The number of video streaming services has exploded over the last year, with several content providers launching their own platforms. And while there’s always consumer appetite for new channels, room on the Roku doesn’t necessarily translate to room in their wallets.

ATTOM Data Solutions, curator of the nation’s premier property database, today released its first-quarter 2021 U.S. Home Sales Report, which shows that profits for home sellers nationwide were again up on an annual basis in yet another sign of how the housing market is fending off economic damage caused by the Coronavirus pandemic. The report reveals that the typical first-quarter 2021 home sale in the United States generated a profit of $70,050. That was down from $75,750 in the fourth quarter of 2020 but still up 26 percent from $55,750 in the first quarter of 2020.

The second Reemergence we saw last issue has tempered a bit. A confluence of events — rising vaccine deployment, dropping case numbers, improving weather, federal stimulus, and more — drove people out of their homes seemingly all at once. Even businesses that were already doing well, like fast food restaurants, enjoyed a spike in traffic starting February 20th.

Hotel performance growth appears to be on hold when compared with the solid gains seen during the spring break period. In a week-over-week comparison, U.S. hotel occupancy was flat during 18-24 April at 57.3%. On a total-room-inventory (TRI) basis, which includes temporarily closed hotels, occupancy was 54.4%. Weekly room demand increased slightly and remained above 21 million for a sixth consecutive week.

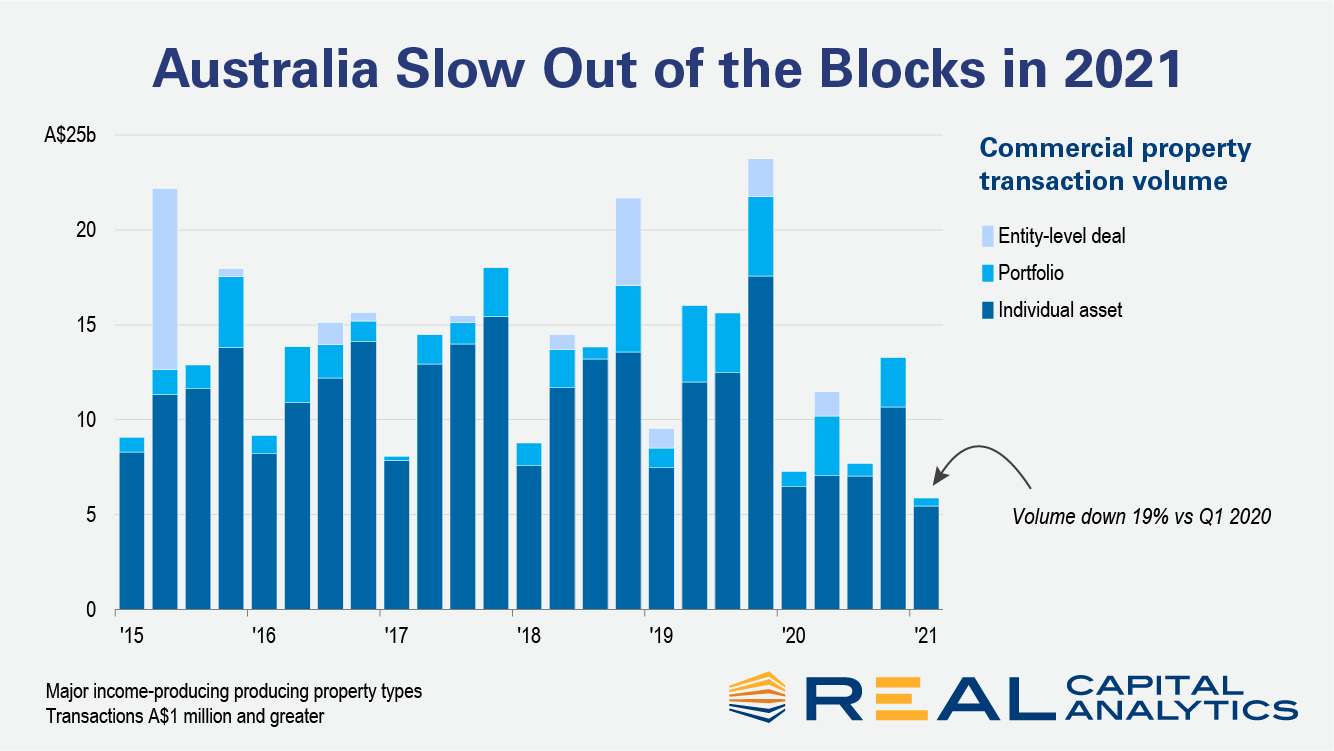

Commercial real estate activity in Australia started 2021 on a weak note, as the pandemic continued to weigh heavy on investor minds, the new edition of Australia Capital Trends shows. Deal volume in the first quarter fell 19% from a year prior.

Lex Machina is proud to release its 2021 Securities Litigation Report, which examines securities litigation trends in federal district court. This report focuses on the three-year period from 2018 to 2020 and includes analysis of emerging trends, including cryptocurrency cases and the impact of COVID-19.

Many things changed in the manufacturing industry due to the pandemic: a push for new digital investments, new visions for how factories and back-offices could work, and perhaps more importantly, a realization of how important and vulnerable supply chains are in crises. “We are going to survive this pandemic. Manufacturing is going to come out of it stronger,” said Adam Aguzzi, vice president of manufacturing at consulting company Ceridian.

Pub-going has increased almost twice as quickly as it did after the first lockdown lifted in July 2020, with attendance surging in comparison to the equivalent days last year. However, while pubs are recovering almost twice as fast than they did previously, Huq’s high-frequency footfall data reveals there is still a long way to go.

Returning retail normalcy is driving visits up across sectors, but there may not be a brand better positioned to enjoy the unique post-COVID environment than McDonald’s. The brand is seeing visits bounce back quickly. Comparing weekly visits to the chain in 2021 to the equivalent weeks in 2019 shows a clear marked recovery. Visits the weeks beginning March 29th, April 5th and April 12th were down just 10.5%, 7.1%, and 16.0% respectively. This is far better than January and February respectively when visits were down over 30% each week on average.

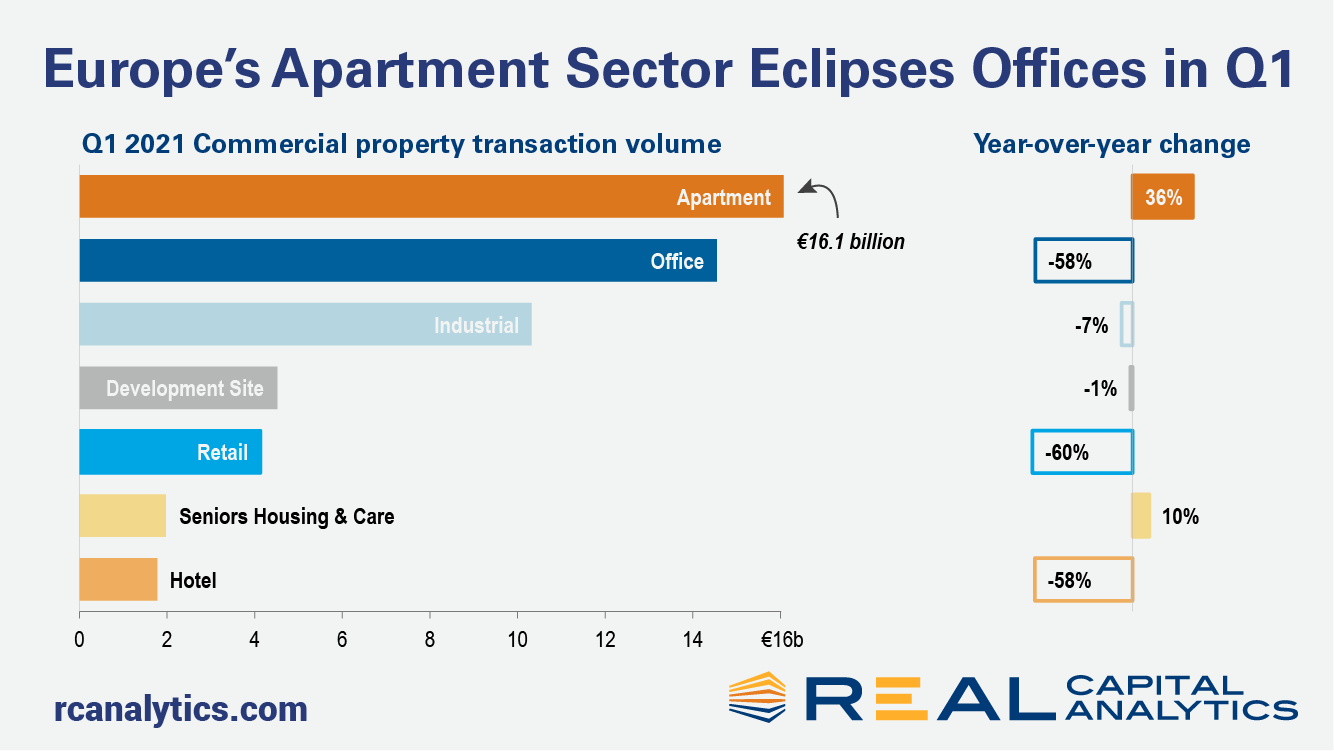

European commercial property sales sales slowed again at the start of 2021, the fourth consecutive quarter that Covid challenges have restrained the region’s largest markets, the latest edition of Europe Capital Trends shows. However, the picture for the sectors was not uniform as investors continued to plow capital into the apartment sector, which surpassed offices in quarterly deal volume. Investment volume across all property types dropped 32% in the first quarter compared to a year ago. The apartment sector bucked the trend, with activity increasing 36% year-over-year. The industrial sector slipped just 7% while acquisitions of office and retail properties tumbled by more than 50%.

Hotel food and beverage operations have radically changed in the wake of the pandemic. From breakfast buffets to banquet dinners, service has drastically altered to keep guests safe and as stopgap against weaker demand. Several of the adjustments made due to immediate needs are likely to remain in place for the foreseeable future, according to some F&B authorities.

This month’s data shows rent rebounds accelerating in markets across the country. Our national index increased by 1.9 percent over the past month, the largest monthly increase ever in our estimates, going back to the beginning of 2017. The data continue to exhibit significant regional variation, but the days of plummeting rents in pricey coastal markets are officially behind us. Although rents in San Francisco are still down 19.5 percent year-over-year, the city has seen prices increase by 7 percent over just the past two months. 9 of the 10 cities with the sharpest year-over-year declines have now had three consecutive months of rising rents. At the other end of the spectrum, many of the mid-sized markets that have seen rents grow rapidly through the pandemic are showing that there’s still steam left in the current boom -- Boise rents jumped by another 5.2 percent this month, the biggest increase among the nation’s 100 largest cities.

For this week, total U.S. weekly rail traffic was 538,184 carloads and intermodal units, up 30 percent compared with the same week last year. Total carloads for the week ending April 24 were 240,075 carloads, up 25 percent compared with the same week in 2020, while U.S. weekly intermodal volume was 298,109 containers and trailers, up 34.3 percent compared to 2020.

In the early days of the legal cannabis industry, public companies were concentrated in Canada where regulated marijuana sales were first allowed. Investors in both Canada and the United States poured investment into these stocks with the hope that Canadian companies could expand in the US as more states legalized medical and adult use. However, as piecemeal licensing regimes have rolled out, Canadian players have struggled to maintain an edge against newer US companies. Viscacha Data sheds some light on the latest in US versus Canadian pot stocks in this analysis drawing upon our realtime sales dataset covering over 25% of dispensaries across the US and Canada.

It seems like everywhere you turn there’s another company touting plans to focus on crypto. And after years of downplaying the technology, JP Morgan is the latest to join the crypto craze with the recent announcement that they are hiring for blockchain. Is this really a significant hiring trend or merely a small one laced with PR opportunities?By looking at all of the positions with the “blockchain” keyword, we’re able to identify companies with the greatest count of these positions:

In this Placer Bytes we dove into the QSR and sit-down sectors to analyze Bloomin’ and Yum! Brands. In order to effectively analyze the true recovery of brands from both groups, we looked at month over month data from November 2020 to March 2021 in order to break down the wider trend of recovery. And both Yum! Brands and Boomin’ Brands are certainly on strong trajectories to a rebound. Visits for each restaurant in the Yum! Brands’s portfolio, including KFC, Pizza Hut and Taco Bell, saw month-over-month traffic rise in December before dipping in January and February. Yet, as states began to open up, visits skyrocketed in March, with KFC showing the most impressive growth at nearly 53%. The combination of improved weather and re-opening retail drove a clear and significant boost.

Domestic airline capacity, and TSA volumes, a proxy for flight demand have increased significantly in the last few months and forward-looking airline capacity data is extremely positive; exciting times (at last) but what can we read in the schedules data and looking forward what is all of this likely to mean in the coming years. We’ve had a look at some key data points. In January 2020, surrounded by uncertainty, limited confidence in vaccine roll out programmes and Covid-19 infection rates, US airlines were naturally cautious but equally thinking positively about the first half of the year. In truth, the first quarter of 2021 was a damp squib, the second quarter looks a bit soft but better than Q1 with increasing confidence about the second half of the year.

Strong acceleration of S&P CoreLogic Case-Shiller Index continued into early months of 2021 with the third consecutive double-digit increase – up 12% year-over-year in February. The month-to-month index also surged 1.05%, making it the strongest January-February increase since 2005. Further acceleration in home price growth is reflecting many of the positive and continually improving signs of the economic recovery, including employment gains, consumer savings resulting from less discretionary spending over the last year, and hence more purchase power among home buyers, and still historically low mortgage rates. As a result, competition among buyers continues to intensify leading to fewer days on the market and higher offering prices than would be seasonally the case early in the year.

Spring Break 2021 didn’t just dive in, it made a cannonball-sized splash for Florida hotels and other U.S. destinations. When looking at STR’s School Break Report, 39% of college students and just 7% of K-12 students were on break beginning 6 March. Despite this slightly low percentage, all signs pointed to a strong spring break period right out of the gate. The STR-defined Florida Keys market, at that point, was the only U.S. market to reach an 80% occupancy level—at 85.9% for the opening week of March. Other markets, such as Sarasota (75.4%), Fort Lauderdale (72.5%) and McAllen/Brownsville, TX (70.5%), were lower but all above the 70% mark.

Retail trading has been booming during the pandemic, sending trading volumes to record highs as everyday investors joined in on the historic rally in equities. Momentum has been growing for several years, as the barriers to entry have fallen. App-based brokerages such as Robinhood and Webull have grown in popularity and made investing more accessible through commission-free trades and user-friendly interfaces. Transaction data reveals how trading deposits have grown in the COVID-19 era, as well as how app-based brokerages have performed compared to more established industry competitors.