most? Using Advan’s mobile phone location data, these questions can be answered.

After Colonial Pipeline - the largest pipeline for refined oil in the U.S. - halted operations after being hacked on May 7, eastern U.S. states have faced the possibility of acute gasoline shortages. Although the pipeline was restarted last Wednesday May 12, many states are seeing lingering shortages. As of the morning of May 17, North Carolina, the state hit hardest, had almost 60 percent of its stations out of gas.

Fitness centers and gyms in many states are reopening as vaccination rates continue to increase. However, while gym facilities were closed early in the pandemic, many people turned to home fitness companies for workout equipment. Sales growth skyrocketed for home fitness brands over the past year, and one emerging player in the industry, Mirror, was recently acquired by Lululemon.

Global office transaction volumes plummeted in the 12 months through March. Real Capital Analytics data shows that office investment dropped 49% in the Americas, 44% in Europe, the Middle East and Africa (EMEA) and by a more moderate 14% in the Asia Pacific region. A slowdown in transactions across all asset classes was inevitable following the lockdown restrictions employed to slow the spread of Covid-19.